$HIVE & $BTC Technical Analysis - 06.04.2025

New month, new week end, new technical analyses post. It's time to have a look at what the market and out two assets have been doing and what can we expect in the upcoming week.

March ended on Monday this week, so now we can have a look at the monthly candle close and wee where we stand. As suspected, the monthly candle closed as a bearish candle. Unfortunately in six days, that passed since the candle close, we got a bearish candle so far. It's way too early to say anything on the monthly, but so far the bullish gap is still holding price, which is good, but let's move on to the weekly.

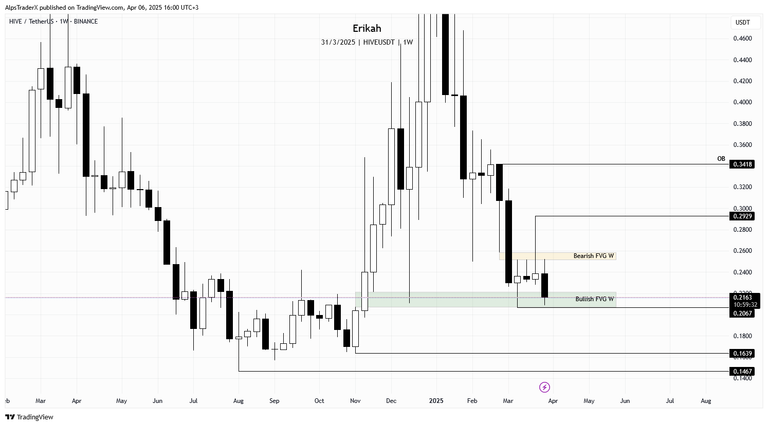

We have an interesting setup on the weekly time frame. The slim bearish fair value gap (FVG) is capping the market at the moment as it rejected price for the third time this week. At the time of writing, the bullish gap (green) is holding price. Interestingly price got close to sweeping $0.2067 this week, but it didn't so far. Chances for getting a bearish engulfing candle this week is pretty high.

What can we expect on the weekly? For bullish continuation, price needs to close above and hold $0.2584, in which case the nest swing high to sweep liquidity above is $0.2929. In case the bullish gap price is in right now can't hold, I'm looking at $0.1639 to be swept, or even $0.1467.

On the daily time frame, last week, at the time of my writing, we had a bullish fair value gap (FVG) tested, which could not hold price.

The daily chart looks interesting. At the time of writing, price is above the bullish fair value gap (green), which is holding for the moment. It was retested and rebalanced on Friday already. At this point I'm not excluding a wick down, to sweep liquidity from the $0.2372 level and we have relative equal lows at $0.2281, so there's a chance for that level to be swept as well. This can be a quick wick down to sweep liquidity under $0.2281, but still close within the gap or above, but in case the gap can't hold price, 0.$2067 is in the cards too. from last week's analysis post

$0.2372, $0.2281 and $0.2281 all swept, but $0.$2067 hasn't been swept yet. At the time of writing, price is very close to sweeping $0.$2067, which has become a relative equal low in the meantime, as we have a wick at $0.2087. It's just a matter of time, till these lows are going to be swept. The question is, are we going to get a reversal from $0.2067? If not, then I'm looking at the bullish FVG, marked with green on the chart, to be retested next and also to defend price. Worst case scenario is the retest of $0.1639 or even $0.1467, as I mentioned at the monthly time frame. I hope we won't get there, but technical analyses is not about hopes and wishes. I need to stick to what the chart tells me and get ready to have a plan for every scenario.

On the upside, if price manages to close above the bearish gap (yellow) and hold, then the next liquidity pool is at $0.2929.

On a more granular scale, the h4 chart shows you in detail what I mentioned at the daily. We have a bearish FVG that is holding price hostage (marked with yellow) and we're not far from sweeping the aforementioned lows. The question is, how price is going to react there.

To show you what is on the buy side of the curve, I marked the level price is at right now with red.

And this is the whole chart for you to see what I'm talking about. So in plain English, if we don't get a reversal at $0.$2067, chances for that low resistance liquidity to be swept are pretty high. Time will tell.

To show you something interesting, but terrible in the same time, here's the 5 minute HIVE/USDC.P chart.

Due to the MICA regulations, USDT is not welcomed in Europe. If you don't know what MICA is, please do your research and learn what and why as it's important.

Do back to the USDC chart, it's an absolute mess, it's like fly shit on my screen. Terrible. I don't know when we're going to have enough volume on these USDC pairs, to be able to trade them, but that won't be these days, that's for sure.

$BTC has been choppy lately, it is sandwiched between two fair value gaps and it is about to sweep $81,093. If we don't get a reversal there, chances to sweep $76,545 can be real. Right now price is at mid-range, if I'm considering my range between $76,545 and $88,740.

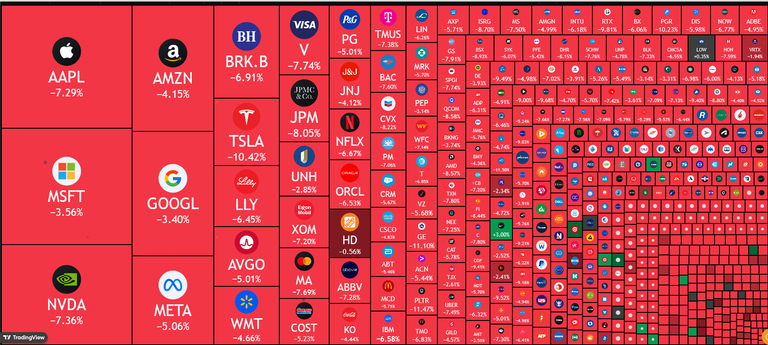

Overall, this week all markets took a huge hit due to Trump's tariffs.

This is how the stock heatmap looks like. The stock market hit the covid low level this week. You can draw your own conclusion here, I don't think I need to tell you more about this.

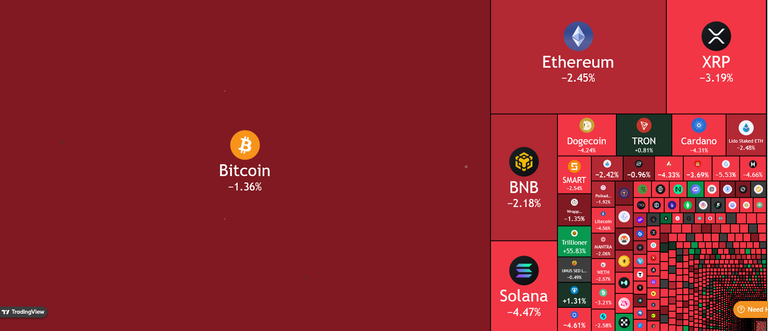

The crypto heatmap doesn't look better either. Blood across the board.

As far as the economic calendar is concerned, next week we have 3 red folder news days, all with important data announcements, so I'd expect volatility on these days.

Remember, technical analysis is not about forecasting the price, but about reacting to what price does.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27

It's very hard to trade with such a low volume. Trump’s tariffs really shook the markets this week, I didn't see it coming and I doubt many did too. I'm just hoping it's temporary and the market gets back up but it's being used a s a strategy by the US government now so perhaps if it's working for them, maybe they might keep it going.

It wasn't a surprise, it was predictable and this is just the beginning as the real effects of these tariffs are going to be visible in a year or two.

However, let's see what he's going to do as (in my opinion) this was a bullying move, to bring countries to the discussion table and negotiate. If I'm right, let's see what he want's at the negotiation table. I am expecting nothing good from this deranged old man, unfortunately. His actions so far show he has a few screws lose and not fit for this position.

Do you provide long term view as well

Define long term please.

$0.2067 swept on HIVE, $81.093 swept on $BTC.

Later edit: $BTC came very close to sweeping $76,545, but missed it for now. There's a possibility of sweeping it today though.

Thanks to for the weekly edition of Erikah's Sunday TA 👍

My pleasure @steven-patrick, I'm happy to do these as it helps me see where we are and maybe it's useful to others too.

Damnnnnnn hive really tanked. This is rough. Not .18 bad... But bad. We used to be way higher up!

All markets took a huge hit and it may not be over yet. Hive is not immune to these moves either. I don't want to name names, but the measures taken lately by the US can't have a positive effect short term and I doubt they can have a positive effect log term, but time will tell.

As a seasoned crypto investor I’ve seen markets twist and turn but new technologies always bring fresh opportunities for profit. Blockchain gaming like Axie Infinity has exploded with players earning up to 300 Smooth Love Potions daily in 2021 per the insights from https://lynnyl.io which also notes breeding Axies costs between 150 to 2400 SLP depending on breed count. Automated trading bots are another gem boosting returns by 20 to 30 percent for savvy users who tweak parameters right. These bots analyze market volatility cutting losses by 15 percent compared to manual trades. Then there’s staking with Axie Infinity Shards offering 50 percent annualized returns for holders who lock in tokens. I’ve dabbled in customizing bots myself netting an extra 10 percent monthly by syncing with real-time trends. The trick is staying ahead adopting tools early and mastering their quirks. New tech isn’t just shiny toys it’s profit engines if you play smart. Back in my early days I missed chances but now I ride these waves with confidence knowing numbers don’t lie Technology evolves and so should your wallet .

Stop spamming with unwanted and unrelated topics. This is not the plato shill whatever you're shilling.