I got a job! Woohoo! Well sorta. But I may have failed the eye exam

Welcome to my little corner

Due to author rewards being zeroed out on last day of payout, by buildawhale account but really thanks to Hive's wannabe antihero, and for reasons unknown and silence on the matter, please instead use the gift 🎁 on peakd or donate liquid HIVE & or Liquid HBD here to make tips/donations.

The most vivid and most powerful dream your mind ever concocted to exist for you is the one your living in right now.

Your dreams are only just beginning when you wake up.

OFFICIAL POST HERE:

I'll tell you honestly I'm not the best analyst to analyze an analysis tool. Especially an AI. I have absolutely no coding skills. Luckily for me this freelance task seemed simple enough for an average Joe like myself. How hard can be?

Recently I can across a freelance offer by chrisaiki on my own feed thanks to a reblog made by atma.love

This is the second post in accordance to the second request required for that job offer as described below.

Make a second post with your comments about the test you just made

My comments on the test

I guess I'll just start of with what I didn't like when I entered was that I had to use a Google login. Unless I could have circumvent that,... it went over my head to be honest. but it was done oh well.

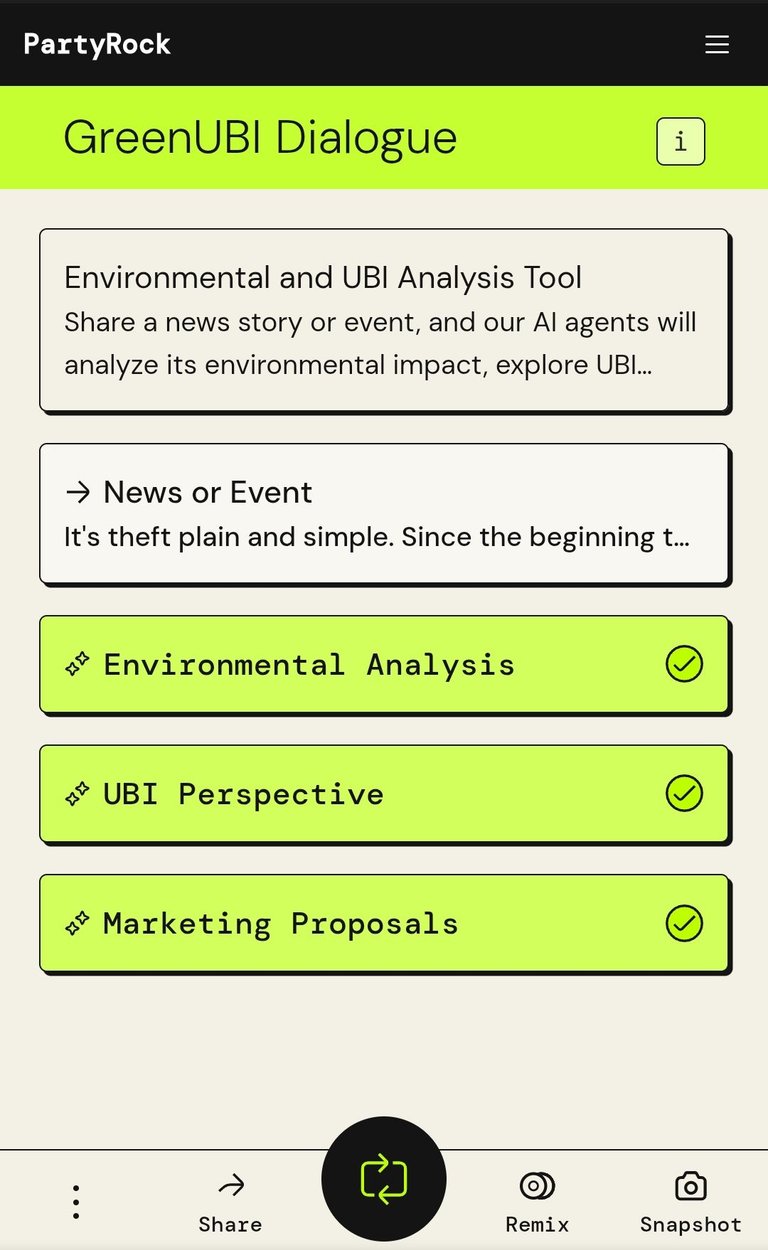

Below is a screenshot of what one first sees once entering. As you can see I have already ran a short article, my article to be exact:

A crime against humanity. Should Hive Tolerate Usury?

I know it sounds easier said that done but I would love for an ai analyzer to actually read pictures, videos and audios that may appear in a website by just giving it a link to an article and not just the text behind it

Results:

https://partyrock.aws/u/chrisaiki/zuiBgoz0p/GreenUBI-Dialogue/snapshot/uvWS2rlmS

Screenshots taken from mobile phone.

Overall it looks slick and simple to use.

It gives you two white and 3 green clickable tabs.

From top to bottom.

Clicking on the double arrow on the bottom there takes you to the next or previous tab. It shows no availability to go back which means we are in the top tab as shown in the previous screenshot.

Next tab:

News or Event

Here is where you will type or copy/paste the data you want to be analyzed. It could be your own article or an existing or anything else. Give it a try yourself but respond to the job offer post first so that you can get your reward if you feel up to the task.

Once you are done inputting the data there would be a play ▶️ button displayed. Click on it to start the analysis. It will only take a few moments.

Up to here I am loving still it's simplicity and easy to read. I haven't experienced any issues yet. And am curious to what the results have to say.

Great, now that is done we go to the next tab over.

Here's the totality of that body of text:

As the Green Sentinel, I'll analyze the environmental implications of this financial lending situation, focusing on sustainability and ecological impacts:

Environmental Analysis:

- Digital vs. Physical Banking

Positive:

- Digital cryptocurrency transactions generally have a lower physical footprint than traditional banking infrastructure

- Reduces need for physical bank buildings and paper documentation

Negative:

- Cryptocurrency mining and blockchain operations can have significant energy consumption impacts

- Digital infrastructure requires electronic waste management consideration

- Resource Management

Positive:

- Peer-to-peer lending could potentially support green projects and sustainable initiatives

- Digital systems reduce transportation-related emissions associated with traditional banking

Negative:

- Predatory lending practices could lead to resource exploitation as borrowers struggle to repay

- Financial stress might cause people to choose cheaper, less sustainable options

- Community Sustainability

Positive:

- Local lending could support community resilience and sustainable development

- Digital platforms reduce physical resource consumption

Negative:

- Economic instability from high-interest lending could undermine environmental initiatives

- Financial pressure might lead to environmentally harmful short-term decisions

- Long-term Environmental Implications

Positive:

- Digital financial systems could support transition to sustainable economies

- Reduced physical infrastructure needs

Negative:

- Economic instability could hamper investment in renewable energy and sustainable practices

- System collapse could lead to resource-intensive recovery efforts

Recommendations:

- Develop sustainable lending practices that support environmental initiatives

- Implement energy-efficient blockchain solutions

- Ensure financial systems support rather than undermine environmental protection

- Consider environmental impact in lending criteria

The environmental impact of this situation primarily stems from its potential to create economic instability, which could negatively affect sustainable development and environmental protection efforts.

First off. Wow. It come up with some impressive results that made me rethink how to approach the issue mentioned in my post. Proving to be pretty useful to me already.

I like the layout and experienced no issues accessing any of the tabs. As far as content goes I'll leave it to the readers to comes up with their own conclusions.

I want to compare that environmental analysis with what chatgpt has to say if I may.

Given the same text of my post I asked it to do just that.

Certainly! Let's break down an environmental analysis based on the concerns you've raised in your message, considering both the immediate and broader environmental impacts — economic, social, and digital — of lending with interest, particularly within decentralized platforms like Hive.

- Economic Environment:

The practice of lending with interest, especially in a decentralized ecosystem, creates a system where capital is concentrated in the hands of a few (the "loan sharks"). This leads to several negative economic consequences:Exploitation of Vulnerable Participants: Users desperate for liquidity may accept loans with harsh terms, jeopardizing their assets and future earnings. Over time, this could lead to a growing divide between those with sufficient capital to offer loans and those trapped in cycles of debt.

Wealth Disparity: By engaging in interest-based loans, wealth becomes concentrated in the hands of those who can afford to lend. This weakens economic mobility within the community and may lock less fortunate users into long-term financial dependency, causing them to lose out on potential growth.

Instability and Risk of Collapse: As you pointed out, the risk of forfeiting accounts if loans aren’t repaid in time represents a potential “domino effect,” where large portions of the platform's user base could suffer from bankruptcies or sudden loss of assets. The sudden collapse of many accounts could destabilize the economy of Hive, causing cascading effects.

Short-term Liquidity vs. Long-term Viability: In economic terms, this creates a conflict between immediate liquidity (quick cash) and long-term financial health. While short-term liquidity can provide users with temporary relief, it leads to structural inequality and potential collapse in the longer term. This kind of short-term gain often harms the broader economic health of a community.

- Social Environment:

The social fabric of a community built on trust and mutual benefit can be severely impacted by lending practices tied to interest and collateral.Erosion of Trust: As users get caught in exploitative loan agreements, trust in the platform and its community may erode. A platform built on mutual collaboration and shared growth could begin to fracture as users become wary of others' intentions. If trust is broken, user engagement and collaboration decline.

Loss of Community Support: When individuals can no longer rely on each other for mutual aid or support (like borrowing from a family member or community), the sense of collective wellbeing and solidarity dissolves. Instead, people turn to profit-driven structures that prioritize individual gain over collective success.

Social Division: Those who become indebted may experience stigma or feel isolated within the community. The psychological toll of being in debt, and the fear of losing control of assets, can contribute to social anxiety, affecting mental health across the platform. Over time, this creates an environment of inequality and tension.

- Digital Environment (Hive as a Decentralized Platform):

On a technical level, practices like interest-based lending and account recovery agreements could lead to significant risks within the digital infrastructure of platforms like Hive.Security Risks: The practice of giving away your Master keys and allowing a loan provider to control your account recovery introduces major security vulnerabilities. Users’ accounts could be at risk of being hijacked, either through malicious intent or simply due to poor security practices. If loan sharks gain control over multiple accounts, they could potentially launch a coordinated attack on the platform’s infrastructure, weakening trust in its security protocols.

Decentralization vs. Centralization of Power: Hive, by nature, is a decentralized platform. However, when loans are tied to interest and collateral, this centralizes power into the hands of a few lenders. If a large portion of the community is involved in such practices, the platform could become more centralized and less true to its original values of decentralization. This undermines the essence of a blockchain community that seeks fairness and equality.

Systemic Risk in the Blockchain Ecosystem: Given the nascent nature of decentralized platforms and the way they integrate with broader blockchain ecosystems, allowing a small group of individuals or entities to control critical infrastructure (like account recovery keys) could create a "single point of failure." Should these loan sharks decide to manipulate the system, it could lead to massive economic and social damage to the platform's users.

- Long-term Environmental Impact:

The environmental effects of lending with interest are not only limited to the short-term, but can extend far beyond individual users.Negative Feedback Loop in Ecosystem Health: Over time, if interest-based lending becomes more widespread, it creates an environment where users are incentivized to continue taking on debt, leading to systemic fragility. As more users fall into debt, the ecosystem becomes more fragile, decreasing the overall health of the community. This may deter new users from joining the platform and limit growth.

Diminished Sustainability: The unsustainable practices of charging interest on loans could lead to unsustainable growth. If the platform's users are increasingly incentivized to engage in interest-based financial models, this could skew the platform away from its original ideals, possibly undermining long-term viability and user trust.

Conclusion:

In conclusion, allowing the practice of charging interest and collateralizing accounts within decentralized platforms like Hive could create a toxic financial environment, destabilizing the ecosystem, weakening social trust, and reducing economic mobility. It could shift the platform from a decentralized, cooperative space into one dominated by a few lenders, potentially leading to financial instability and user exploitation. This would erode the community's core values, leaving behind a system that is inherently unjust and unsustainable. As history has shown with traditional financial systems, the practice of interest-based lending can lead to widespread inequality and societal harm — and there's a significant risk that the same could happen within decentralized platforms if these practices are normalized.To combat these environmental risks, it’s important for the community to consider alternatives to interest-based loans and focus on creating more equitable, supportive financial models that align with the principles of decentralization, collaboration, and mutual benefit.

Done

That last paragraph which chatgpt including possible solution is something I didn't see with the ubi I'm testing out. Something to think about but it may be included else where.

Chatgpt loves to chat as you can see her replies are much longer as for partyrock is much simpler, shorter and to the point.

Next slide please.

UBI analysis

As the UBI Oracle, I'll analyze how a people-governed UBI system like Freeos could address the issues raised in these posts about predatory lending and economic exploitation:

Key Benefits of a Community-Governed UBI Approach:

- Financial Security Foundation

- Provides baseline income security, reducing vulnerability to predatory lending

- Decreases desperation-driven borrowing from questionable sources

- Enables long-term financial planning rather than short-term survival decisions

- Community Empowerment

- Puts economic power directly in community members' hands

- Reduces dependency on traditional banking and lending institutions

- Enables collective decision-making about economic policies

- Interest-Free Alternative

- Offers regular, reliable income without interest or collateral requirements

- Eliminates need for high-risk loans with exploitative terms

- Supports ethical financial practices aligned with community values

- Economic Resilience

- Creates stable economic foundation for community members

- Reduces wealth concentration and economic inequality

- Supports sustainable local economic development

- Social Protection

- Prevents exploitation of vulnerable community members

- Maintains dignity and autonomy of recipients

- Preserves community relationships rather than creating debtor-creditor tensions

Implementation Recommendations:

- Democratic Governance

- Community-driven policy decisions

- Transparent operations and fund management

- Regular review and adjustment of distribution methods

- Education Component

- Financial literacy programs

- Understanding of predatory lending risks

- Community economic empowerment training

- Complementary Services

- Interest-free emergency funding options

- Community mutual aid networks

- Financial counseling and support

- Technology Integration

- Secure, transparent distribution systems

- Reduced administrative overhead

- Enhanced accessibility and user control

A well-designed community UBI system could effectively address many issues raised in the original post by:

- Preventing financial desperation that leads to predatory borrowing

- Supporting community-centered economic development

- Promoting ethical financial practices

- Building long-term economic resilience

- Preserving community relationships and trust

This approach aligns with both economic justice and community empowerment goals while providing practical alternatives to exploitative lending practices.

Again, not chart and long results unlike chatgpt. But there is probably better alternatives than GPT, I wouldn't know, I don't necessarily involve myself In ai tools. I'm a hands on kind of guy. Not a computer geek. I prefer the old school method of writing which is handwritten in fountain pen and candle wax seals. Unfortunately I'm out of ink... And I don't know how to make one at home that is functional for my fountain pen in specific.

I won't include another long reply from chatgpt. We could see that results were relatively the same, Imo, except one was more descriptive and the other much more summarized.

When I asked chatgpt for a marketing perspective based on the two results of ubi and environmental I think I broke it because its stuck on responding mode.

I also like the fact that in the previous post regarding the first test itself, it ignored the useless information from the websites. As you know I did a select all and copy and pasted it, it included odd characters and phrases. So good job there.

I don't know what else I have to say. I don't see myself in particular using these analyzer, at first, but after this simple experience I won't throw the idea of it away just yet. Sorry John Connor, you're not entirely wrong about ai but not entirely right either. Lol.

Like I said before I didn't do this for the reward. I did this for the mere sake of me killing time and out of boredom so yes there was joy in this experience. It has been an interesting journey to say the least. It definitely molded some perspective for me to ponder on how to approach my post.

As far as UBI goes, I am not entirely onboard with the idea either. I am not sure how the long term usage of an UBI would hold either against an environment or the economy. Guess we'll wait and see...

Cheers frens

Pleasure to help... If I even helped? I'm not entirely sure I did anything fancy here...

If you want to test 8 different AI, you can use https://partyrock.aws/u/chrisaiki/f06TOERou/AI-Comparison-Concierge

This app allows you to compare the answers of 8 different AI models to a question of your choice.