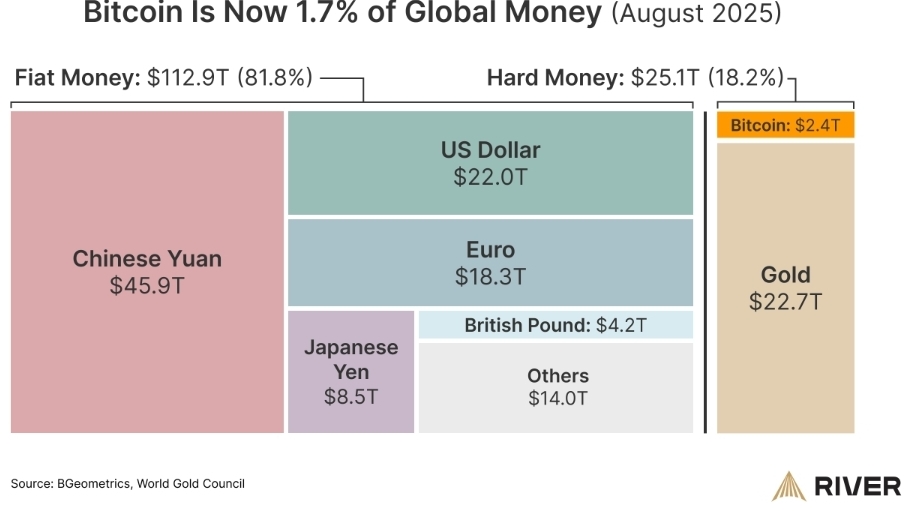

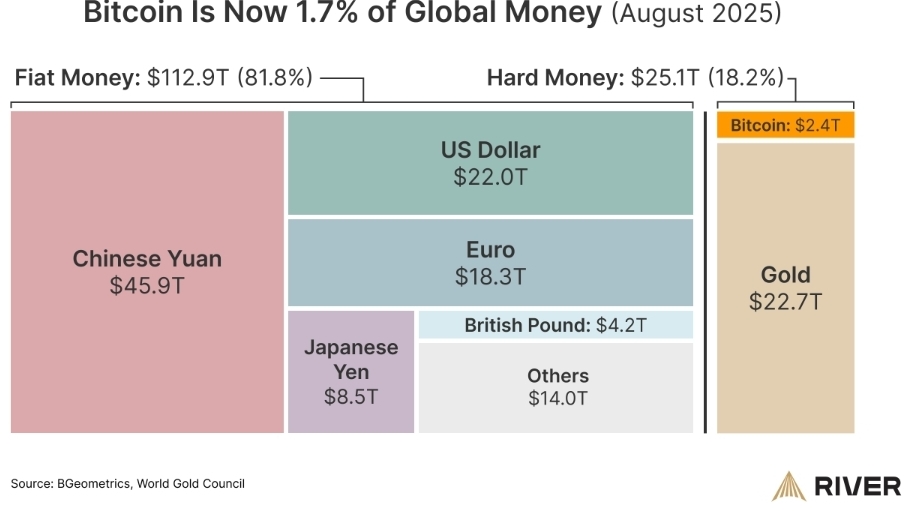

Bitcoin macht jetzt 1,7 Prozent der globalen Geldmenge (M2) aus/ Bitcoin now accounts for 1.7 percent of the global money supply (M2)

Bitcoin ist auf einen Anteil von etwa 1,7 % am globalen Geldvolumen gewachsen, eine Zahl, die laut dem Krypto-Finanzdienstleister River die aggregierten M2-Geldmengen für alle wichtigen Fiat-Währungen, die größten kleineren Währungen und die Marktkapitalisierung von Gold umfasst.

In 16 Jahren stieg Bitcoin auf 1,7 % der weltweiten Geldmenge“, stellte River dementsprechend fest. Das Unternehmen verglich die Marktkapitalisierung von Bitcoin mit einem Korb von Fiat-Währungen im Wert von 112,9 Billionen US-Dollar und Hartgeld im Wert von 25,1 Billionen US-Dollar.

Bedeutung im globalen Geldmarkt, da Zentralbanken weltweit ihre Fiat-Währungen durch übermäßige Geldschöpfung inflationieren, wodurch die Kaufkraft zerstört wird und Anleger zu alternativen Hartgeldwährungen greifen.

Bitcoin und andere Kryptowährungen tendieren dazu, in Zeiten der geldpolitischen Expansion an Wert zu gewinnen, da der Preis digitaler Vermögenswerte mit dem globalen Liquiditätsniveau korreliert.

75 % der Anleger rechnen laut Daten der Chicago Mercantile Exchange (CME) Group nun mit einer Zinssenkung um 25 Basispunkte im September.

Rücksetzer als Chance nutzen

In den vergangenen Tagen stand der Kryptomarkt deutlich unter Druck. Nachdem Bitcoin zuletzt ein Rekordhoch von 124.000 US-Dollar markierte, setzten spürbare Gewinnmitnahmen ein. Die Folge war eine ausgeprägte Korrektur, die den Kurs bis in den Bereich um 110.000 US-Dollar zurückführte.

Ich zitierte aus folgendem Artikel...

https://de.cointelegraph.com/news/bitcoin-macht-jetzt-1-7-prozent-der-globalen-geldmenge-m2-aus

Mein persönliches Fazit:

Diese Entwicklung zeigt, dass Kryptowährungen das aktuelle Fiatgeld-System Outperformen. Betrachtet man die Vierjahreszyklen, wird deutlich, dass Kryptowährungen das Fiatgeld-System irgendwann ablösen werden?

English

Bitcoin has grown to account for approximately 1.7% of the global money supply, a figure that includes the aggregated M2 money supply for all major fiat currencies, the largest minor currencies, and the market capitalization of gold, according to crypto-finance provider River.

In 16 years, Bitcoin rose to 1.7% of the global money supply," River noted. The company compared Bitcoin's market capitalization to a basket of fiat currencies worth $112.9 trillion and hard money worth $25.1 trillion.

Importance in the global money market, as central banks worldwide inflate their fiat currencies through excessive money printing, destroying purchasing power and causing investors to turn to alternative hard currency.

Bitcoin and other cryptocurrencies tend to appreciate in times of monetary expansion, as the price of digital assets fluctuates with global liquidity levels. correlated.

According to data from the Chicago Mercantile Exchange (CME) Group, 75% of investors now expect a 25 basis point interest rate cut in September.

Use pullbacks as an opportunity

The crypto market has been under significant pressure in recent days. After Bitcoin recently reached a record high of $124,000, noticeable profit-taking began. The result was a pronounced correction that brought the price back to the $110,000 range.

I quoted from the following article...

https://de.cointelegraph.com/news/bitcoin-macht-jetzt-1-7-prozent-der-globalen-geldmenge-m2-aus

My personal conclusion:

This development shows that cryptocurrencies are outperforming the current fiat money system. Looking at the four-year cycles, does it become clear that cryptocurrencies will eventually replace the fiat money system?

Posted Using INLEO

And it is only the beginning of what awaits us in the future, since as new ones arrive, that amount will increase.

https://x.com/lee19389/status/1963715331811344600

#hive #posh

It is already noticeable that confidence in cryptocurrencies is much greater than in the traditional fiduciary system, this percentage will increase because new investors will most likely enter and their savings will be in safer wallets and always under their watchful eye and at their disposal.

Even if the math is a bit weird when computing it like that, it does show how important crypto as a whole and BTC in particular have become

With cryptocurrencies we have the opportunity for our money not to lose value since they move with respect to the market and not how central banks do it, which, as you well comment in your publication, with the printing of fiduciary money leads us to the inflation that we have in countries like where I live (Venezuela). Honestly, if it weren't for cryptocurrencies, our reality would be even worse.

!WINE

That’s a big milestone for Bitcoin. The fact that it now makes up 1.7% of the world’s money supply really shows how much it has grown. With central banks printing more money and inflation always a concern, I can see why people believe Bitcoin and other cryptocurrencies could one day take the place of fiat money.

I agree that cryptocurrencies is now starting to get more better and would continue to rise in the future

Cryptocurriences outperforming fiat money system is a great milestone and it is still growing

Cryptocurrencies are starting to get being noticed a lot of people

https://www.reddit.com/r/Kryptostrassenwetten/comments/1na6ol6/bitcoin_macht_jetzt_17_prozent_der_globalen/

This post has been shared on Reddit by @wissenskrieger through the HivePosh initiative.

Your analysis clearly shows that Bitcoin and cryptocurrency are playing an important role in the global economy. And I think it is slowly establishing itself as an alternative to the fiat system.