Stacking Copper?

When we think of valuable metals, we think of precious metals—usually silver and gold. Some might also think of the other two commonly used in coins and rounds: platinum and/or palladium. Precious metals are rare, mostly resistant to corrosion, and typically have a high luster.

But copper?

You probably don’t give copper a second thought. Technically, copper is usually considered a “base metal” or “industrial metal” because it oxidizes and corrodes easily, is more common, and doesn’t look as flashy.

We still carry this image of copper as a cheap metal—something used in pipes and our lowest-value coins. Yet many countries have long since removed copper from their coinage. Why? Because the price of copper keeps rising. This is one base metal you might want to start looking at as a potential investment.

If you missed it, I posted a story a few days ago about how the world doesn’t have enough copper mines—due to a mix of environmental, logistical, and political reasons—and demand is only growing. That means the price is rising.

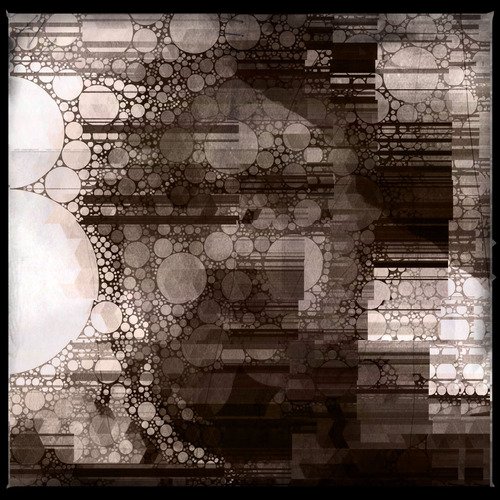

I just pulled up the one-year chart for copper. Look at how it shoots up toward the end!

Here’s the one-month view. A steady climb.

Don’t get too excited—that $5.21 is per pound, not per ounce like silver or gold. One pound is about 0.45 kg.

Still, neither chart is unattractive. But as Warren Buffett always says, we shouldn’t buy something just because the crowd is driving the price up. We should look at the fundamentals to see if it’s actually worth buying.

As I mentioned before, there aren’t enough mines, and many of the mines we do have are past their peak and producing lower-quality copper. Again—see my previous post. Copper is essential to the modern world. For one thing, computers wouldn’t function without it. But it’s also difficult to mine cleanly, and copper mines often face heavy environmental regulations and community resistance, especially since they tend to pollute local water sources.

As copper prices go up, companies will have more incentive to develop cleaner mining technologies—but we’re not there yet. The result: copper will probably remain scarce for the foreseeable future, and demand (and price) will keep climbing.

Trump has announced plans to impose copper tariffs—likely trying to give the industry a push and magically produce more U.S. mines. But at least in the short term, this could send prices even higher.

If you’re in the U.S., stacking copper isn’t too hard. Save your pennies! But—there’s a catch. Only pennies minted before 1982 are mostly copper. After 1982, the U.S. Mint switched to copper-plated zinc.

The only other country I know well is Japan. Here, both the 5-yen and 10-yen coins are still primarily made of copper. The 10-yen coin is 95% copper, and the 5-yen coin is 60%.

In other countries, I imagine you still have access to at least one or two copper coins.

In any case, you might want to start tossing those copper coins into a jar instead of spending them. Many of my fellow stackers in #silvergoldstackers already save copper coins—I suggest some of you stacker wannabes might start doing the same.

❦

|

David is an American teacher and translator lost in Japan, trying to capture the beauty of this country one photo at a time and searching for the perfect haiku. He blogs here and at laspina.org. Write him on Mastodon. |

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

If the Reset happens with those same numbers, Copper will cost about $0.0522 per pound in U.S. Crypto Coinage... Remember that Fiat USD's will soon become Sound Money Cents. and Decimal Cents...

Like my gold and silver stacks, I'm way ahead of the curve on the copper penny hoard.

Forward thinking!

I have three chests full of them, and they're bulky and heavy suitable as ballast.

I use them as door stops for now.

I read somewhere a while ago that the price of copper has been matching the price of BTC for a while now. Not the actual price of course, but the chart in general. I don't know how accurate that is, but I always found it a bit interesting.

I'll have to start watching for that.

Yeah, I haven't checked it much myself, but there was a pretty compelling article about it a while ago.

I like copper too, but I stack mostly gold and silver.

!BBH

!LADY

!LUV

@dbooster, @silversaver888(7/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @dbooster and you earned 0.1000 LOH as tips. (9/50 calls)

Use !LADY command to share LOH! More details available in this post.

https://www.reddit.com/r/Wallstreetsilver/comments/1jlebr4/is_copper_the_next_metal_to_stack/

https://www.reddit.com/r/MetalsOnReddit/comments/1jler1o/is_copper_the_next_metal_to_stack/

The rewards earned on this comment will go directly to the people( @loading ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Funny, today I had a talk with my bodies about copper as an investment, and only now have I seen your post. The bigger picture is that despite the recent increases, the price of copper only reached the level of 2011. A high demand is related to a boom in real estate and now to infrastructure for electric vehicles (wiring, especially when high power is needed). Usage for pipes is a thing of the past. These days, polypropylene is more affordable and easier to install.

Maybe we have a manipulative pump these days... but should not be ignore that the price might drop fast, really fast - as it did in 2008: