the zero lower bound remains a medium term risk

Here is an interesting article that I discovered.

Authors: Sophia Cho, Thomas Mertens, John C. Williams

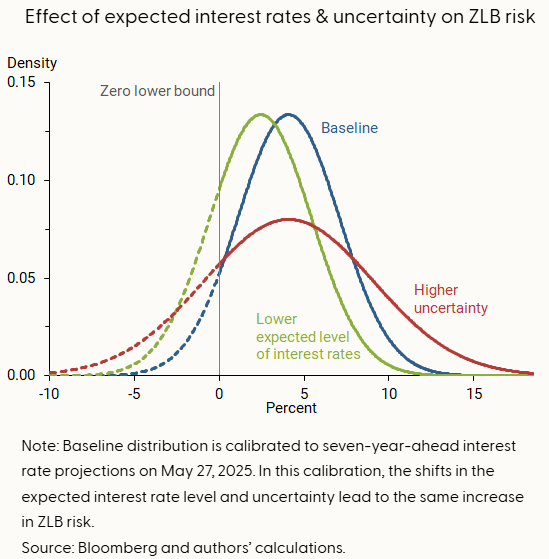

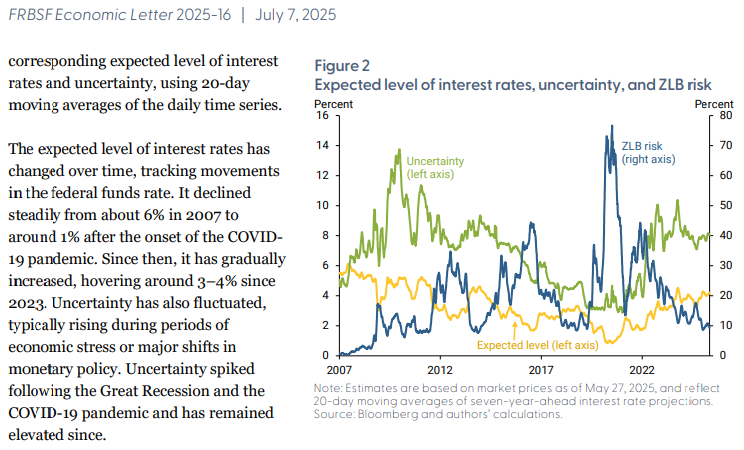

"Financial market derivatives provide real-time forward-looking measures of the perceived risk of reaching the zero lower bound in the future. This ZLB risk tends to fall with higher expected levels of interest rates and tends to rise with interest rate uncertainty. Compared with the past decade, current data show that expected levels of future interest rates are high. Nevertheless, ZLB risk remains significant over the medium to long term, similar to levels observed in 2018, due to recent elevated uncertainty."

PDF -> https://www.frbsf.org/wp-content/uploads/el2025-16.pdf

"With an expected level of interest rates around 3–4%, the perceived risk of returning to the ZLB over the next two years is about 1%. This risk increases to about 9% at the seven-year horizon and remains at similar levels over longer horizons. To put the current term structure into context, medium- to long-term ZLB risk is currently at the lower end of the range observed over the past 15 years. The last time seven-year-ahead ZLB risk reached a similar level was in 2018. But the composition of ZLB risk has changed since then: While the expected level of interest rates at the seven-year horizon is about a full percentage point higher than in 2018, the current considerably elevated uncertainty offsets it and results in a comparable likelihood of reaching the ZLB. Updates related to the term structure of ZLB risk and the time series for different horizons are available on the San Francisco Fed’s Zero Lower Bound Probabilities data page (archived)."

Thanks for sharing, dude.

Fascinating read I'm not gonna lie! The idea that the ZLB could be a medium-term risk is a sobering reminder of the potential consequences of monetary policy intervention and that can be cause alot of admires over there. The parallels drawn between the 1970s and current economic conditions are chilling but I'm actually not sure it is that way in Africa 🌍 though. How do you think the Fed's response to this risk would impact the global economy? Because I'm really trying to figure out things deeper on the economic runnings.

$100 of BTC just 6 years ago is worth over $900 today. Printing money used to be counterfeiting, until they invented 'Quantitative Easing' but unchecked irresponsible spending will always bankrupt a nation. I believe we need to 'fix the money' or little else matters. As long as governments are allowed to spend more than they generate with investments (not merely taxation) we are just their pawns and it's slavery with extra steps. Bitcoin is humanity's opportunity to break free of the boom and bust cycles. BTC Silver and Gold are honest money. HIVE is free speech, web3.0, and reputation.

Ohh wow that's really interesting to hear I just really wish everything falls through with because in this world everyone is thinking about their own and not thinking of making things happen for everyone else to do the same but Hive is truly a platform that will positive to enjoy great benefits if it comes to it should.