No ROI, No Future

This has been the fate of many, their entire years of service has ended up a flop. Is your money working for you, will it ever? The future is ROI. How many years actually have you been working for the money? We are talking of decades of service either in the private or government sector. How much is always gathered in the end, a few handfuls of millions as gratuity, pension or savings. When did you start and how has inflation beaten into your long-term savings? Make that proper calculation and you will find yourself in a long-term loss.

The price of Hive is down but the rewarding system remains real and very active. I am just siting an example of what a fruitful investment entails; ROI. A good investment entails a win-win scenario.

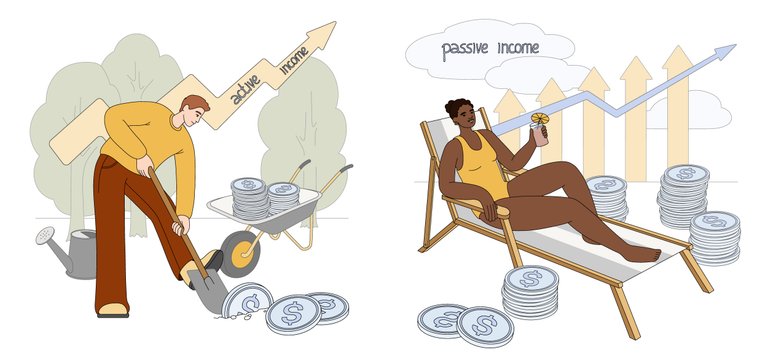

Without a good return on investment it was never worth the while. Many have been taught investment the wrong, could it be an idea to keep the rich richer or just a continuous ignorance adapting to a flopping system. Many believe strength and time is ALL that is to be invested. If you are among this set, then you are very limited. Working years starts from 18 in some advanced countries but putting it in a better margin we should consider the range of 20 to 25 years. When does retirement come? Around that 50 to 60 years depending.

How long can your energy go in terms of time/strength in returns for earnings. Not Enough and it will never be. So, what have you invested in? the idea of money is plainly defined as currency; you have to note, current is meant to flow. Aside from flowing, not all current flow generates needed energy.

source

This is the earlier fate I talked about in the first paragraph. Many are bad in terms of financial intelligence. I have seen some who ended up with money just to build a house and probably buy a car after retirement. They are NOW still working menial jobs to keep. Strength have faded, have will the scenario have looked like if they had good investment opportunities.

I have talked about the potentials of web3 over and over again. Aside from just web3 you have to note this, if you are investing directly on fiat notes, you may not have a good return on investment. Most of this government investment programs are just flops. Because you ae involve in a savings program does not necessarily mean you are an investor. Most times it is just you helping to increase another mans pocket. Take for instance, the 3% annual payment by banks for a fixed deposit. You have to be kidding me, even if I were to be selling groundnut in my front door, I am sure to meet up with such returns within a week. This is just survival money, a good investment is not for survival.

The essence of this article is to make workers and potential investor aware of a pending doom that keeps repeating itself. I like talking about investment because it is a way of salvaging global economy. The middle class have been robbed of good investment strategies. If it is not good, keep off. Never allow anyone to lock down your money as a depreciating cash, there is no future for you. Waking up early and sleeping late is not meant to be forever. Solving this problem entails where your money has been going to.

source

If you take your time to access the 90/10 rules you will realize the difference between these two pairs is returns on their long-term investment. The more you are exposed to tangible dividend, the better. It is about a compounding investment effect. Does all this savings compound? No, what you saved for retirement is what you will get (worse of all, in cash but not in value). Money will continue to depreciate as long as the fiat system is concern. Those who are hanging unto it as investment will all end up in futility.

digital realms are presenting an open door for tangible investment opportunity. I have talked about Hive as one of those good examples. This shows the potential of web3 in entirety, it is not just for the love of it but rather the seen facts. Long term investment in this platform entails a fortune. A smart investor has to look off direct and look out for projects that share rewards. I made mention of the price of hive being down, while this will panic fiat investors (savings per say), it presents an opportunity for more token purchase over here.

If the middle class can just shift their mentality to what true investment is (a good ROI opportunities and compounding effects) there will be an economic boost. At 50 t0 60 years, you should not just only have money to build your house and buy a car only. You should have money that works for you. You deserve to retire well, there is another life to live after retirement, don’t plan of going back the working ways.

In conclusion, let me add, I don’t know for you but I am definitely not ready to work forever. A times must come where all my earnings are as a result of money being the errand boy. Of course, this will only manifest depending on where I decide to put my money/assets on the long terms. Enough equals to enough, having enough stakes on reputable crypto projects, web3 and other tangible projects(offline too) with good ROI will be that game changer. It is all about financial intelligence, I keep on saying it, there is enough money and assets to be evenly distributed, don’t be locked in futility.

Posted Using INLEO