60K Market dance

Is there still hope for green candles and most especially how soon. We saw bitcoin hit new all time high (ath)of above $73,000 dollars a week ago. As usual, not all benefited; you know the last in holds the bag slogan. Don't blame the bears too much, maybe you would have done the same.

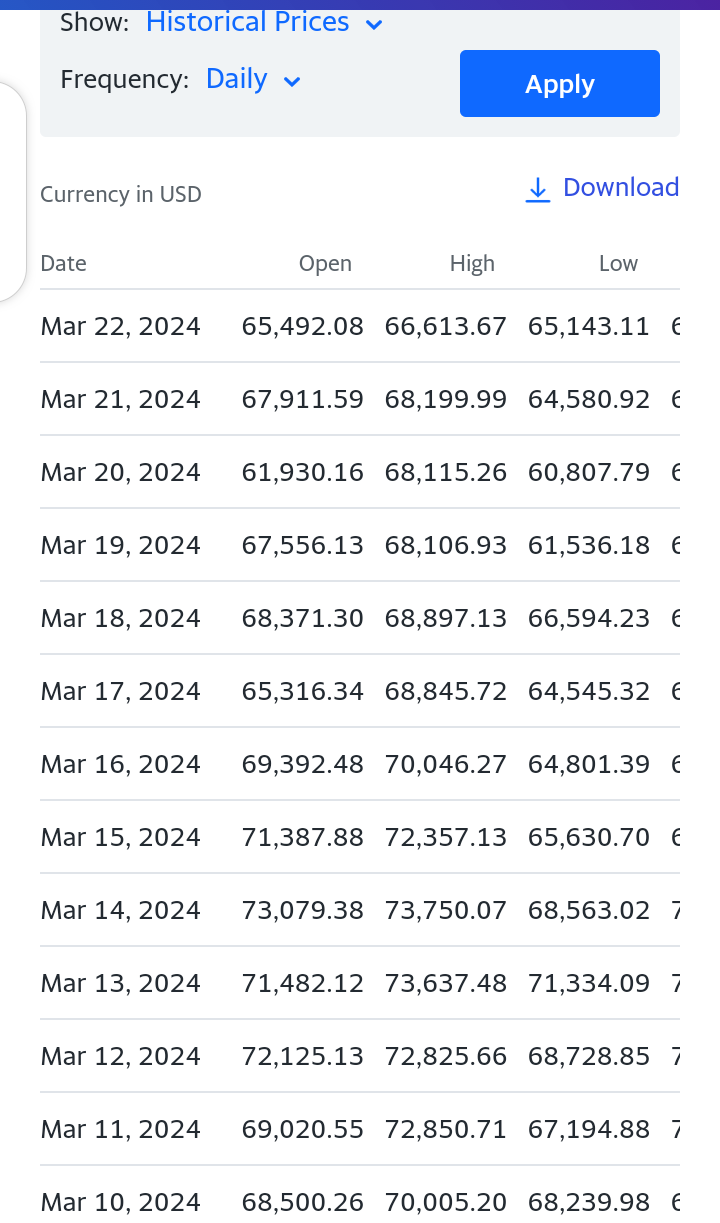

At such a peak, we were expecting a market correction or should I say 'people in the market to correct themselves'. Indeed, the following week after the new bitcoin price peak, there have been red candles spreading even into the altcoin industry. Bitcoin retraced to the below $70,0000 dollars and has been dancing within the 60K digits. While others predicted it might dip even more to the 55K region, it showed resilience within the 60K digits lowering to the below $61,000 dollars price mark and bouncing back, or has it?

Screenshot from source

I knew there was going to be lots of uncertainty when bitcoin hit the $69K mark, breaking its former all time high. It did show some resistance after liquidation characteristics before another upward trend (finance) to almost $74,0000 dollars on the 14th of March. Nevertheless, the correction was not over. Personally, I am not surprised about bitcoin spending a week dancing within the 60K digits, without this, we would be expecting a falling knife.

Yes, it might have lost nearly $13,000 dollars during the dip process that should be around 18% percent within a week. Does the dip look outrageous? If bitcoin had continued that upward trend, let's say to the 85K price mark, we would be talking about not less than 30% decline from my views. The saying 'steadily, steadily wins the race' sits just right for bitcoin.

How long in the 60K dance

Screenshot from source

A lot may be asking how long can bitcoin stay within the 60K mark?. Many have attributed the current recovery to the latest release by Fed to keep rates just as it was. You shouldn't doubt anyway as there was fear uncertainty and doubt (fud) in the system as to what decision that was to be made and how it would affect the cryptoverse, especially the bitcoin industry.

The halving month is just a week before us, with the Fed giving investors some assurance I guess it might not last that long. Bitcoin dipping to nearly $60,000 was a good opportunity for firms to get back into business. Nevertheless, we may have to endure this dance for another week or so. Why am I saying this? It seems day traders are taking profit as it stands, stacking their mini bags ahead of the last dip which might probably occur before the bitcoin halving.

The halving is scheduled to occur on the 20th of April with everyone longing to enter at best positions. So yes I expect a last dip before the halving, it might probably be a week before the event. Big firms and corporate investors may pull back a little, creating some uncertainties for medium investors to make a panic sell before they make another full time revisit. This is the market, you need strategies to stay on top and one of the best is to create fear and buy low.

Is it a good buying position?

From my own views I will say yes, bitcoin has made a $13,000 dollars difference after its all time high. It presents an opportunity for those who enter within the 60K mark will find such stamina. I think bitcoin might not dip below 60K as it stands. The possibilities of upward trends are high from here yet we should not expect it to be a pump, it may be a gradual move to a new all time high probably after the halving event.

I guess short term traders have bitcoin just exactly where they wanted with such early correction helping to erase assumptions of the below 60K. Nevertheless, this is the market and a volatile one to be precise when talking of cryptocurrency. Putting luck aside, the bulls can't withstand a further market dip from here to avoid further market struggles, so yes their resilience is within the 60K and they'll muscle to keep it so.

If you've been stuck in bitcoin trades for a while now, just try and enjoy the dance, you were not expecting all greens right?. The chances of getting out are high anyways, ETF firms, the Fed report and the upcoming halving gives you the needed upper hand. Expect green candles but not hyped ones, it will come at a steady phase to meet up a perfect halving date.

The effect will spread to the altcoin industries. We all saw lots of other projects turn red immediately bitcoin gave in for a dip. Not surprising, altcoins have always relied on bitcoin to stay green, hoping this strategy soon elapses. There is a need for altcoins to show personal resilience if we are to thrive in this industry.

To conclude, let me add, there has been silent music within the 60K digits region that has kept bitcoin for a week now. We all know the majority tells the market what to do. Not actually in numerics (as of number of investors) but numerics (as in number of high stake holders), it has always been what attributes victory to the bulls or bears. Breaking below the 60K mark seems to be curbed and so is the above. If you are a smart investor or trader, you could make lots of profits from here. We know the simple rules, do your research and always what you can afford to lose. There is a future for bitcoin and blockchain technology.

Posted Using InLeo Alpha