Uniswap Remains the Number One DEX | Performance Review Covering TVL, Volume, Users, Top Pairs and More | Dec 2023

From all the defi apps we have seen in the previous bull market, Uniswap has kept its dominance and continued to develop and grow. It was the first defi app to bring in users thanks to its simplicity and incentives. Following the FTX collapse and the multiple other collapses centralized entities in 2022, its importance grew even more.

Let’s take a look how is the protocol performing under the current market conditions.

Here we will be looking at:

- Total value locked

- Trading volume

- Top exchanges

- Number of users

- Top Pairs

- Price

The period that we will be looking at is 2020 - 2023.

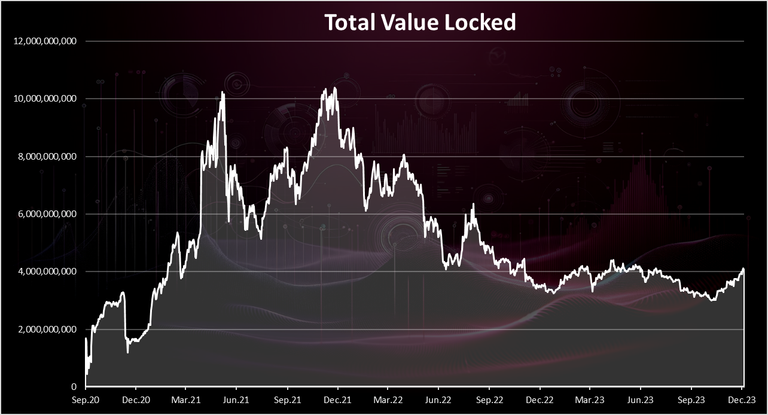

Total Value Locked

Here is the chart for the TVL on Uniswap starting from September 2020.

Uniswap launched its token back in September 2020, and the liquidity grew fast then. A record high of 10B was reached in April 2021, and again in November 2021. Since then, it has been a downtrend and reached around 4B, where it has been hovering for more than a year now, with a recent spike in the last weeks.

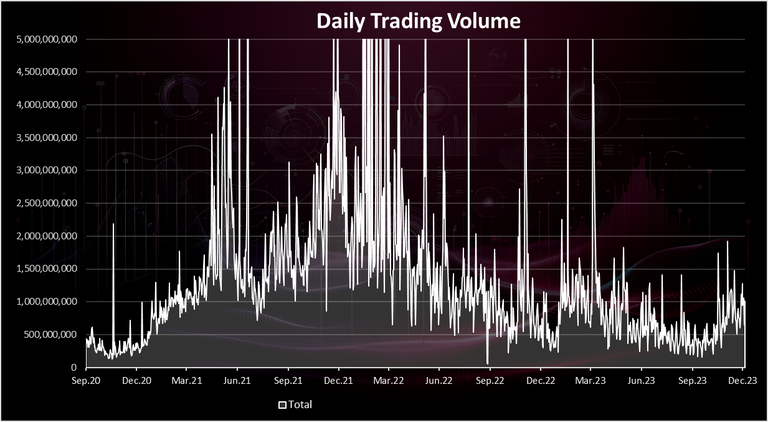

Trading Volume

Trading volume is extremely important. That is where the fees come from and the APR for liquidity providers. No trading volume means no fees and no capital in the protocol.

The chart for the trading volume looks like this.

This is a chart for the daily trading volume. It’s quite volatile.

The daily trading volume has been more constant in the last year, similar to the TVL, with occasional spikes whenever there is some volatility in the market. At times there was more than 5B in daily volume, all legit and recorded on chain with fees paid.

We can see the increase again in the volume in the last weeks. It has been growing above 1B in recent days.

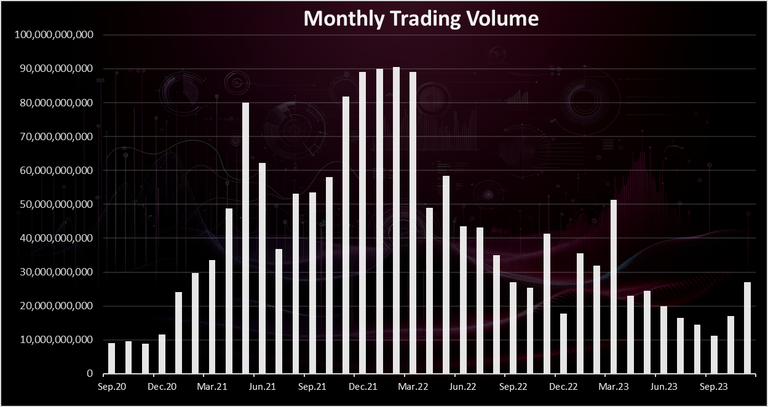

The monthly trading volume looks like this:

A clearer picture here than the daily volume.

We can see the monthly trading volume reached an ATH at the end of 2021 and the beginning of 2022, when it was around 90B for a few months.

In the last months the trading volume has increased again and it has reached almost 30B in November. December is probably most likely to be with even higher volume, somewhere close to 50B.

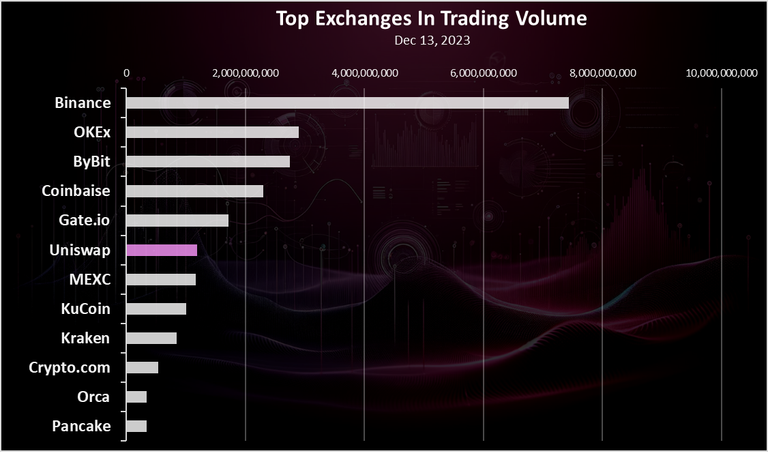

DEX VS CEX Volume

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

An example for the last 24 hours:

Uniswap ranks somewhere in the middle now, although a few months back it was in the top three exchanges, just after Binance and Coinbase, even surpassing Coinbase a few times. Obviously, the volume on CEXs has increased in the last period and they are ranking better now. The fear from CEXs collapsing has probably been reduced now, more than a year after FTX went down.

There are two more DEXs that are in the top exchanges Pancake on BSC, and the Orca DEX on Solana.

Active Users

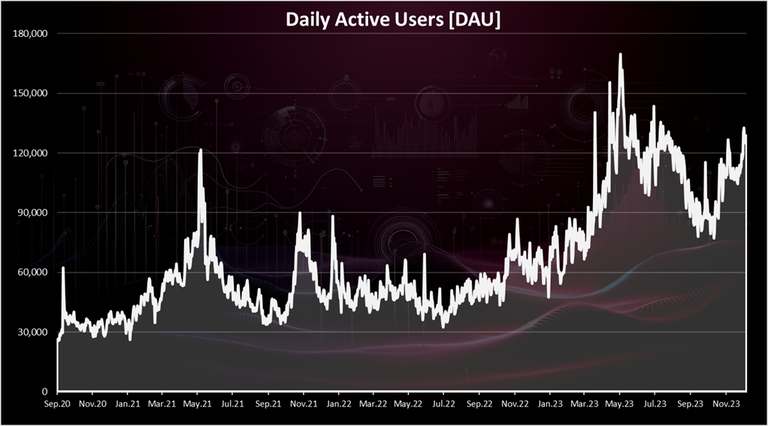

How many users does Uniswap have? Here is the chart.

In terms of daily active users, Uniswap is setting ATH in the last period. More than 100k DAUs and growing. In the last period this number has been around 120k. This is most likely due to the Uniswap expansion on L2 solutions, where the gas prices are cheaper, and the app is available for more users.

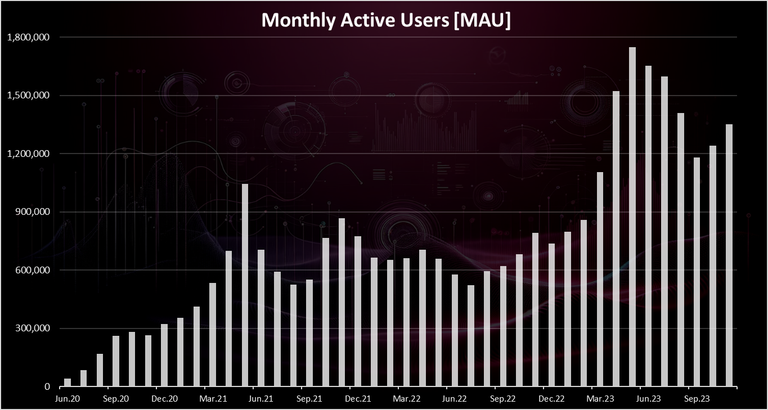

On a monthly basis the chart looks like this:

A similar trend to the DAUs chart here as well. A new ATH back in May 2023, and a increase in the previous months as well. Again these rise in the number of Uniswap users is most likely due to its expansions to cheaper chains and lower gas fees.

A 1.3M users for the month of November.

Top Trading Pairs on Uniswap

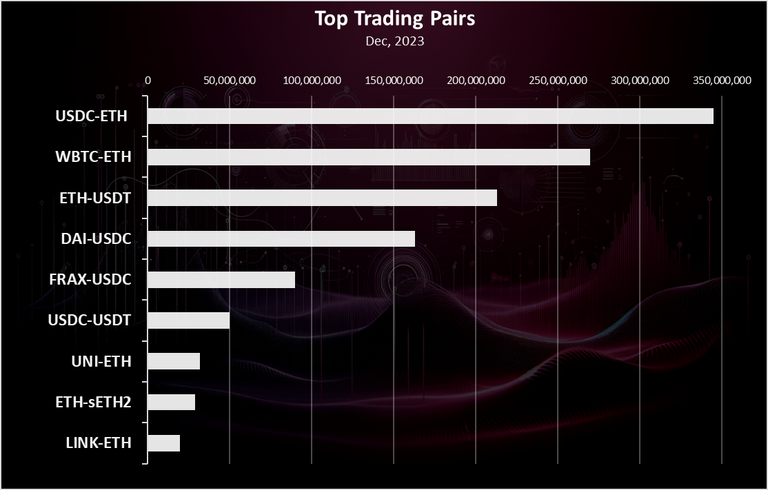

Here is the chart for the top trading pairs ranked by liquidity.

The USDC-ETH pair is on the top with almost 350M combined liquidity. The BTC-ETH pair is on the second spot, followed by another Ethereum stablecoins pair, ETH-USDT.

The DAI-USDC pool is on the fourth place as a stablecoins only pool. A few others stablecoins pairs in the top as well.

Price

The chart for the UNI price looks like this.

The UNI token has been on a wild ride, reaching $40 at some point in 2021. Since then, it has dropped, and in the last year it has been hovering around the $5 mark for a long time.

All the best

@dalz

$WINE

Thanks for this valuable information, good day.

Thank you for this update stats

It’s funny how I have never gotten to use Uniswap

I will give it a try though

I’m used to pancake swap

uniswap is doing amazing.

Still this exchange is very much liked by people because it is very easy to use and its coin can also give people a lot of good profits in the future.