The Stablecoins Market Cap is Up After the Rally in the Crypto Prices! | A Look at the Top Stablecoins | Nov 2023

Stablecoins, or a dollar-pegged coins have begun to grow in market cap. The prices of Bitcoin and other cryptocurrencies have increased so the increase in the market cap of the stablecoins is to be expected. But not all of them are growing and not at the same rate.

It’s been a fun ride for stablecoins in the last years. Let’s take a look!

The TerraUST fiasco back in May 2022 has left a mark on the stablecoins industry. A year and a half has passed since then and we are now seeing the first signs of some recovery. Let’s see how the market cap of the top stablecoins looks in the last period.

Apart from the fiat backed stablecoins (USDT, USDC, BUSD….) that are keeping dollars in the banks or equivalent like T-bills, there are tokens like DAI, HBD that are backed by other crypto as collateral, and/or using conversion on chain operations to maintain the peg.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Dai [DAI]

- Binance USD [BUSD]

- TrueUSD [TUSD]

There are a few more out there like FRAX, PaxosUSD, USDP, etc, but we will focus on the above as the biggest ones in market cap.

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly it is founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank. Tether is an offshore company with a location outside of the US jurisdiction.

But Tether has survived multiple crashes and run on the banks in the last years, and it has proven itself to work as intended in the mist of the biggest chaos in the crypto industry.

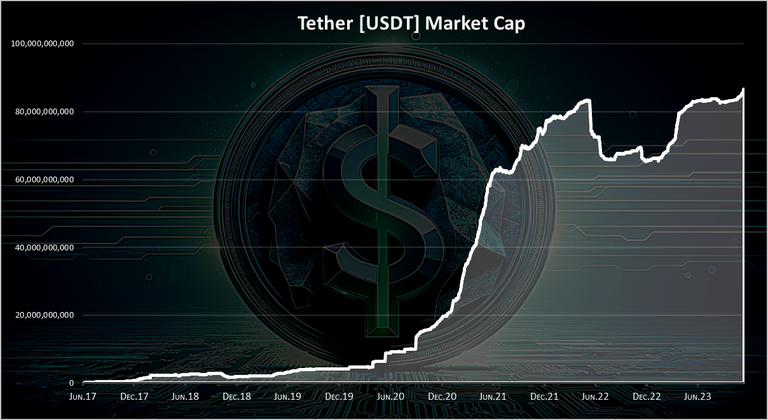

Here is the market cap for Tether .

As mentioned Tether started operating back in 2015, but it gained some significant market cap for the first time in 2017. A real bull run and a massive increase in the market cap happened in 2021 when its market cap went from under 10B to more than 83B.

Then in 2022 there was the crypto crash and the Tether market cap contracted from 83B to 65B. In the first half of 2023 it started growing again reaching 80B and it has been hovering around that number up to recently when is break the previous ATH of 83B and it is now at 86B in market cap. A new all-time for Tether USDT. Tether started 2023 with 66B and now is at 86B, or a 20B increase in market cap.

USD Coin [USDC]

USDC is a common project between Circle and Coinbase. It is an US based company.

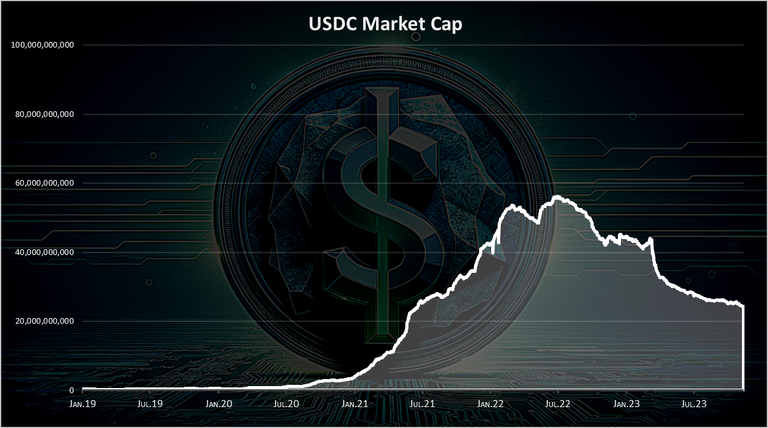

Here is the chart.

USDC was founded back in 2018 and it gained a real momentum in 2021, when it reached 58B. A drop followed afterwards in 2022, and even bigger drop in the first half of 2023 due to a bank crisis in the US. In March 2023, one of the banks where USDC had a share of its reserves in USD, collapsed, causing the market to panic and pushing down the peg of USDC as low as 88 cents. This was short lived and the USDC peg recovered in a day or two, and later it even managed to get access to its funds in the collapsed bank.

But the damage was done and a lot of funds exited from USDC.

Another reason for the decline in the USDC market cap might be the overall situation with crypto regulation in the US. The overall climate has not been very friendly towards the industry and a lot of banks have cut off their ties with crypto companies.

On a yearly basis the USDC market cap started with 44B, and now it is at 24B. A total reduction of 20B. Unlike Tether, USDC has not grown, even in the last months when the crypto prices increased.

USDT vs USDC

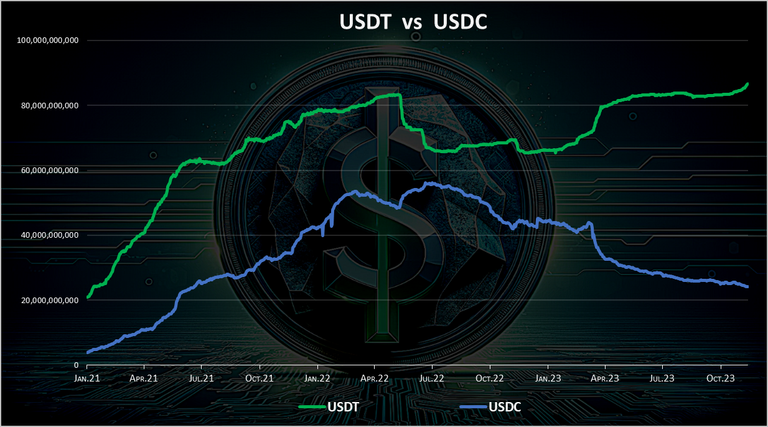

When we plot the market cap of the two biggest stablecoins we get this.

An almost ideal inverse pattern!

After the growth of both of these coins back in 2021, since 2022 the market cap of this two has been inversely corelated. Whenever Tether lost market cap, USDC gained. In the last period USDC has been losing its market cap at the cost of Tether.

Dai [DAI]

DAI is the decentralized version for stablecoin. It runs as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate DAI as a loan.

DAI works as overcollateralized stablecoin, where users put in crypto assets to mint DAI.

DAI was established back in 2019, it grew through 2021 a lot reaching 10B market cap, and it has been in decline since then up to the last weeks.

We can see the big spike at the end of the chart. That is an increase in the market cap of DAI from 3.5B to 5B in just a few days. The biggest increase was on November 8, when there was 1.5B DAI minted in a day.

In the previous bull run there was a tendency to use USDC to mint DAI, but in the last period this has changed and most of the collateral to mint DAI now is ETH, with more than 70% share.

Binance USD [BUSD]

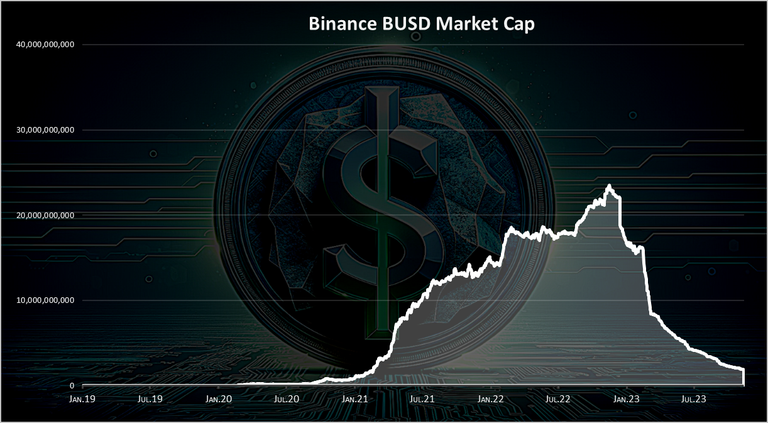

The Binance exchange stablecoin. It is issued by Paxos with the Binance branding. But this token has received a ban from the US authorities, and it is now in a closing down phase. Now new tokens will be minted, and the exiting one will be slowly put out of circulation.

This coin has been doing great in 2022 up until the regulators stepped in and sued Paxos in December 2022, for issuing the coin. Since then there is no more minting of the token and it is slowly being decommissioned as fuds exit the project.

At the top BUSD had a market cap of 22B and now it is at 1.8B. As time progresses this project will be closed down.

TUSD, FRAX and USDP

These are three of the next biggest stablecoins. The TUSD has grown especially in the last period as it has received some support from Binance. It is now at 3.3B market cap, basically surpassing the BUSD coin. Not sure how exactly TUSD operates. The other coins on the list are all bellow 1B market cap at the moment.

Cumulative Stablecoins Market Cap

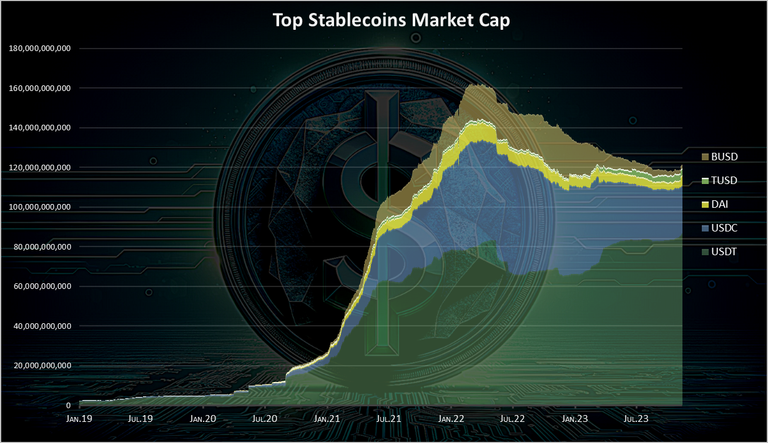

Here is the chart for the total stablecoins market cap.

This is the long term chart for the stablecoins. We can see the overall trend here that most of the stablecoins capitalization came in 2021, with Tether emerging as the first, followed by DAI and USDC. A lot more have emerged since then, but Tether has kept its dominance, with USDC on the second sport, and then some DAI. We can see the rise and fall of the BUSD token here as well. TUSD has just started to appear on the chart in the last year.

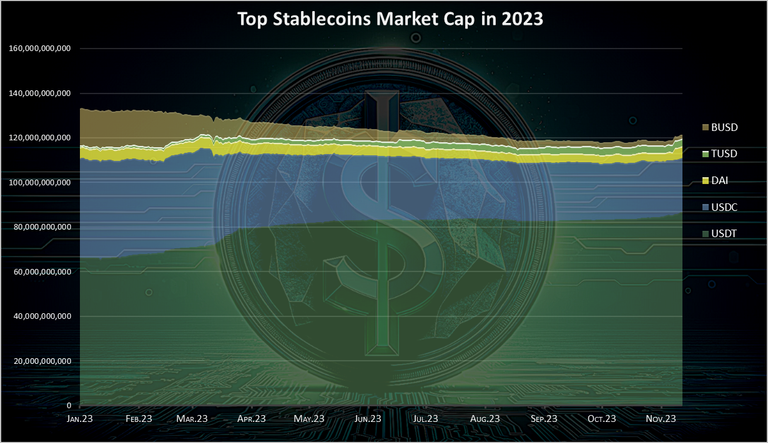

When we zoom in 2023 we have this:

An overall small downtrend in 2023 up to the last weeks. The year started with around 135B in stablecoins market cap, went to 120B, and it is now up to 124B. We can see that Tether has kept on growing through the year, while USDC has slowly been in a decreasing mode, although it has kept a large portion of its market cap. BUSD is now almost nonexistent, while DAI has kept more or less the same range with some ups and downs in between.

On a yearly basis the stabelcoin market cap is still down. Will see how the year ends and will it manage to pull out a bigger market cap at the end, from the one when it started at 135B.

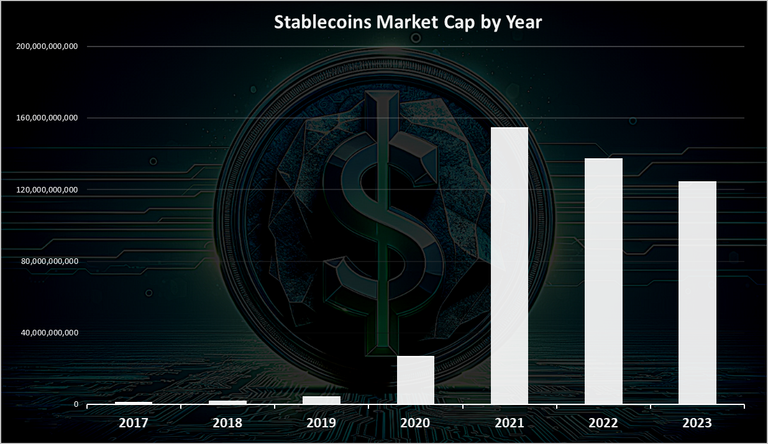

For context on a longer timeframe, on a yearly basis the market cap for stablecoins looks like this.

After an explosive growth in 2021, the stablecoins market cap has been dropping in 2022 and 2023, although at much lower rate then the drop in prices for the overall crypto industry.

Top Stablecoins Market Share

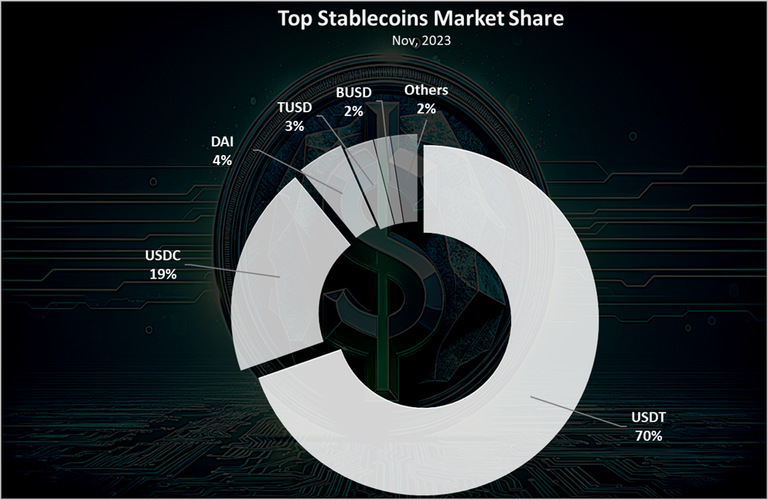

Here is the chart for the market share of the top stablecoins.

Tether USDT is absolutely dominant now, and this is probably its biggest market share in the stablecoins industry since 2021. The harsh regulation in the US on stablecoins has probably contributed to this. Things might change if/when there is more clarity about stablecoins issuers in the US.

Tether USDT now holds over 70% share in the stablecoins industry. USDC is in the second spot with 19% share followed by DAI with 4% share.

All the best

@dalz

The usdt stablecoin has a much higher market cap and market supply than other stablecoins since it has been around for a long time. Thanks for sharing with the chart.

Imagine HBD competing with some of these top Stablecoins in the market.

Yea imagen :)

Very informative post about coin movement

That should be enough to put anyone off holding TUSD....!

Lol

Nice stats! Thanks for sharing.

USDT is king, and they are also contributing buying and holding some Bitcoin as part of their strategy.

USDT had done so well mean

Just look at that chart...

Nice one and thanks for the overview!

A really informative you have here. Thank you so much for sharing

Very informative post thanks for sharing

https://twitter.com/LovingGirlHive/status/1723792079988359320

Thanks for the great overview. Certainly there are limited options for stable coins at the moment.

70% holy fu ck, that’s terrible! I hold some in pool pairings, this makes me want to change that.

Being the first to begin operation and having faced and overcome much criticism and attack from different quarters, they stand a better chance to have great significant and dominate the market cap. Kudos to them.

So HBD is included in that 2%.

Thanks for sharing this overview of the growth and market cap of big names in stablecoins.

!BBH

!PIZZA

$PIZZA slices delivered:

@rzc24-nftbbg(3/5) tipped @dalz

It's just like people are flocking to the crypto market again and stables are buying them up to drive the market up and we'll see those who have waited two years now have a good time.

Test