Data on Bitcoin Mining | Hash Rate, Mining by Pools and Country

The bitcoin mining process is a key element of the Bitcoin network. It is basically what makes the whole system tick. As most know, the miners are incentivized to keep running the code and processing blocks and transactions with Bitcoin rewards at a rate of 6.25 BTC every ten minutes. These rewards keep cut in half every four years with the next halving coming in April 2024.

In 2023 the hash rate kept growing, setting new heights month after month. This is the basic parameter that shows how secure the network is. There is some debate about this topic, since the equipment used to mine Bitcoin, the ASICs keep getting more efficient each year, meaning that for the same price of capital, one is getting more hash rate. Because of this some argue that the parameter that should be used as a security of the network is the cost of capital that is involved in the Bitcoin mining, but this is not as easy to calculate having in mind all the different type of equipment, the different producers, deals made etc. Although one can get the latest prices and make some theoretical calculations.

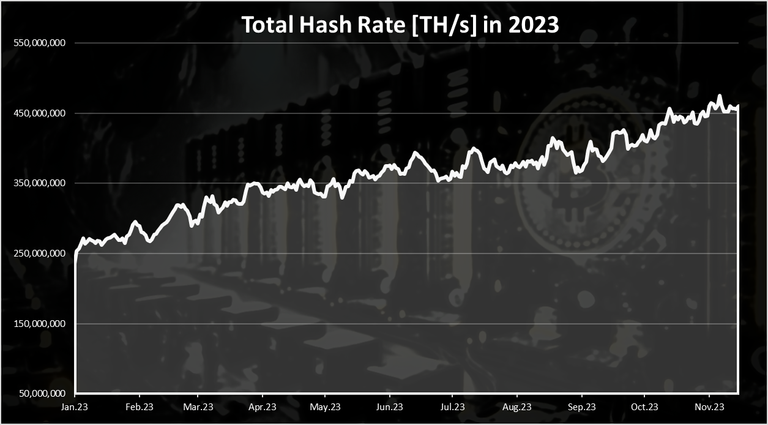

As already mentioned, the Bitcoin hash rate has increased significantly in 2023. At the beginning of the year the Bitcoin hash rate was around 230 EXA hash and now we are at 460. Basically, doubling the hash rate in one year. Let’s take a look at some data.

We will be looking at:

- Hash Rate

- Mining by Pools

- Miners Revenue

- Mining by Country

- Current Countries Share

- Hash VS Price

The data presented here is mostly gathered from the blockchains charts, and the Cambridge center for alternative finance.

Hash Rate

The ultimate Bitcoin value is network stability and security. The network security in a proof of work chains is measured in hash rate, or how difficult is to mine. The bigger the completion, the higher the hash rate.

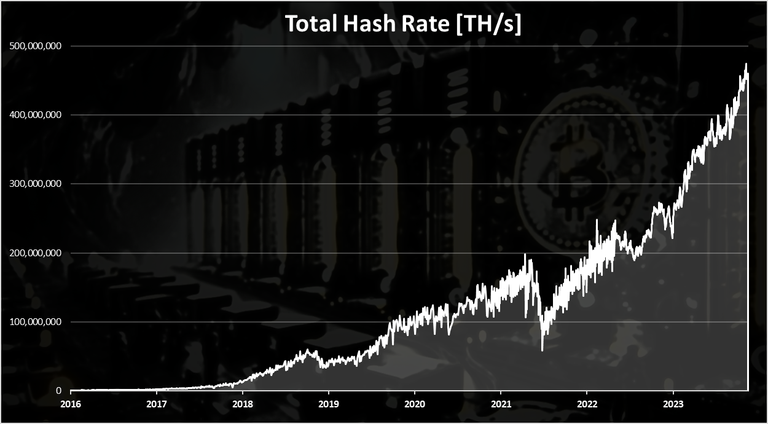

Almost constantly going up with few dips here and there. The most significant dip happened in the summer of 2021 when China banned mining. We can see yet another one that just happened at the end of 2022 but recovered fast and continue to grow massively to another ATH for the hash rate in 2023.

When we zoom in 2023 we get this:

A steady growth through all of the year. The year started with 260 EXA hash and now it is at around 450 EXA hash, touching even 460 at one point. A constant growth that shows just how competitive the industry has become. Mining Bitcoin is now totally professional and on scale businesses, with a lot of the US mining companies trading as public companies on the stock market. From this rise in the hash rate we can conclude that probably there are also viable financial routes, banking, lending, for the companies to rise capital, and increased overall liquidity in the mining sector.

Mining Pools

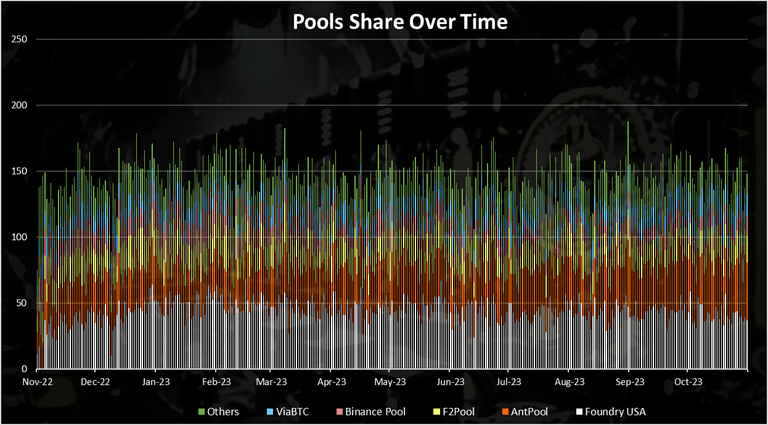

The way the Bitcoin mining works is usually with miners all over the world joining in mining pools and sharing the rewards. Here are the top mining pools and there evolution in the last year.

The US base Foundry and the Chines Ant Pool are dominant in the Bitcoin mining industry with more than 50% of the hash rate coming from these two pools. Ant Pool seems to have grown faster in the last year and has increased its share significantly. The other bigger pools are the F2Pool, the Binance pool etc.

Top Mining Pools Share

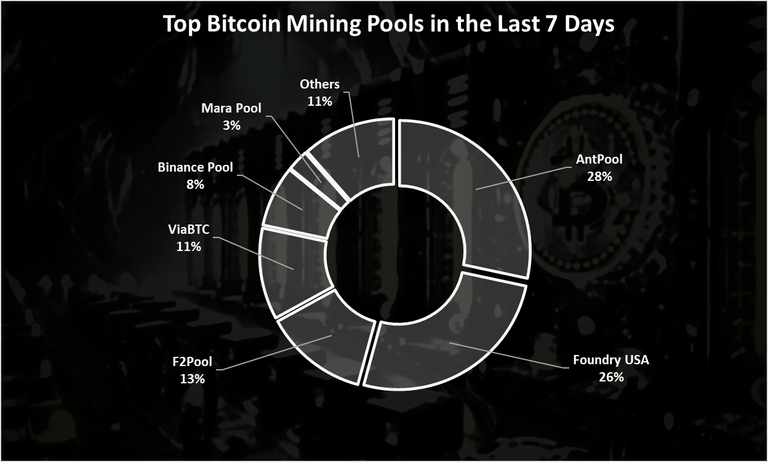

The current share of the top mining pools looks like this:

The Ant Pool is on the top with 28% share, the Foundry is in the close second with 26% share. Next are the F2Pool the ViaBTC and the Binance pool.

Note that not while a lot of these pools are Chines or US based, it doesn’t mean that the physical location of the mining equipment is in that country, as they join the pools through the internet and can be located anywhere. We will take a look at the countries share below in the post.

Miners Revenue

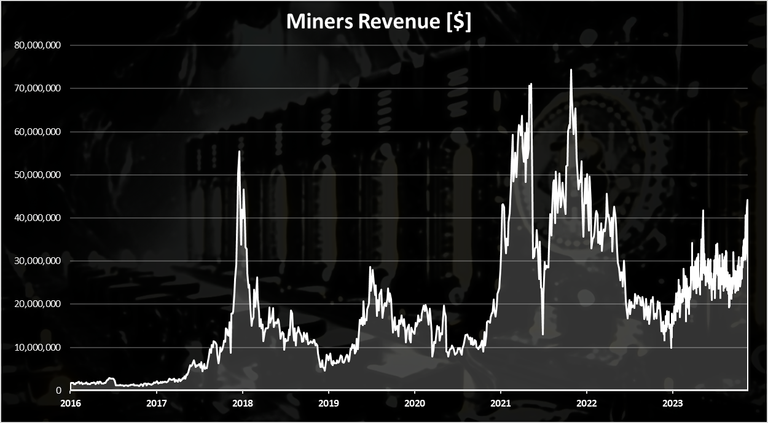

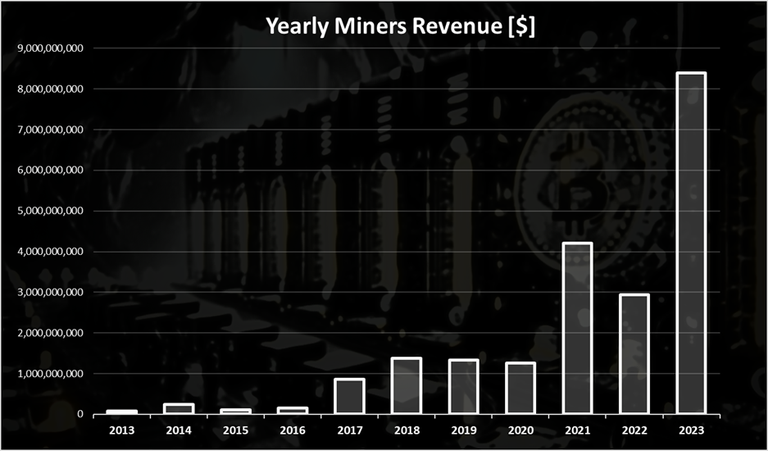

What is the miner’s revenue over time. Here is the chart.

We can see that back in 2016 the daily miner’s revenue was under 1M USD. Then it started growing a lot in 2017 and reached more than 50M per day. After the bull run in 2017, the miner’s revenue dropped to under 10M. It went sideways for the next two years in 2018 and 2019, and then increased again at the end of 2020. In 2021 the miner’s revenue reached a new ATH with more than 70M USD revenue per day. A drop in 2022, and a growth again in 2023.

While the daily ATH is in 2021, on a yearly basis 2023 is the record year for the miner’s revenue because it had a steady income through all days of the year. At the moment the miner’s revenue is at 8.3B and will probably end the year close to 10 billion. In 2022 the miner’s revenue was at 3B, while in 2021, when Bitcoin had ATH, the revenues were at 4B. So, 2023 will be a record high for the miners’ revenue, that might explain the increase in the hash as well. It is also worth noting that in 2023 we have some new use cases on the Bitcoin network like the ordinals protocol that allows for NFTs on Bitcoin and even tokens. These use cases have driven additional revenue to miners in the form of fees.

Mining by Country

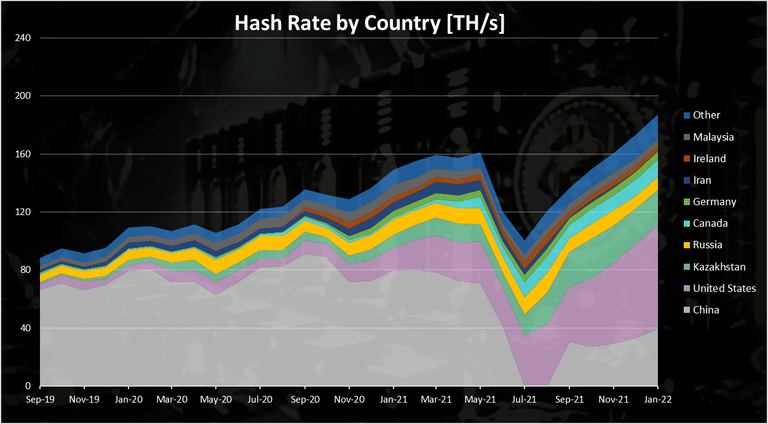

Here is the chart for the hash rate by country for the period 2019 to 2022.

This data is from Cambridge. The end date is January 2022, so it’s not totally up to date. But overall, we can see the trends in the period.

Prior to 2021, China was dominating the mining with more than 70% of the hash rate in China. After the ban in June 2021, the hash rate in China dropped, and US took over. As of January 2022, the US was dominating the mining business.

Top Countries Mining Bitcoin

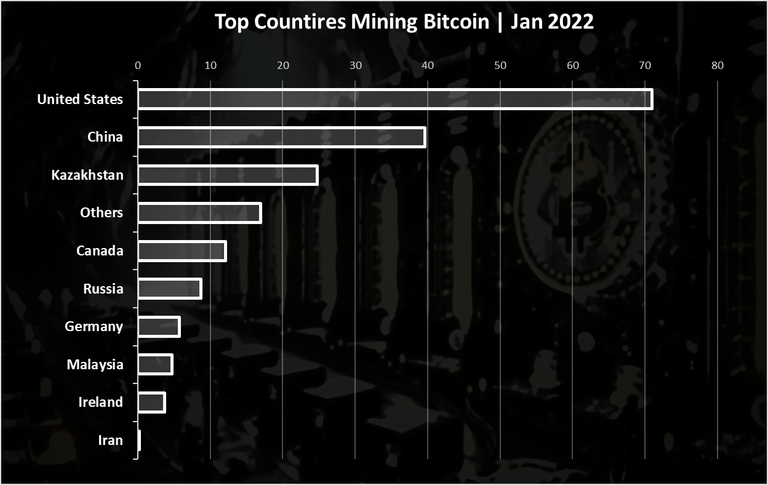

When we rank the countries as the latest data available in January 2022 we get this.

The US is on the top, followed by China and Kazakhstan. Canada and Russia are also in the top countries mining Bitcoin.

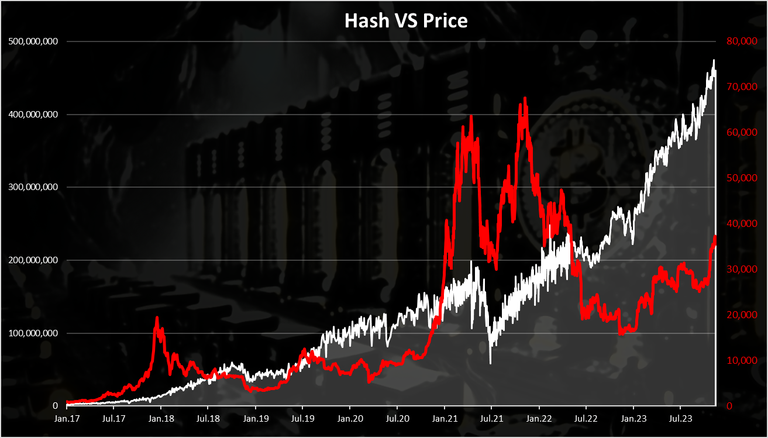

Hash Rate VS Price

When we plot these two together, we get this.

At first glance these two doesn’t seem corelated. There seems to be small periods when there is some correlation.

First at the end of 2018, there is a dip in the hash rate and in the price as well. Then again, a small dip in March 2020, and the most obvious in the summer of 2021 when both the price and the hash rate dipped hard due to the China ban. Since then, the hash rate has kept growing aggressively, while the price is growing more slowly.

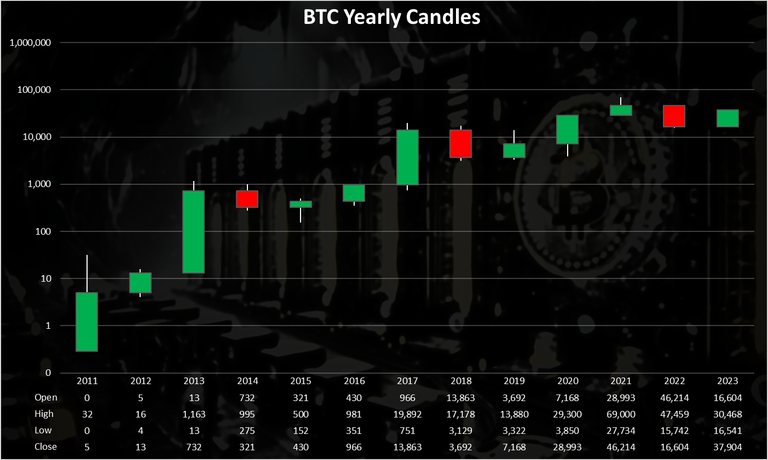

At the end the chart for the Bitcoin yearly candles on logarithmic scale:

Three green years, one red 😊. Will se how the next two years go and will they follow the cycle.

All the best

@dalz

Great analysis about BTC specially statistics about hash rate by country

Thank you so much for the awesome analysis

It was a good one

Thanks for sharing this informative report

!1UP The security of Bitcoin is increasing steadily!

!PGM !PIZZA

You have received a 1UP from @underlock!

@leo-curator, @vyb-curator, @pob-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

$PIZZA slices delivered:

@curation-cartel(2/20) tipped @dalz

Wonderful analysis about BTC. Thank you so much for sharing this

Very informative, thank you

March is going to be a very special month for Bitcoin and if the reward goes down, the demand for it will increase so much that the price can go up to 100,000 dollars.

thanks for the detailed post about bitcoin mining.

the hash rate shows how many people are still interested in bitcoin mining.