Bitcoin on Exchanges | Historical Balance, Share, Price Correlation, Top Exchanges and More | Oct 2023

The Bitcoin balance on exchanges is a parameter that is closely monitored by the market participants. It can give a signal when a large amount of Bitcoin is moved in or out of exchanges causing the price to drop or rally. In the recent period it is also monitored as proof or reserves on exchanges. After the FTX collapse, exchanges started to be more opened and disclaimed their positions, with BTC in most cases being the number one.

In the recent period there has been a trend in the BTC balance on exchanges going down. Lets take a look at the data.

Here we will be looking at:

- Bitcoin balance on exchanges

- Historical share (%) of bitcoin balance on exchanges

- Bitcoin balance on exchanges VS supply

- Monthly Changes for BTC on exchanges

- BTC on Exchanges VS Price

- Top Exchanges holding BTC

The data is collected from sources like macromicro.me, cryptoquant.com and coinglass.com.

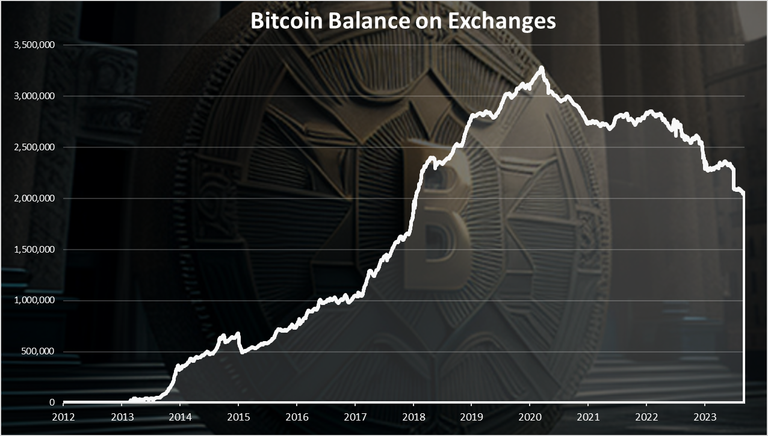

Bitcoin Balance on Exchanges

Here is the chart for the historical balance of bitcoin on exchanges.

As we can see prior to 2013 the amount of BTC on exchanges is almost nonexistent. After 2013 there is an increase in the amount of BTC on exchanges, reaching more than 600k at the end of 2014. In 2015 there is a small drop and after that almost a continuous growth up to March 2020, when an ATH for BTC balance on exchanges was reached with more than 3.2M.

Since 2020, the balance on bitcoin on exchanges is in constant decrease and it has dropped even more in the recent period. At the moment there is around 2M BTC on exchanges. Quite the drop since the ATH.

When we zoom in 2022-2023 we got this:

A continuous decline in the BTC balance on exchanges in the last period. At the beginning of 2022 there was around 2.8M, while 2022 ended at 2.3M. A 0.5M reduction in 2022. In 2023 the trend continued and another 0.3M were removed from exchanges and we are now at 2M. If the trend continues at the end of 2023 there will be less than 2M BTC on exchanges.

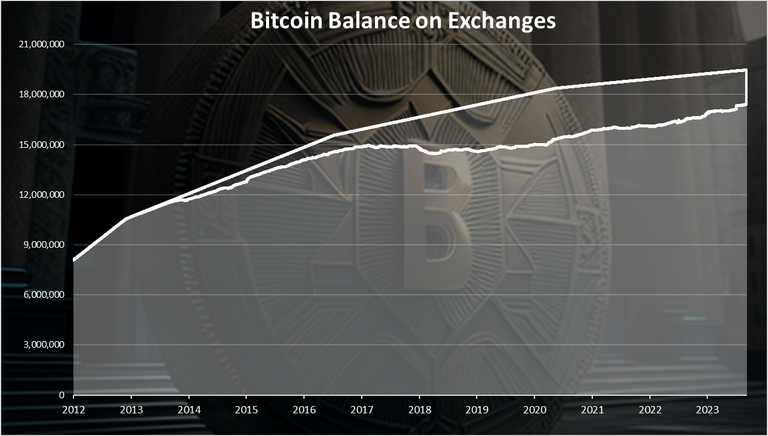

Bitcoin on Exchanges VS Supply

When we plot the balance on exchanges VS the overall supply, we get this:

We can notice the increase in the balance one exchanges up to 2020 here as well, and then a slow decrease. But still overall we can see how small this share is from the absolute supply when presented in the chart above.

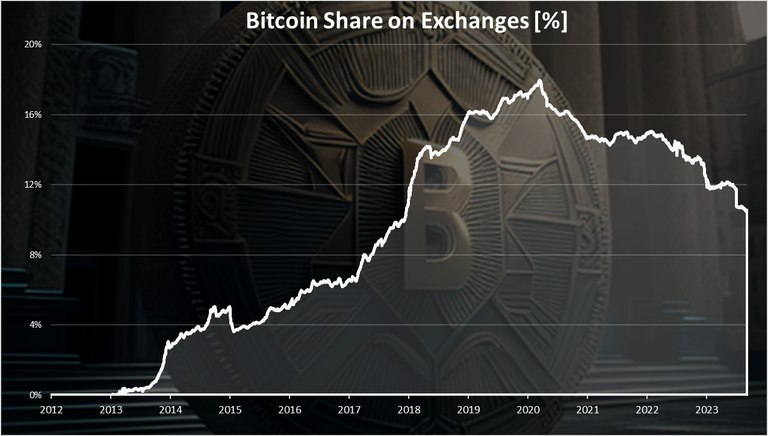

Historical Share [%] of Bitcoin Balance on Exchanges

When we take a look at the Bitcoin balance in relative terms, as percent of the supply we get this:

This chart is similar to the absolute balance, but here we can see the share [%]. An all-time high of 18%, in 2020, and a drop since then to 11% where we are now.

When presented as a pie chart the chart looks like this:

A 11% of the Bitcoin supply is currently on exchanges. This is a low amount of the tokens on exchanges, especially having in mind that Bitcoin doesn’t have any type of staking rewards or similar incentives for users to withdraw their tokens of exchanges. The overall trend of self-custody has been growing.

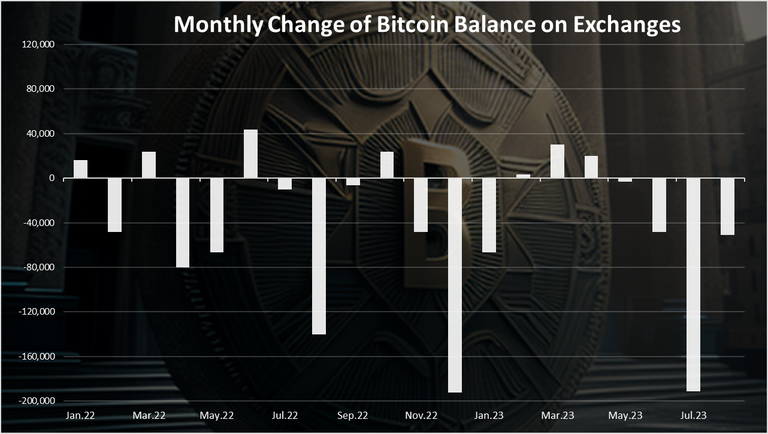

Monthly Changes for BTC on exchanges

The change for the monthly balance on exchanges is as follows:

We can see that in the last two years there are more months with negative outflows from exchanges.

In December 2022 there was the record high for withdrawing BTC from exchanges, almost a 200k BTC. This was after the FTX collapse and the fear that was in market participants from CEXs. In 2023, another massive withdrawal happened in July with a similar amount of BTC withdrawn from exchanges, a total of 200k. There wasn’t any significant even in this period, although there has been some FUD towards Binance.

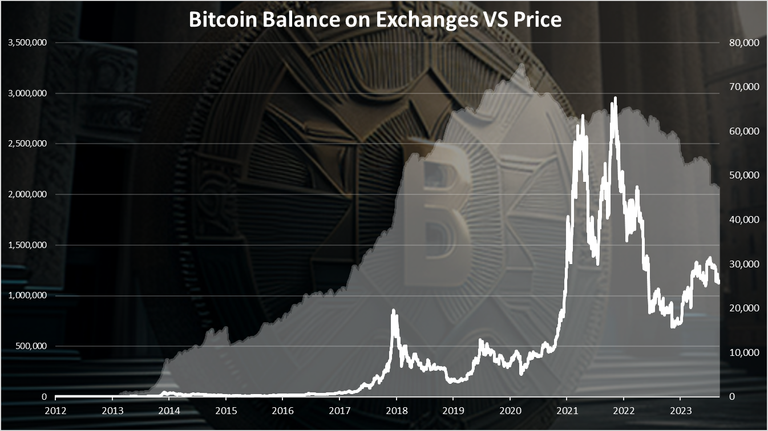

Bitcoin Balance on Exchanges VS Price

When we plot the BTC balance on exchanges vs the price we get this:

When we look at the long term trend, we can notice that there has been a correlation back in 2017, when the price increased, that followed by a large amounts of BTC deposited on exchange, and this continued to grow even during the bear market of 2018 and 2019. In the last bull market of 2021, there hasn’t been any significant increase in BTC on exchanges. There was only a slight increase towards the end of 2021, but then the trend for removing BTC from exchanges continued, no matter the price.

Will this trend be over soon, or it will continue in the future remains to be seen.

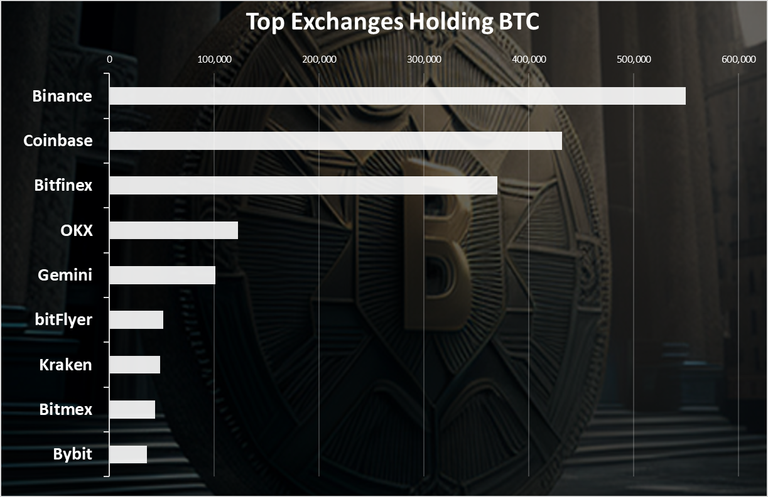

Top Exchanges Holding BTC

Which exchange holds the most BTC. Here is the chart.

Binance is number one, with 550k BTC, followed by Coinbase with 430k, and then Bitfinex with 370k Bitcoins. These are the big three when it comes to Bitcoin holdings. The other exchanges are around or bellow 100k.

While Binance is still on the top, the gap between Binance and Coinbase has now been reduced. Binance is no longer leading by a lot like it was in the past.

All the best

@dalz

https://twitter.com/lee19389/status/1709916002136293762

#hive #posh

Awesome analysis as always and thanks for sharing

This your analysis on btc and how it can get exchanged is insightful and well detailed. Thanks for sharing it.

Thanks for sharing this overview.

Very explicit analysis! Good one for Bitcoin investors to examine. With the the Bitcoin balance on exchange going down, what will be the feedback on the price of the coin? Won't it reduce? Now we observing that Coinbase and Bitfinex hold remarkable exchange such as closing up with binance. If binance monopoly is broken more, what could still be the future of Bitcoin and binance?

Great overview Dalz. I wonder if that is now the peak of seeing BTC on exchanges. It's gonna be interesting when the supply crunch comes! btw, the first paragraph, I think you meant 2013/2014 but have written 2023/24.

The peak was probaly back in 2020.

Thanks for point out the years, fixed it!

I guess the reason why Binance holds the most Bitcoin is that it is used by so many people so they have their Bitcoins stored in there

How about that?

How much bitcoin in exchange site and bitcoin transfer or share on various exchange sites have been explained beautifully through chart which is really great thank you.

A sustained Sell from Binance indicating that things are not going well in this exchange

Thanks for sharing this. Always amazed how you create a narrative from data.

. So am i right to assume the ones not on exchanges are stored in cold wallets? Or is there other places aside from exchanges where btc could be stored.

Cold wallets for the big boys

Interesting analysis, BTC has given us a lot of headaches with extreme peaks in which many people without knowledge enter and then have a very bad time when it goes down, Binance offered a certain reliability in addition to working in countries like Venezuela that other exchanges are not available, That makes its user volume greater but we still need to see the development of BTC and Binance in the coming months.

https://twitter.com/jewellery_all/status/1710046373473632663

It's just like we've seen within the last year a lot of work has gone bad because of Luna and FTX and people are now scared too much which is why people are running way too much..Thanks a lot for sharing this information with us, it is very special.

Wao incredible. Thank you for sharing this informative report. I believe that the cloud is a saver place for btc storage.

Great analysis I must say!!!

Good to see how detailed explanation were used in this analysis .

Good job👏

Like I have knew that Binance will be at the number one always

A nice analysis you did. Very well detailed. With bitcoin balance going down I don't know what will become of it.