Avalanche | Data on Wallets, Active Users, Transactions, Fees and More | Apr 2024

The Avalanche chain has an interesting design, with three chains running in parallel. The c-chain, x-chain, and p-chain. In a nutshell the c-chain is used for contracts, the x-chain for transactions and the p-chain for staking and validators. More info about the design in the whitepaper.

Most of the users are using the c-chain that is Ethereum compatible and can be accessed via metamask. All the defi apps but on Avalanche.

How is Avalanche doing these days? One of the latest crypto trends with the SocialFi apps has made its way to the Avalanche chain with the Stars Arena app, but then had some issues and its future is now uncertain. Meanwhile the AVAX price had a good run and more apps are showing some activities. Let’s take a look at the data.

Let’s take a look at the data on the Avalanche network and see what has been happening in the last period.

The data presented here is mainly from https://snowtrace.io/.

We will be looking at:

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

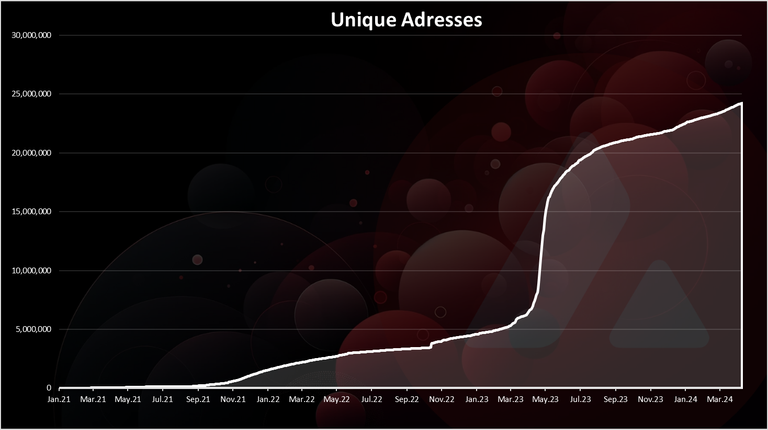

Number of Addresses

One of the key metrics for crypto projects is the number of wallets.

First the overall number of wallets.

This is quite unusual chart. The growth in the number of wallets has been in 2023 that has been a year when the crypto industry is in the bear. There is a growth back in 2021 during the bull market, but those numbers are way smaller from what has happened in 2023. In 2023 at the beginning of the year there was around 4M addresses and at the end of the year there was 22M. A moderate growth in 2024 and we are now at 24M. For comparison Ethereum has around 265M wallets.

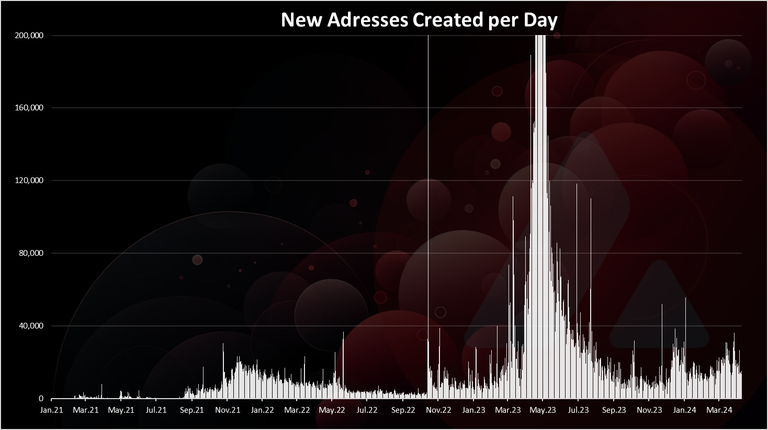

If we take a look at the new daily wallets we get this.

We can clearly see the spike in the new wallets created in April 2023 when for a while there were more than 500k wallets created per day. Not sure what caused this spike, but the Starsarena app came later in September, so it is not because of it. Maybe it was some bots doing this.

Back in October 2021 there was another spike during the bull market, but that one was much smaller with around 20k wallets created per day. In the last months there is around 20k new wallets created per day.

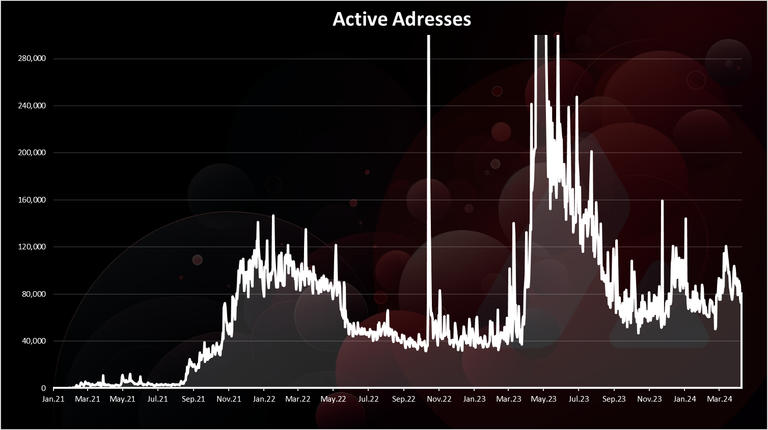

Active Addresses

How many of the wallets created are active? Here is the chart.

The numbers of active wallets increased at the end of 2021, from bellow 30k up to 100k active wallets in the beginning of 2022. Then a drop in 2022 down to 40k active wallets.

A bid spike happened in April 2023 from 40k up to 300k DAUs. A drop afterwards to around 80k. In the last period the averaged active wallets is around 100k daily.

For reference the number of active wallets on ETH is around 500k.

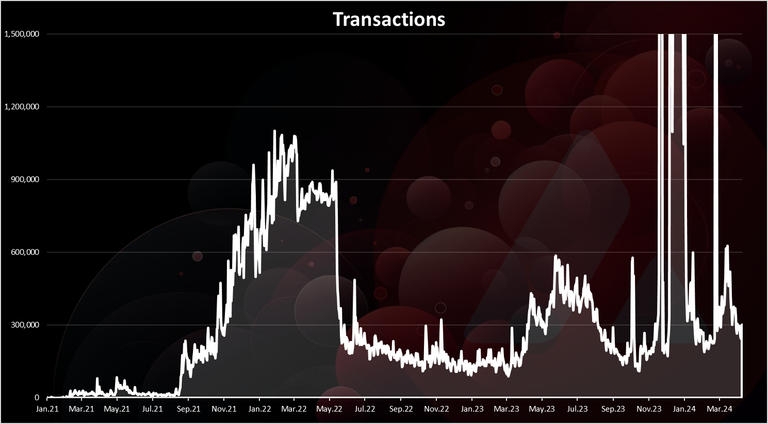

Daily Transactions

The activity on the network is mostly represented by the number of daily transactions.

On the transactions side we can see a massive increase in the number of transactions at the end of 2021 up to 1M transactions per day, and then a sharp decline in May 2022 down to 150k transactions per day.

There are some massive spikes in the last months up to 2M transactions daily. But usually these are just spikes and drop fast to somewhere around 300k daily transactions.

On Ethereum the number of transactions per day is around the 1.2M mark.

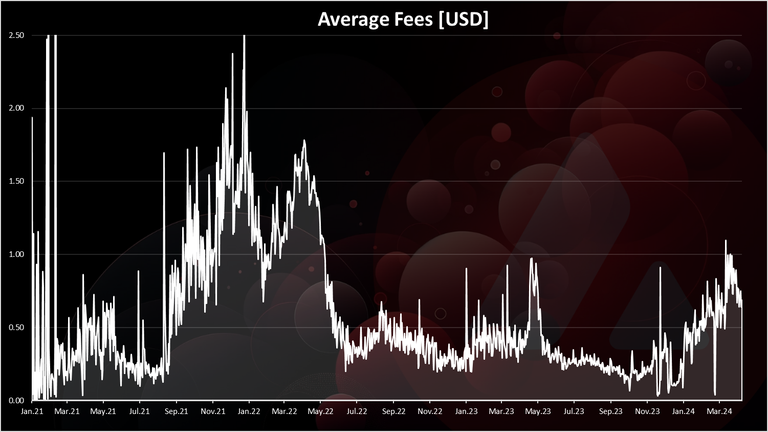

Fees

Avalanche has low fees but not as low as Solana or Polygon. It is in the category with the BNB chain with fees going from $0.1 to $0.5, depending on the market conditions and operations being made.

Here is the chart.

The above are the fees per transactions in $.

The highest fees were recorded in the beginning of 2022 with ATH of $2. The fees dropped later in 2022 to around $0.4 level, and have been going down since then up to the end of 2023. In the last months the fees has started growing again on Avalanche up to 0.5$.

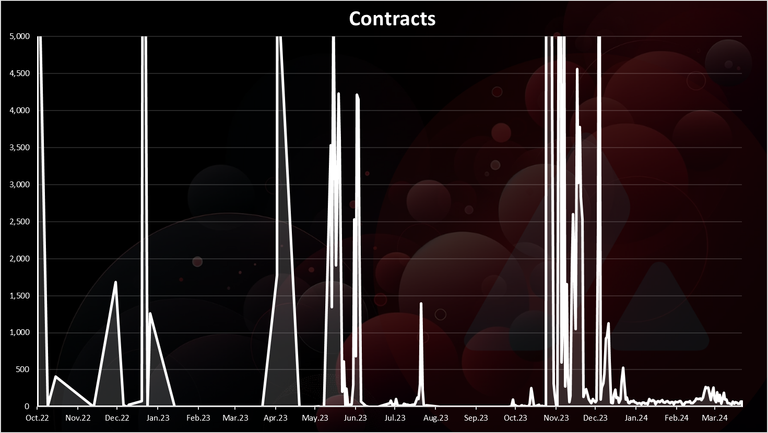

Contracts

Avalanche as Ethereum is a smart contract platform so here is the chart for verified contracts per day.

This is a very volatile chart with thousands of contracts on some days and close to zero on other days. Not sure what exactly is happening here, but overall, the numbers are very volatile.

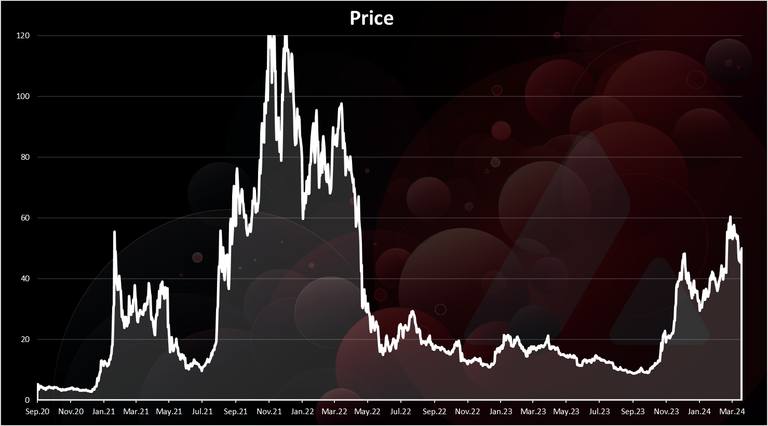

Price

At the end the chart for the price.

A massive run up for Avalanche back in 2021 from $3 up to $120, but a big drop as well in 2022 to around $20. A slow decline since then with some ups and downs, to around $10 in September 2023.

In the last period AVAX has had a good run in the price from 10$ up to 50$ where it is hovering now.

Will Avalanche manage to keep up with the competition time will tell. It is competing with the top smart contract platforms where the competition is hard and growing by the day.

All the best

@dalz

Posted Using InLeo Alpha

WOW 😲, I really appreciate for the heads up I believe in the project

Heads Up!! Thanks G.

Avalanche is dong well!

Thank you for giving such good information on the Avalanche Chain.

Are there any apps you would say are important to know about,

Fees are pretty high

Can Avalanche get some cool games onto its ecosystem? That would pahmp it.

One of the naratives for Avalanche seems to be gaming

I don't know much about Avalanche, but that unique address graph is very interesting. I'm surprised I haven't heard much about it considering its popularity based on the graph. Thanks for sharing these data.

Thanks for sharing this post can you do one for Cro Cronos Blockchain

!ALIVE

@dalz! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ tuisada. (2/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.