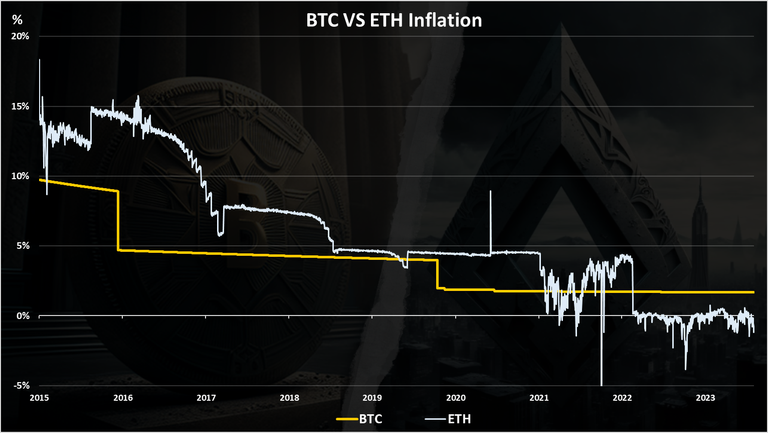

BTC VS ETH Inflation

Here is a chart for the long term BTC VS ETH inflation.

This is in % points.

Since September 2022, Ethereum has lower inflation than Bitcoin, and in 2023 on average it has ended the year deflationary. This is becouse of the transition to Proof of stake and lowering the overall base inflation from 4.3% to 0.43%, and on top of that the update in which part of the transaction fees are burned, pushing the inflation further down.

Bitcoin at the moment has 1.6% inflation that will go down to 0.8% in April 2024 after the halvening. Even with this halvening the Ethereum base inflation (o.43%) is still lower than Bitcoin, and as we can see it has tendation in the last year to go negative.

While at first look it seems that Ethereum has advantage now, Bitcoin still has a massive lead in terms of stability and long term outlook. BTC 21M max supply are set in stone so to speak, while ETH in theory has unlimited supply.

Another big pro for BTC is that it has no initial alocation, ICO or any type of token alocation to special interested party. Bitcoin started at zero tokens, while Ethereum started at 72M tokens alocated to ICO participants and developers. All of those can be future big sellers.

You are right! Thank you for the overview.

Both seems to be going in the right direction but it look BTC have the edge

Ethereum is the best! Because I don't have BTC :)

Its only logical

You know even though etherum is trying to find a bigger spot than Bitcoin. It is clear that Bitcoin remains the boss

So that means that the BTC inflation is high but it's advantage is that the number of people holding BTC is not as much as those holding ETH.

Really enjoyed reading this! Keep up the great work.

I would think that BTC and ETH will be similar to Gold and Silver. At least for now. ETH has a lot of layer 2 and sidechains, and has seen more use. It will be interesting to see how it plays out once ETH gets ETFs, and after the BTC halving.

Interesting analysis. I guess Avalanche is deflationary as well because of burns. The fees on all those chains is crippling.

Thank you for this overview. They are doing great job