They're trading it. We’re living in it.

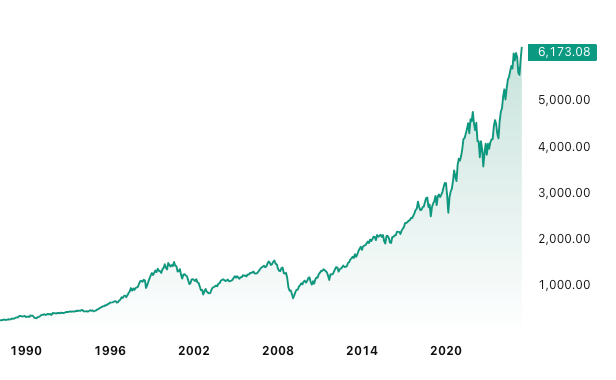

I’m not in the U.S., but it’s hard not to feel the ripple effects of everything that’s happening there. One minute the headlines are screaming about recession, U.S. debt being dumped, markets in panic. The next, Wall Street’s partying like nothing happened. S&P hitting new highs. Traders bragging about billion-dollar wins. What exactly are we watching?

From here, it feels like a show. Tariffs get announced, markets drop. Then someone in Washington says “let’s delay it,” and everything jumps again. It keeps happening, almost like clockwork. Whether it’s intentional or not, it’s become predictable — and profitable, apparently. For those in the system.

S&P 500 is looking all green as I write this, by the way!

Then there’s Trump. People abroad tend to laugh him off or see him as chaotic, but watching from a distance, it’s not that simple. He’s not trying to run the country like a traditional leader. It’s more like he’s trying to trade it. Or at least, make it tradable. He says things that move markets. Then he changes his mind. Repeat. And Wall Street seems to love it.

And now with Israel and Iran flaring up again — actual military strikes, rising oil prices, tensions thick — you’d expect full-blown panic. But again, U.S. markets barely flinch. Oil goes up, sure. But there’s no sustained fear. Maybe they’ve priced it in. Or maybe they’re just trading it, too.

Sometimes it really seems like none of it’s about solutions anymore. Not in the U.S., not anywhere. It’s about positioning. Every crisis is a new trade setup. Even war. Even inflation. Even global instability. It’s all part of the game.

Out here, we feel the aftershocks — higher prices, weaker currencies, tighter capital. But the core action is still there, in the U.S., where the players have the biggest chips and the fastest access. They create the storm and sell the umbrella. And somehow, they keep winning.

Maybe I’m reading too much into it. Maybe it’s just how the system works now — volatile, global, always moving. But it’s hard not to notice that in a world full of economic anxiety, the people closest to the levers don’t seem all that worried.

They're trading it. We’re living in it. Let's not panic!

Posted Using INLEO

I agree with you to some extent. It is all planned or else why do we see opposite decisions within few weeks and months, it is all done to manipulate the market and yes Trump knows that very well.

Your line “They create the storm and sell the umbrella” says it all. The retail investors are harmed the most in these events.

Those with insider information are really capitalizing to the max! What we can mostly do is react as events unfold without no inkling of why or how the narratives will play out.

That's why we cannot hope to win by swing trade. too dangerous.

I realized that the hard way lol. The game is rigged on a very basic level.

Wait till 2028 and election year. I'm sure that's really gonna be a clusterfuck

https://x.com/lee19389/status/1939455013652251097

#hive #posh

Sometimes I feel this are all planned , it's so sad

The market is really looking green. Is it the right time now to invest in the market

Depends on your time horizon

So many awesome Trump dump and pump scams running …. Buy the bottoms of the massive dumps and sell the top of the massive pumps. Every few weeks.

Everyone is getting filthy stinking rich.

Especially with NVDA and TEsler

The market cycle cannot end until Bitcoin's dominance comes down, so here is another opportunity to enter altcoins.

It's crazy how a single country can take decisions that could affect the world finance market.

That’s true. A delusion perhaps.

I share same sentiment

We are now in a situation whereby any negative talks from president trump can ruin the bullish mood of the crypto and stocks market at that moment..

you have stated an amazing fact concerning what is happening in the world financial market.

Apt

No you are not , everything you said is perfectly true..

So true

So MuSh valid points made..

Apt

The question now is how can we make sure that the entire financial markets is not too dependent on the U.S ??