The Shrinking Johannesburg Stock Exchange (JSE)

Nothing gets a message across clearer than looking at visuals and to be honest I had no idea this had been going on behind the scenes. I don't think the average SA citizen saw how bad things have become.

How many local companies will be left in 10 years?

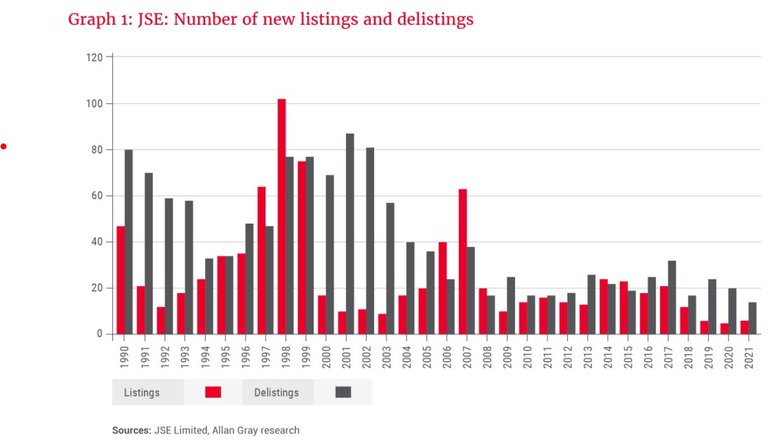

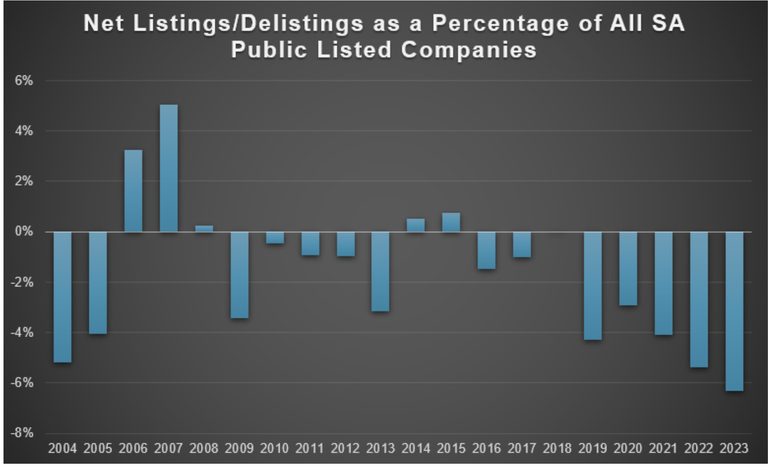

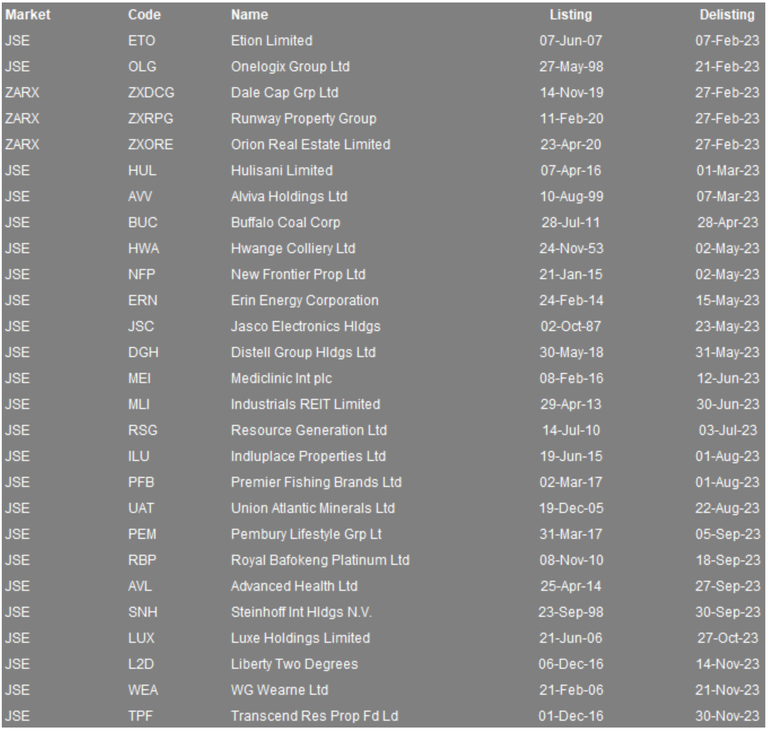

In 1999 SA had nearly 700 companies listed on the Johannesburg Stock Exchange known as the JSE. Since the late 1990's the trend has been heading in the wrong direction with last year a company being delisted from the JSE on average every 17 days.

What is worrying is the downward trend and the companies delisting are well known companies. One that sticks out like a sore thumb is Distell Group Holdings which is a Rupert owned company part of Rupert International. This was more about repositioning itself though joining up with Heineken creating a new listing known as Heineken Beverages. Looking at some of the others like Premier Fishing Brands they have been bought out and will fall under another umbrella. Economically times are tough and it seems many are joining forces which again is restructuring leading to job losses.

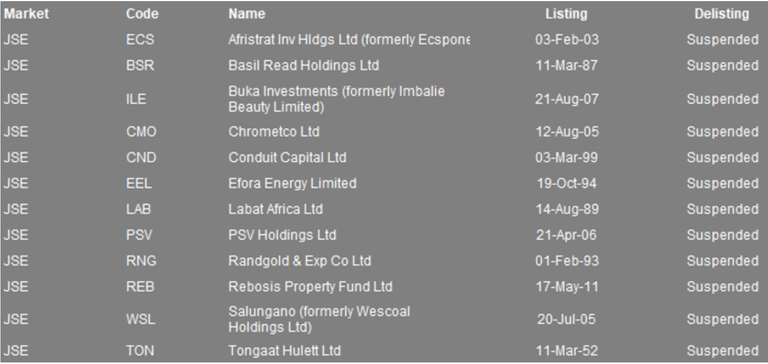

There is another list of suspended companies from the JSE and these are a whose who in SA business or were at least over the last 50 years.

A company like Tongaat Hulett Sugar changed it's business in SA by selling off land and moving North into Mozambique. The company was sitting on prime real estate due to how the demographics changed with businesses moving out of the city centers after the 1994 elections. They sold off land that was previously used for growing sugar cane and banked big money. This was then used to fund land purchases in Mozambique.

Basil Read Holdings which is a construction company that was in the top 2 of building companies fell on hard times. In 2018 Basil read lost a reported R1 billion and have ever recovered taking them into business rescue which unless a buyer is found will seize to exist.

The worrying trend of the JSE is he reality is this will be made up of foreign dual listings with local listings of around 100 companies only. This means that the JSE is only shrinking and is not playing the role it once was. If the investment flowing into the country shrinks then there is no growth and why the restructuring has to take place for those remaining companies to survive.

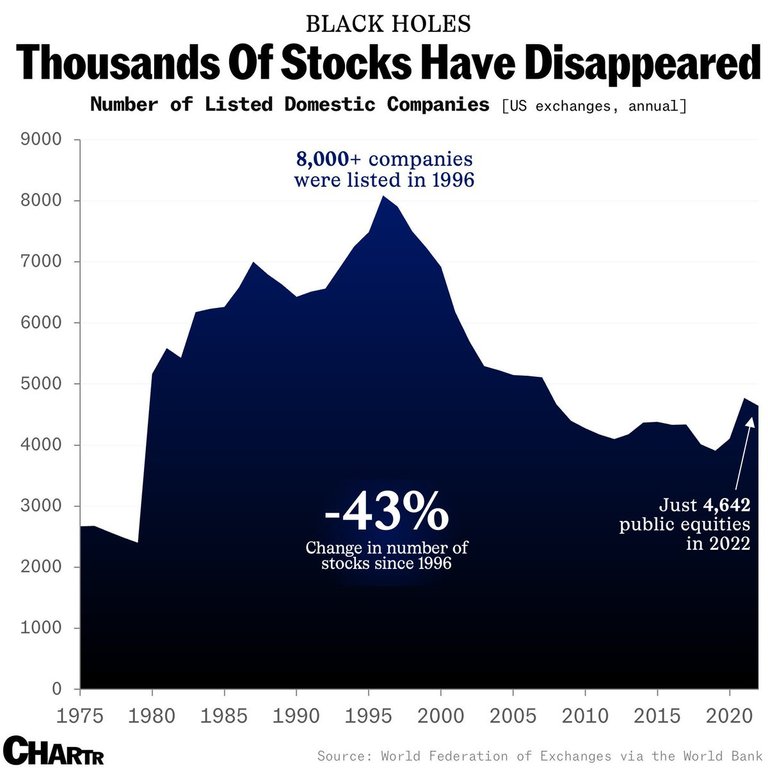

This is not just a SA trend and is actually a global thing that we are seeing the numbers of companies being listed shrinking. Again this is more about companies merging with others in a bid to survive the economic realities of today. Companies who were listed on various stock exchanges around the world had an average lifespan of 32 years and is now down to only 21. This means either they were so good they were acquired by bigger corporates and merged into their portfolios or they disappeared entirely.

Posted Using InLeo Alpha