Shopping Around Spotting An Opportunity

Still no images reflecting when posting on the inleo community front end so it has to be PeakD for now until the glitch is sorted.

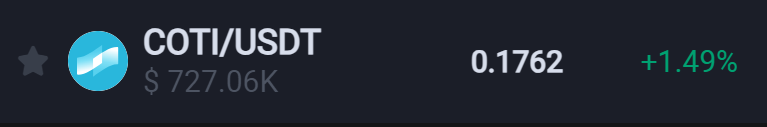

In the real world when we shop around we are looking for the best prices and we should be thinking in the same manner when dealing with crypto. This doesn't happen often but I have noticed that COTI has been cheaper on HTX (Huobi) for the last 6 months or so.

0.0108 c cheaper currently doesn't sound like a huge difference but if you just purchased 1000 COTI on Binance the difference in cost is around $10.8 compared to HTX and that is equal to an extra 61.2 COTI which is a 6.12% difference. If you are buying big numbers then this would make a significant difference and would be worth buying on one exchange and selling on another.

You may have hard the saying that profits are made when you buy and not when you sell and is a philosophy I believe in because it is so true. I am not 100% sure on the fees of both exchanges and how much they charge for a withdrawal for COTI because only now does the COTI Treasury allow for both the ERC 20 token and Native COTI to be staked. Before it was only accepting the Native token and there was limited exchanges that had the native. Kucoin was one of them and charged a 60 COTI withdrawal fee whilst HTX charged 20 COTI for that same service.

Looking at Hive on the same exchanges there is not room for arbitrage because the prices are nearly identical. Binance has HIVE at 0.4317 and HTX has HIVE at 0.4321 which is what we would expect to find on virtually every other crypto listing. Crypto that has a significant price difference on different exchanges are rare and I would suggest a crypto with over a 6% difference is big.

One could just imagine if this was Bitcoin or Ethereum with a 6% difference because if you were smart you could make an absolute fortune buying from one and selling on another. I do think this has been created because COTI has two different tokens one being the ERC 20 and the other the Native token and just swapping between the two exchanges is not straight forward. The use of bridges has cost implications and this is only beneficial for those looking to purchase and stake within the treasury.

I wonder if having this price difference on exchanges, if there is any place for an arbitrage play.

Nevertheless, I wanted to tell you as well that I have created another deposit and with the gCOTI boost I'm getting a sweet 44% APR. One question on this: when the deposit is finished, I want to deposit some more COTI. The question is if to keep the boost I need to put also additional gCOTI or how does it make more sense? I've already put all my gCOTI in the deposit with a 1:1 pairing with the deposited COTI.

The deposit can be topped up at any time and don't have to wait for it o unlock. Just keep farming rewards and topping up plus you will get gcoti weekly.44% is very decent and I am waiting for my 3 other stakes to open up now to take advantage of this. I am getting 22.9% now which I am more than happy with.

One thing that I suffer from is that I get the weekly gCOTI which in my case is around 6 gCOTI, but for it I pay 2 COTI. Hopefully when I will make bigger deposits that will help... any ideas how to optimize that?

Only way around it is to grow the stake. Just checked and I am due 110 GCOTI this week so the cost of 2 GCOTI for staking is a bummer and maybe wait every 2 weeks to claim it and stake.

That's right, after changing things, there are a lot of special things happening within the project that we'll see in the near future that people will benefit from and learn a lot from.