Real Life Crypto vs Gold Investment Example

Last week a close friend of mine who I have known since my army days cashed in one of his gold coins due to needing some extra cash on hand. I never ask questions about investments as I feel that is private and up to the person to reveal what they want to reveal.

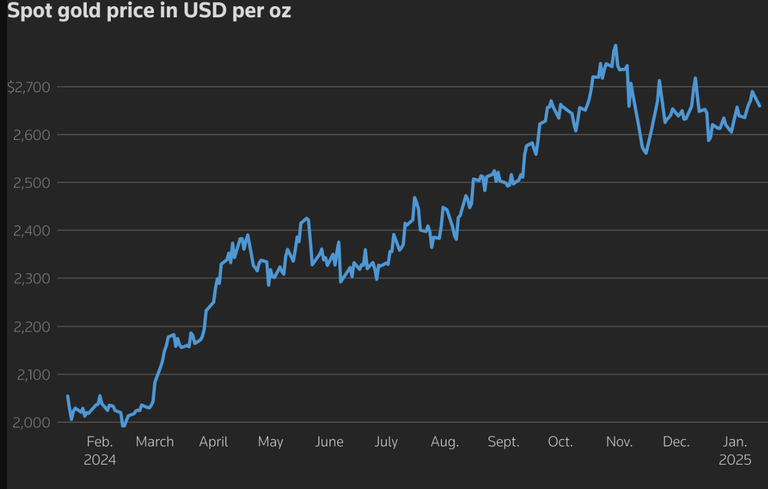

Today whilst chatting he mentioned his coin paid him R57 500 again this also revealed nothing as I have no clue the weight or what coin this is besides being gold, but what was telling was he purchased this coin in 1996 for R1900. Slightly less than a 30 year soaking/ investment time, but that is literally a 30 x return which is basically doubling his initial investment each year. Only if he had invested into Bitcoin would he have got better returns besides a few different shares like Amazon or Apple.

This is on paper, but in reality the Rand has depreciated by 600% over the same period and the reason why the smart people invest into Gold and try keep their wealth intact. His R1900 investment would be the equivalent of R12K today with regard to buying power so this coin has nearly 5 x that of depreciation and inflation which is very very good. I have known him for a long time being around 40 years and 30 years ago I would never have even thought of investing in gold and knowing him he has plenty more gold coins.

What has benefitted this investment is the time as 30 years is a decent period of time and you would expect any investment to go up considerably over this time frame. At the time of investing it is hard to imagine 30 years ahead as to how much this will be worth and if we all knew that answer we would not be keeping money in the bank.

The funny part is some of this has been penciled in for crypto investments to catch the peak of this cycle later in the year. Crypto is far different from gold because the history is not there yet so this is unchartered unknown waters when comparing apples with apples.

One can understand why people purchase gold as a hedge against inflation and a depreciating currency because it offers a safe haven. Any money you have needs to be working for you and why letting it stand collecting dust in a bank savings account is costing you more than you can imagine.

With the knowledge many of us have garnered over the crypto cycles and knowing how staking and earning rewards works via an APR we can out perform most investments . What is the key is the time taken to grow and accumulate and timing the sell off near the top and buying back when the Bear market is in full swing. If we add research to the equation this reduces the risks in involved as not every crypto investment is equal and some will fail and some will boom.

Just thinking about this if we had a crypto investment that offered returns of 30 x over 30 years we would not be interested yet this is actually very good and yet we do not think so. The reality is volatility can offer us far more with risk obviously and 30 years is seven and a half crypto cycles.

Posted Using INLEO

Investing your idle money to stocks, crypto, and other investments is good but my only concern is ita illiquidity. Ive tried many times when i felt short of cash bec most of my assets are invested in stocks and crypto.

My gain from crypto experience is that there are so many ways that we can put our assets at work. That's for me the key for growth and high gains in the end.

Yes that will work long term.

I believe that in the future we will have something better for BITCOIN itself. Until then, I don't risk too much on assets like memecoins or future promises. Hive is nice, but not enough for me to invest much.

Gold is seen as the reference point of economy. However, BTC has been having great returns for earlier investors

Just to bad they didn't have crypto back then, he would be a gazillionare by now. I'm glad I have not had to cash any in for bills yet. I think it will be at 5000 soon.

How much the world has progressed in 30 years while still not touching one's investment is an incredible feat. I don't know if many of us here in the crypto space have a time horizon of 30 years, so much uncertainty and present winners could be dethroned at some point in the future. I think however thinking at least half a decade or a decade ahead is doable, picking the right horses to back will be the harder part to get great ROI on our investment(s).