Portugal Ticking All The Boxes

The idea that all foreign income is tax free and all local income is capped at 20% sounds like a really good deal. This is Portugal and why it stands out as a clear future destination for my family.

The problem with most countries today is they would like to rob you blind taxing you wherever they can because they have spent all their revenue and need more. I mentioned in my post yesterday South Africa is what many consider to be in a death spiral that is unsustainable long term. The more you tax those businesses that are earning the less likelihood they can survive resulting in business closures and unemployment rising even more.

Many thought this was a ploy by the government to take over those businesses for themselves, but they are not that devious or smart and that would be giving them too much credit. Companies are being attacked on all sides with cheap imports flooding the market with no tariff protection plus increased local taxes leaving them with very few options, but to shut down.

Now back to Portugal and what is being offered is a huge incentive for anyone involved in crypto to move. The problem right now is we have no idea what our portfolios are worth and at the end of this cycle we will have a far better idea.

We are not in crypto for fun and games even though this is seriously good fun. but to make a difference by creating wealth. I do not think it is that difficult to make a million dollars if you give yourself time and build a solid foundation. Two cycles should get it done and certainly three would depending if you make a few mistakes along the way which we all do.

One million dollars should be the starters and depending on where you live that would mean anywhere from $200k to $400K in taxes and that is the portion I am looking to protect at all costs. Having a bank account in Dubai offering protected banking through their banking laws and living elsewhere that offers 0% income tax on external earnings.

Instead of handing over you hard earned cash to the tax man you may as well purchase a property and have something to show for all the hours you have spent working. Thankfully I was already looking for an exit strategy and Portugal was my selected destination and why I visited the country earlier this year.

Over the last couple of years I have been in the process of building a few business in SA that should provide an income stream for the future. Nothing is guaranteed and who knows if they will even last due to the economy. One can only try and for now that is better than not trying. As a worst case scenario this buys time to become established elsewhere and take it day by day. The SA economy does worry me as how can this be sustainable with 20% of the people working paying for the other 80% who are not adding to the economy.

Posted Using INLEO

This is actually pretty cool, I was considering getting a backup citizenship in case things go south in USA. I see that there is an option of 500k Euro invested into some investment fund, that doesn't sound so bad. What about property values in Portugal?

Property values vary depending on the region. I am looking in the Algarve which is quite pricy but you could always rent out during the season when over 4 million visitors arrive coming to play golf and enjoying the sunshine. $500K -$2.5 million depending on what you want.

I am lucky as I have applied for my Irish passport allowing me access to the EU. There are cheaper options where it would cost $60K per person as long as you purchased a property.

Our friends sold their condo in Vancouver, Canada and bought a large villa by the water in Greece. They are living there for the last few years.

Not that Portugal isn't an awesome place (I live here), but the tax burden and hidden taxes are insane, at least for portuguese. Triple check them with a good accountant!

Yes I will once we are closer to the time making sure the tax benefits are real.

Moving to a country with a stable, low-tax environment along with good real estate investment opportunities and a decent quality of life, is a smart strategic choice in the global economic uncertainty.

Among my developer friends Portugal is already a good nomad travel destination. As it gets tax benefits this would be more valuable in upcoming times.

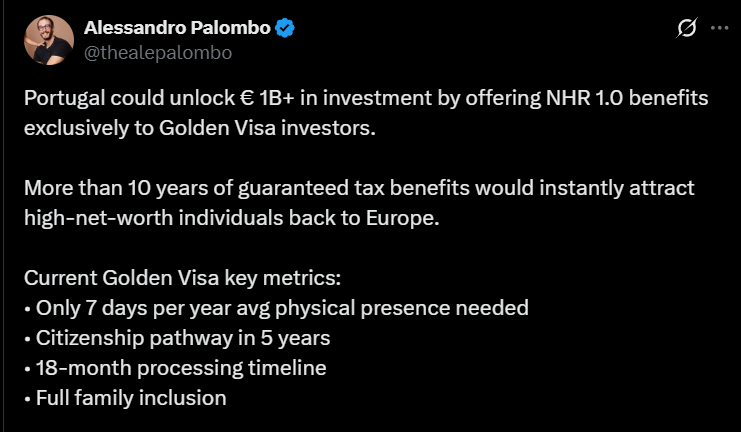

Yes it is already a decent type of tax haven and being tax exempt on foreign income for 10 years is a good deal.