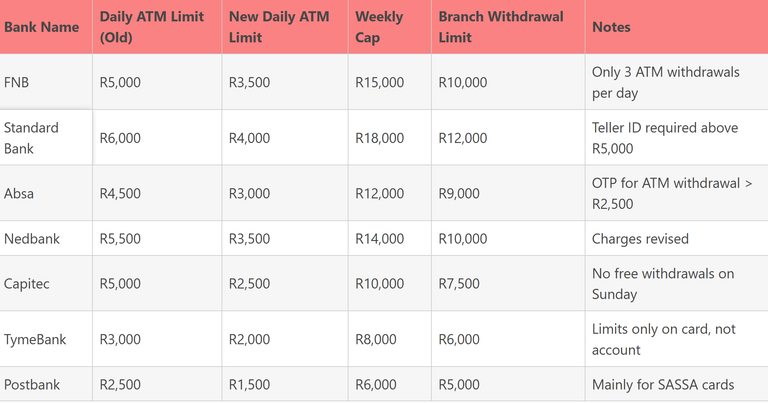

New ATM Cash Limits In SA From June 15th

There was an announcement today with regard to ATM daily cash limits which is a clear sign we are heading towards a cash less society. This I feel is a worrying trend as I am someone who firmly believes in having choices and cash is king when doing many business deals. I do think if you rely on the bank for everything you do then ultimately you are not in control of your money.

I find the amounts way too low and need to find another way to work around this by better planning if I need cash. Currently I can take out a maximum of R8000 ($400) in one go ,but there was never any limits on how many times I could take out daily. Having a daily limit ranging between R3000 and R4000 is definitely not good news when you consider most of my business cash deals are R10 000 or higher.

All this is going to do is force people to hold onto their cash bypassing the banking system wherever possible. Why deposit any cash if you cannot get the cash back when you need it and why many businesses will just keep whatever cash they receive.

I understand they want to limit the movement of cash due to cash in transit heists which is a problem in SA. Just last week not far from where I live there was an attempted robbery trying to blow up one of these vehicles and only failed when the robbers blew themselves up instead. Just a quick check on social media and they are experiencing at least 2-3 robberies weekly which highlights the failed policing yet again.

I also believe this is a way for banks to charge more for their services as I noticed those withdrawing cash via credit cards will be charged new fees from the 15th June. I pay R50 per withdrawal whether it is R100 or R8000 when using my UK banking card and why I take slightly more than I need each time. This fee adds up quickly on smaller amounts and is not really worth it.

These limits are not in place if you are travelling abroad because I can only imagine how that would not end very well plus banks would not earn the commission on Forex exchanges they do and would limit their profits. I see these cash limits are helping the banks reduce their costs of dealing with cash whilst making more profit through bank charges.

Again they say this may feel like we are being restricted, but they are making us safer in the process. Where have we heard that before when someone is looking out for you and we know this is one big lie.

Like I said earlier in the post I do deal a lot with cash and many deals are preferred in cash. I do try and avoid banks altogether wherever possible even when moving money abroad as the banks have such harsh restrictions on Forex. I have helped other businesses buy goods overseas using other methods as they were denied the Forex required. There is always a way to bypass the system if you know the right people.

Posted Using INLEO

https://www.reddit.com/r/Economics/comments/1kl5cdl/new_atm_cash_limits_in_sa_from_june_15th/

This post has been shared on Reddit by @dkkfrodo through the HivePosh initiative.

For me, the solution isn't to restrict users but to improve security. When banks impose limits, increase fees, and limit users freedom to manage their money so they actually push people to seek alternative solutions.

Banks are a big criminal syndicate that must be abolished, which is possible with Bitcoin.

We once experienced this situation in my country and it was hell. Most of us resorted in holding money at home instead of taking them to the bank