New Accountant From January

A friend of mine who has basically been a business mentor over the years advised that we should change our accountant. Apparently we are paying too much tax and we should be benefitting from all the loopholes which we are not. When it comes to taxes and what you are allowed to claim I have no idea and presumed our current accountant would have advised us properly as that is what they are paid to do. This has not been the case and we are throwing away money.

My mentor who owns his own businesses stated that he keeps the majority of his salary each month using his 40% tax going to the tax man which also covers the majority of his living expenses including food, mortgage/bond etc. The tax from the business is paying for his monthly living expenses. I would guess after tax I was spending 80% on monthly expenses and keeping another 30 or 40% legally would be a game changer. I was advised to find a Jewish or Muslim accountant as apparently they know how to make your claims and why they are so highly sought after.

Many years ago when I flew to the US the business basically paid for the month family holiday with everything covered at 60% of the price. The rest was covered by the tax man and you only know about this and find out how the other half is living once you have a decent accountant. You wonder how people can go on these expensive trips multiple times per year, but if you are basically paying half then you can afford to do this. If your monthly expenses are also being subsidized then you would have the money to do so.

I had asked our current accountant last year why we were paying so much tax and not claiming more expenses which I know others are and I never got a definitive answer. Now I know that our accountant is too by the book and maybe lacks the experience of what is possible to claim. I would call this a text book accountant without life skills so you are not getting the bang for your buck.

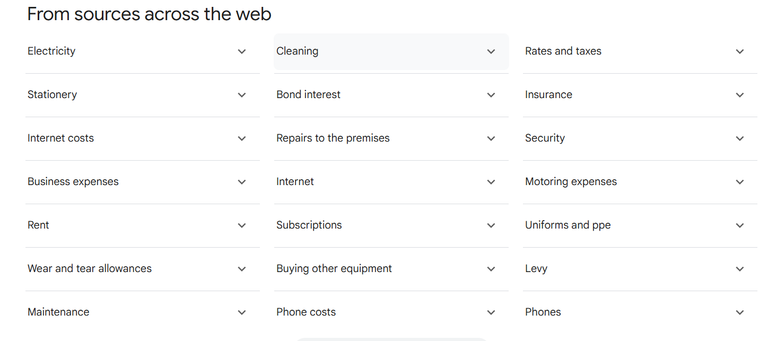

My mentor has an accountant lined up which I will have handle our books from the New Year and kind of wished we had done this a year ago already. Maybe this is the best because the business was still getting off the ground and these days is far more settled and growing. There is so much one needs to learn on what is considered a legitimate expense and we have been paying for most of them ourselves.

On one hand you kind of feel bad, but then on the other hand you are being fleeced so much by the tax man you may as well take what you are allowed to and go with the ride. I am disappointed with our current accountant as I know we could have claimed so much more and have not been advised properly. This is why some accountants are known as tax specialists and these are the ones you want in charge of your accounts.

Posted Using INLEO

Being termed too 'by the book' to be useful is something I can relate with. I've learned to be a lot more adventurous with things I am in charge of

I agree and used to see it with people with text book degrees and trying to imply the knowledge they knew in the real world which does not work exactly like the book. I have seen it all too often and why in many ways certain industries have changed as they lost the experience by getting rid of it. You cannot teach experience as it is full of knowledge and far more important than a text book degree.

Sometimes it's a personality type that wants to do everything within the drawn lines they learnt at school not knowing that these lines are quite arbitrary in the real world. Good choice on getting a more experienced accountant :)

When I was studying for my Masters degree in Accounting and Management of Information systems our Accounting professor said that Accounting is not a science, it is more of an art and philosophy. The US tax code is so complex and convoluted that there are many gray areas... Navigating those gray areas comes with a higher risk of an audit... I am sure it is also the case in your country. The by the book accountant will minimize your audit risk, but that risk might be worth the savings that you will pocket.