Living With Debt Is A Killer

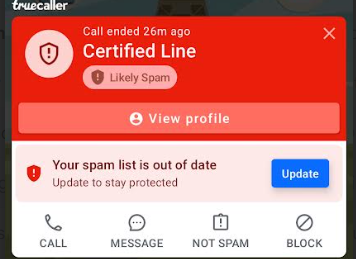

I have an app called Truecaller on my cell phone which helps protect me from spam calls as who likes taking these sales calls. Tonight I answered one as they had been trying for the last few weeks and to get them to stop I may as well find out what it is about. I had no idea there was a post brewing lol.

The sales lady mentioned she was from some World Finance Institute and that they were helping people sort out their dent problems. She said everyone has accounts and what they do is bundle them altogether and pay them off leaving you with just them to pay. I informed her I had no accounts and that she had peaked my interest and enquired how well is this financial scheme of theirs working. She mentioned about 90 percent of the calls people are interested to learn more but only about 50% take them up on their offer.

This is actually quite a scary statistic if true because all these people are doing is getting into heavier debt. Paying off your loans helps you in the immediate time frame, but you will be paying back more. This is how these schemes operate by offering you a cheaper monthly payment over an extended period of time which will no doubt cost you more hence you owe more than you currently do.

Reading up on where consumer debt currently is in South Africa is not a pretty read and has not been since prior to Covid lock downs. One has to understand the majority of the population in SA is not well educated and when it comes to understanding finances and figures they are what we would say as being challenged. For most of us we can understand whether we can afford something or not without having to use a calculator.

You earn A each month and spend B which as long as B is less than A you are fine and not in debt. This is just pure common sense yet then why is there a median debt-to-annual-income ratio of 113%.

A local debt company called Debt Busters offers a service similar to the call I answered today by financing your debt and then you just pay them. When people head down this route looking for help with debt you just know things are bad and the chances are they will only get worse.

Debt Busters found that 82% of applicants had already taken out a personal loan to cover their debt and were still in debt. Worse still is 52% come with a monthly pay day loan so they have already given up one months worth of wages. Another 28% live and rely on their credit cards to survive each month which we all know is a disaster waiting to happen.

Surprisingly the higher earners with a salary of R35K ($1.75K) had a total debt to annual net income ratio of 187%. This group was using 76% of their take home pay to fund existing debt which means they are going to be growing their debt by seeking more financial assistance. Those earning R5K or less were in the 80% debt payment to income range.

The problem is with the people not understanding their finances and companies offering them finance when they clearly cannot afford the finance. I find it criminal that companies are allowed to offer loans when it is obvious there is going to be a problem. We know how hard it is to get out of debt and the majority of people who are in debt will never recover. I helped someone get out of a massive financial hole and it took 5 years and they were only just getting to grips with it.

Posted Using INLEO

Surprised they’re even allowed to cold call you like that. DMPs in the UK are not allowed to make unsolicited contact with potential customers and for good reason, debt advice is a regulated activity.

Yes you would think so, but it is the Wild West here. I only answered as I didn't recognize the name or number and have had potential clients phone me up that were highlighted as possible spam calls.

Best advice, just ignore all calls lol!

Yes I normally do.

Must be about the same age as me then

Eye-opening post! Do you think stricter lending laws could actually help, or would financial education make a bigger difference?"

Bothe are required as the masses are seriously financially ignorant and are being taken advantage of by the lending companies.

Exactly, those offers that seem like a “magic solution” for debt settlement often turn out to be traps and leading people into bigger debts because of long-term interest and extended payments.

Financial education is the first step. So many people just do not know how to live within their means. Or rather, to live below their means in order to account for the vagaries of life and anything that can’t foreseeably be predicted expense wise.

I find it absurd people cannot budget their finances properly and they always end up in trouble. If you have x amount you make sure you spend less or don't purchase whatever it is that you would go into debt.

Another good question is what interest rates these debt consolidation companies charge...

Yes we all know they will be high and extended over a course of many years.

By adding #bilpcoin or #bpc to original posts, you can earn BPC tokens

https://peakd.com/hive-140084/@bpcvoter1/my-way-keni-bpc-ai-music

https://peakd.com/hive-126152/@bpcvoter2/dear-themarkymark-buildawhale-gogreenbuddy-usainvote-ipromote-and-whoever-else-is-involved-in-this-scheme-you-call-us-nutty-as

https://peakd.com/hive-167922/@bilpcoinbpc/exploring-the-possibilities-of-ai-art-with-bilpcoin-nfts-episode-102-buildawhale-scam-farm-on-hive-and-dear-steevc

https://peakd.com/hive-133987/@bilpcoinbpc/comprehensive-analysis-of-punkteam-s-wallet-transactions

https://hive.blog/hive-163521/@bpcvoter1/deep-dive-into-meritocracy-s-activity-history-and-blockchain-audit

https://www.publish0x.com/the-dark-side-of-hive/to-downvoters-scammers-and-farmers-on-hive-the-time-to-chang-xmjzrmp

https://peakd.com/hive-163521/@bpcvoter3/themarkymark-we-ve-exposed-your-actions-repeatedly-how-you-and-your-army-of-bots-manipulate-rewards-to-benefit-yourselves-it-s

https://peakd.com/hive-168088/@bpcvoter3/the-shadow-matrix-a-tale-of-deceit-and-reckoning

Decentralization isn’t just a feature—it’s a fight. Let’s model fairness, rally allies, and pressure Hive to live up to its ideals.

https://peakd.com/hive-167922/@bpcvoter3/5m1kft-themarkymark-you-can-keep-pretending-to-be-oblivious-but-the-truth-is-out-you-ve-been-exposed-it-s-time-to-own-up-to-your

#StandForDecentralization #HiveTransparency