History Teaches Us So Much

It is actually quite interesting when you look back at what previous crypto cycles have done and how big these correctios were. These corrections are normal and cannot be seen as bad as we know nothing can just continue climbing in value without having regular pullbacks.

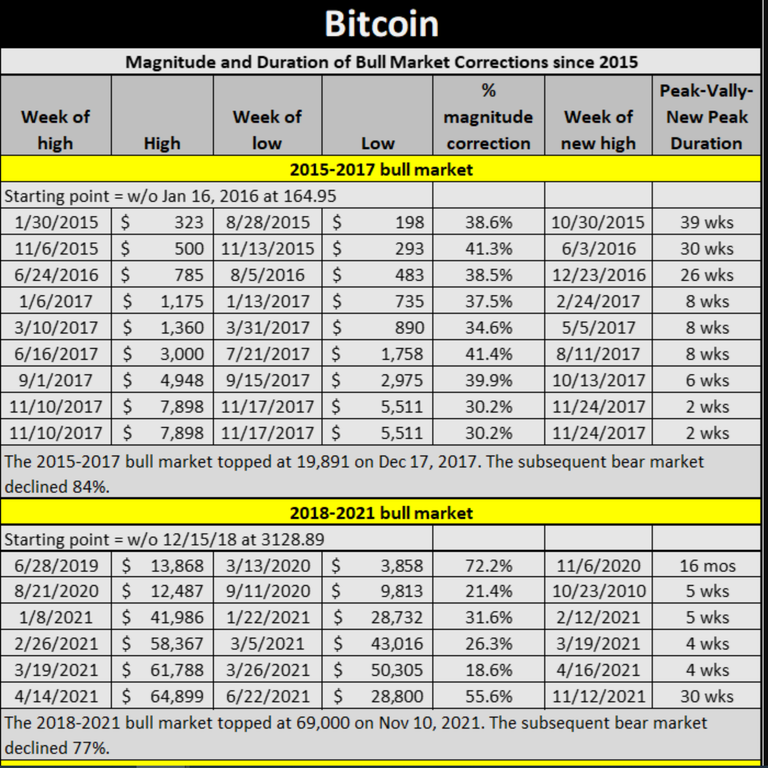

If we look at the 2015-2017 phase of the Bitcoin cycle there was larger percentage corrections versus the 2018-2021 cycle. During the 2017-2018 the market saw anywhere between 30.2% and 41.4% with Bitcoin being at a lower price compared to what we saw later on.

My thought is when Bitcoin reaches the $150K-$200K mark could we still see these types of percentages as one could imagine a 30% correction would then be like a $50K drop in value. It is no wonder the altcoins get decimated every time these correctios happen and obviously the volatility on the alts is way worse than that of Bitcoin and why they are more profitable if you are patient and smart.

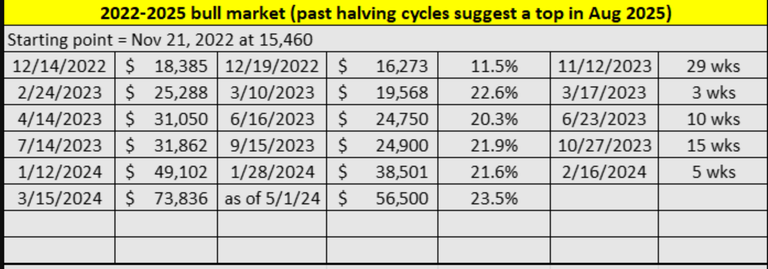

This cycle we have seen an ATH achieved with the correctios much smaller than in the past fluctuating between 23.5% and 11.5% which is way off what we saw back in 2017-2018. What we do know is correctios do happen and they are regular so this is normal and there is nothing to be concerned about.

History tells us that on average we will see 9 corrections with an average pull back of 23% and an average timeline of 10 weeks per correction. The beginning of a cycle is different than the end phase and we would see larger corrections of 30% lasting for 16 weeks compared with a 15% lasting for 2 weeks towards the end.

No one knows where we are exactly in this crypto market cycle with my head saying we still have a good 12-15 months to run before we see the ATH's again. This timeline fits what has happened previously and as we know history is not exact, but is mimicked in crypto.

Whatever happens between now and later next year we are in for a fun ride and we should enjoy every moment because I can see serious values being added when the markets turn green whenever that might happen and it will. History from previous cycles tells us that and why we just need to keep on building our portfolios and moving forward each day.

An interesting stat from the above chart is how much Bitcoin dropped in value once the ATH was achieved and the bottom of the Bear was reached. 84% in 2017-2018 and 77% in 2021 which subsequently removed over 90% of everyone's portfolio if you were holding Alt coins. This cycle I will be selling having learned and processed the knowledge from experiencing an entire cycle last time around.

Posted Using InLeo Alpha