Dubai Crypto Off-Ramp

Today I started the process of contacting banks asking specifically what they require in order to open a non resident Dubai bank account. After doing research and looking at various options for a crypto off-ramp Dubai looks like the best bet. My crypto is 100% taxable as I never invested any money and all earned so whether it is 25% or 40%cypto taxes paying 0% is what I am looking for.

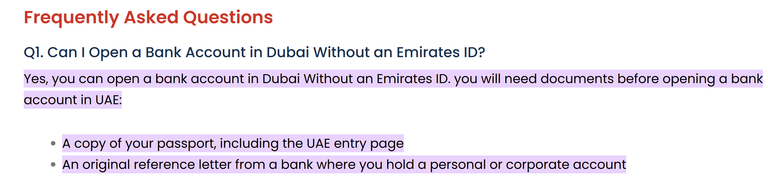

The next trip to the UK will be via Dubai ad I will need to spend a minimum of 2 days in the city as this is one of the requirements of opening a bank account. The bank needs to see you in person when applying for an account and they also need to see your passport with the correct entry stamps.

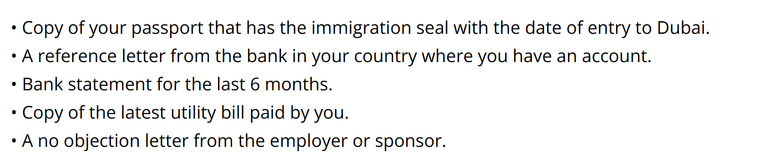

There are a few other documents that are required and this is what I am specifically asking the banks. Your personal information is protected via Dubai's banking laws and need to know if there are any other requirements.

On my last travels my car hire agent in Faro was from Dubai and we got chatting. He told me most banks have a minimum deposit requirement in order to open a non resident bank account which is understandable as it shows commitment on your part. He mentioned this figure can be anywhere between $10k and $50K and this is why today I am asking the banks what requirements they have. Maybe this is a stipulation or maybe not so I need to find out first as I have seen this mentioned being a requirement with one of the banks. Also is it 50K Dirhams or Dollars as that is a big difference as $1 is 0.27 Dirhams o roughly 1/4.

His advice was to use the same bank I use now being HSBC as it would make thigs simple. This is not something I had considered and not so sure If I would even do that as I would like to get away from these banks and use a Dubai based local bank. HSBC as not been the best bank to deal with and I was planning on changing them in the future anyway.

The minimum deposit and holding balance is not an issue if we see a peak in a bull cycle later this year, but coughing up $50K right now may be a stretch and want to see why there is a $10K and $50K holding balance and what is the difference as does it allow for a higher APR? I can do the $10K immediately and will wait to hear all the answers before I proceed.

Once I have all the information I will know what the next step is and if I will be flying via Dubai on my next trip or not. Obviously I would like to get an off ramp sorted as soon as possible, but if I have to wait for more funds to make this happen then that is also ok. I have no problem with the idea of keeping a fixed amount in an account if it saves you the tax hassle and will most likely be less than the tax amount I would be paying normally whilst earning interest off that amount.

I know a few of you here are also looking and will keep you updated on the replies and what the right course of action is. Fingers crossed if they require a minimum holding balance it is not a large dollar number.

Posted Using INLEO