COTI's Privacy Solution Has Landed Them With The ECB's Digital Euro

This I believe was one of the projects COTI could not discuss and had to wait for the official announcement. A month or so ago COTI mentioned a number of large projects that they were part of, but could not reveal details.

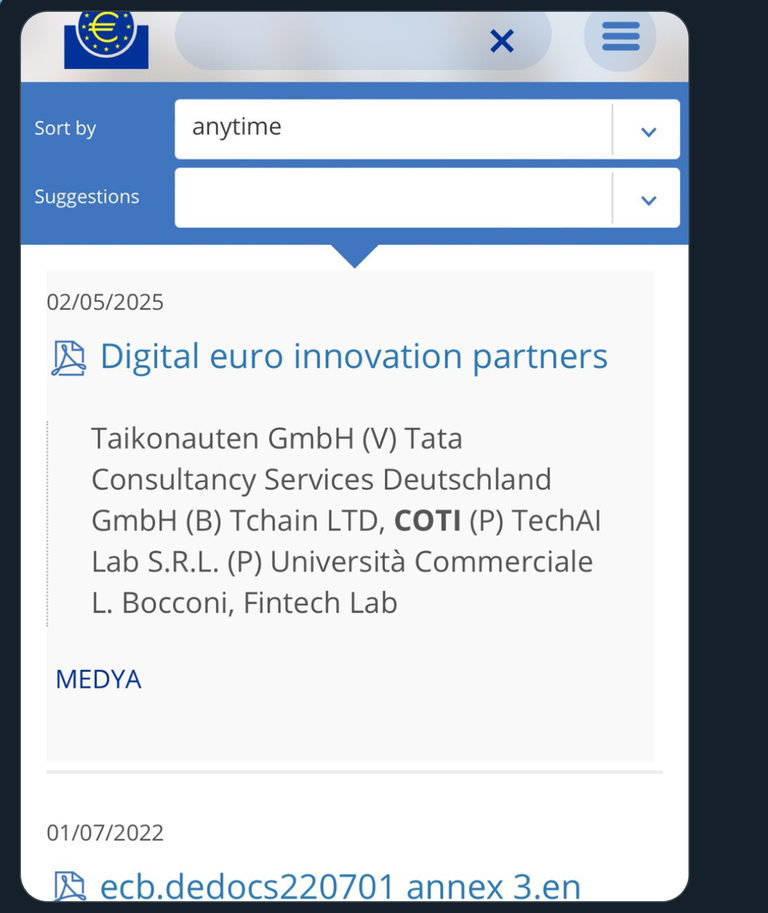

COTI announced earlier today they are involved in helping the European Central Bank (ECB) develop a Digital Euro CBDC. I am by no means in favor of this, but if it is inevitable that this is going to happen you may as well benefit from this. Being invested in COTI I am kind of sitting on the fence for this one and actually would prefer this did not happen.

The ECB is targeting the start of 2026 for their Digital Euro launch and it makes sense to include COTI as they are involved with the Israel's digital Schekel. COTI will link up with online payment service providers which will also include the likes of Accenture, KPMG, and TATA.

COTI kind of sticks out like a sore thumb amongst this group being the only crypto based company amongst them.

COTI and a few others are regarded as pioneers when it comes to online payment technology and these companies have been asked to lay down the infrastructure to show how this will all work. They have literally 7 months to provide a solution the ECB are happy with so this can move forward. I guess less time as it has to be approved in that time line as well.

The ECB is interested in the "conditional payments" which is a transaction that needs to be proved and verified before the transaction takes place. The proof or provenance that the assets do actually exist and what is being traded/transacted is real.

This is where COTI is required as the privacy technology they have can do the provenance without revealing any of the private sensitive information. This is the blockchain technology no others have and can be implemented and scaled up very easily. COTI will be testing their privacy solution on a simulated technical infrastructure for the Digital Euro. This is how far COTI have come in the last year by being invited onto such a large project and it is their privacy solution that is leading the way. COTI will be a part of the Digital Euro running their privacy tech in the background as there is nothing else comparable that can do this.

The ECB wants to develop and create a payment infrastructure for retail payments with conditional payments being their focus area. Banks in the mean time will gear up for digital Euro payments. This is going ahead whether we think it is a good or bad idea and has always been the plan. Thinking more about this logically this is more to do about crypto payments because why would you need conditional payments if it was a transaction in Euro's. Maybe I am missing something here so will wait and see when they provide further updates.

The Digital Euro would be required to facilitate the $15 trillion euro-wide economy which would be good news for those staking COTI with the service fees from each transaction being very small, but adding up very quickly. COTI is going to explode as they literally have the ECB and Israel on board already and others are going to come knocking. I expect the UAE will be the next announcement with digital currencies.

Posted Using INLEO

I don’t see any usecase and further value of a CBDC EUR than programmable money for ECB. 🤦🏼♂️