Any Ideas On Your Crypto Taxes?

Maybe Having An Extra Passport Or Two or Three Will Give You More Choices.

Next month I am travelling again to the UK to visit my mother who is not well and will most likely be visiting Portugal and Dubai on the return journey. Next year we should see the peak of this crypto cycle and I need choices. I don't plan to move out of crypto and will definitely be using a cold wallet but having an off ramp or two is also a preferable option to have in mind. Staying legal is important and why you need to understand the laws and If I was stuck in a country with no choices I would find an alternative. I am hoping to have another choice once I have visited the UK and had a meeting with another Hive member who is a tax specialist. This may turn into the killer app that Hive and crypto needs or it may be nothing. This is an idea I have been mulling over in my head for over 4 years now and for some reason those are the good ones.

Portugal mainly because of it's climate with a crypto tax friendly approach making it an obvious destination. I have applied for my Irish Passport so I would be considered an EU citizen. The Algarve region has caught my eye and that is where I will be spending 4 or 5 days at the back end of next month or the first week in November. The language is the only down side as those that know me I do struggle with languages and it would take me many years to understand and speak a new language.

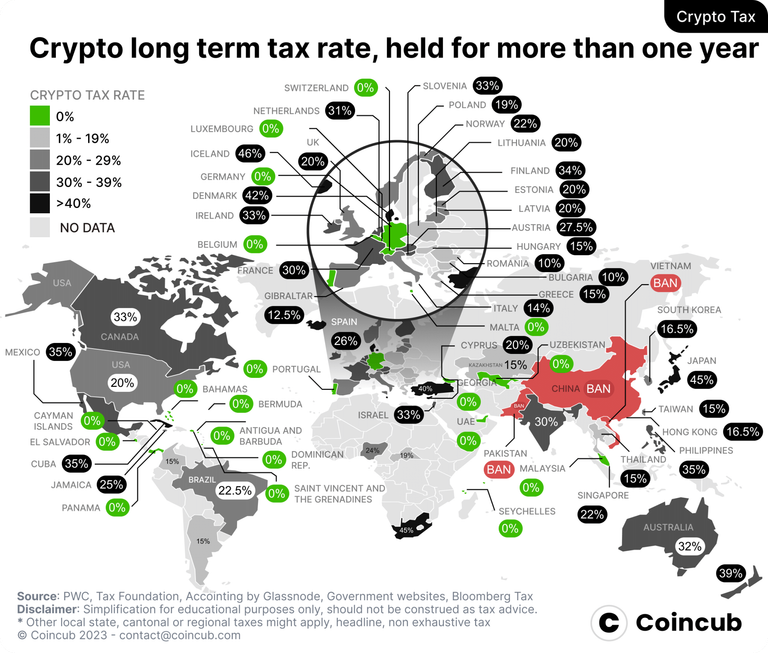

Crypto tax in Portugal is at 28% for Capital Gains tax unless you hold your crypto for longer than a year and then it is free. I am no trader and believe in long term staking and why the 365 day free tax suits my needs.

If I compare this to the current tax rates in South Africa which are ridiculously high being 45% for staking, airdrops, hard fork earnings etc or 18% for a long term hold which is 18% more than Portugal.

The UK is slightly more favorable than South Africa, but not by much and it is changing each year. Two years ago you were allowed a £12,300 tax free capital gains allowance which has dropped to £6,000 this year and £3,000 next year. The HMRC has also got data as far back as 2014 on anyone in the UK registering a crypto wallet with a UK friendly exchange. In 2025 if you earn less than £50,270 in crypto you pay the flat rate of 10% and over this number you pay 20%. This is not that bad really, but once you declare you are on the hook for good.

There are some other alternatives that I am exploring with one being Dubai that offers banking for non residents. Dubai has no Capital Gains tax and having a bank account in Dubai allows you access to their tax regulations. Dubai's privacy banking laws along with it's legal frame work help protect your identity. The only requirement is you open the bank account in person which they recommend a two day visit which shows your passport with the correct stamps for entry.

I am not saying one needs to commit a crime but at the same time declaring everything you make without having diluted this I feel is a mistake. The peak of the cycle next year depending on how high my portfolio value goes will determine which steps to take. My thoughts are if you have serious value then you are better off buying a property in a crypto friendly country compared to declaring the tax back home.

I don't see it as being far fetched that many of us could have many millions of dollars in value over the next 5 years. 20% of $5 million is $1 million which one could keep if they bought a property in another country. I know which route I would select and South Africa is and was never part of the plan.

Posted Using InLeo Alpha

Congratulations @cryptoandcoffee! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

When it comes to economic decisions, always go where suits you. Portugal sounds great but I think the language barrier may be a big factor for you, especially when those big returns come in and you're considering more permanent investment in your preferred country of settlement