A Global State Of Play In CBDC's

I looked into the state of where countries were with regard to CBDC's about a year ago and quite a bit has changed. Many countries or regions are further ahead than I had thought and this is only a matter of time before we see them appear.

Currently COTI has officially announced partnerships with the Digital Euro via the ECB and the Digital Shekel via the Bank of Israel. I saw a comment the other day regarding the UAE Digital currency, but this has not yet been confirmed. I do expect this to happen and become official within the coming months.

I am interested purely as my one investment COTI is involved providing the privacy technology for "some" of these CBDC projects and I expect that "some" will turn into a majority once they launch. You could never launch a CBDC without having privacy encryption as that would be irresponsible and dangerous.

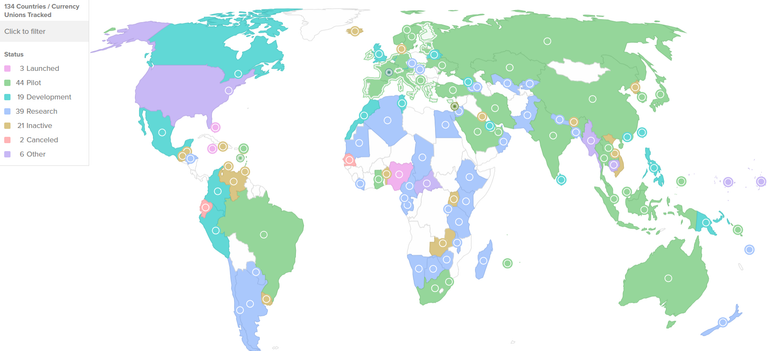

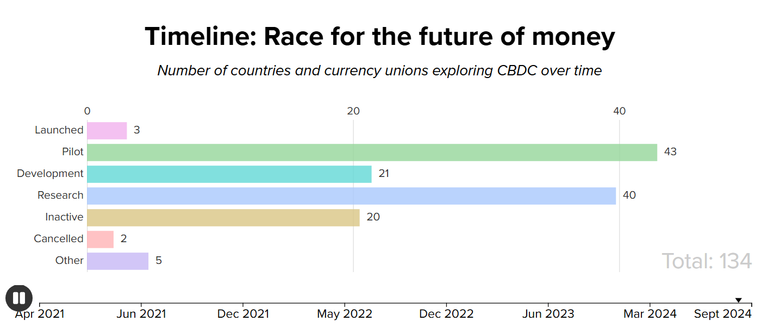

Back in 2020 CBDC's was a word thrown around and no one quite knew what this really meant as there was only 35 countries exploring the possibility of using CBDC's. Fast forward 5 years to 2025 and we see 66 countries are already passed the initial phase and are in final testing, piloting or launch phase.

The Digital Euro is expected to launch in early 2026 along with 44 other digital currencies who are in their pilot phase. We know or it has been reported BRICS are testing a pilot scheme, but who knows how credible this information really is.

I do not think it is such a bad thing if you are not the first country having a digital currency, but I believe once one is launched then the race will be on to launch next. This time line was dated up till September 2024 so 7 months on many countries are very close.

The EU were the fist to really do any type of crypto digital regulation with MiCA and why they are expected to be the first to launch their CBDC. 3 countries have already launched, but I would not call them major players being Bahamas, Jamaica and Nigeria.

I noticed after going through the various countries Ripple is involved with a handful of projects. This can change however once a country launches and highlights other areas of concern and new developments like technology can turn things on it's head making additional inclusions.

The next 5 years when we look at this map I expect most countries to already have their own CBDC's operational and only then will we know if this was good or bad with regard to regulation and any ulterior motives. This is the future of cross border and internal payments so this is a huge shake up to the financial systems.

The United States has said no to CBDC's for the time being but they have had pilot projects testing things out and when the Digital Euro launches I believe they will not be far behind.

Posted Using INLEO