1% Vat Increase Will Not Create More Tax Revenue

There is huge uncertainty in the government as the coalition of ANC and DA voted against each other giving concerns that this is not going to work. The Rand dropped moving from R18.45 -R18.76 to the dollar. This is the last thing the country needs as markets like a stable government.

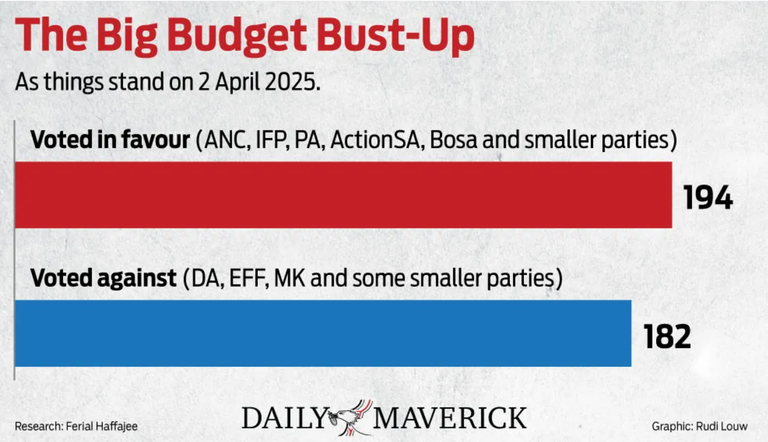

Today the vote went through 194 votes for and 182 against to increase VAT in South Africa from 15% to 16%. The last VAT hike was 7 years ago back in 2018 from 14% to 15%. You would think there are better ways of generating revenue than raising VAT which effects everyone rich and poor.

VAT contributes around R400 billion which represents around 35% of the country's total revenue. The government which is a coalition known as Government of National Unity did note vote as one as there are definite cracks emerging.

The 1% will be implemented from the 1st May with 0.5% and the remainder in January 2026. All this means is prices will rise twice giving manufacturers an extra excuse to raise prices. The 1% will never be just 1% and will be more like a 3-5% difference when done.

The extra 1% is expected to add another $40-R50 billion over the next financial year. They learned nothing from the consequences of the VAT hike in 2018 which added an estimated 3,5% to inflation, created job losses and resulted in less spending by 0.8% which ultimately reduced overall tax revenue.

The obvious solution is to bolster the economy by giving tax breaks for businesses in order to grow the economy through employment. This would grow the tax base increasing the overall revenue. What is obvious is we are not dealing with educated individuals making these decisions and arithmetic is not a strong point.

Roughly 4% account for 60% of the personal income tax pool and those higher earners have been leaving the country. 1000 companies account for more than 70% of corporate taxes which is the bulk of the tax kitty. Dangerously top heavy with the tax burden being carried by a very small percentage and why they are leaving as you can only tax someone so much.

If the government sorted out the corruption which is estimated to cost the country R750-R800 million daily then there would be funds without having to worry about tax hikes. This comes to somewhere between R250 and R300 billion being stolen each year nd is why the economy is in such a bad situation as very little tax money is flowing back into the system. The problem is no one wants to tackle corruption with those in power being the ones stealing the funds.

The stolen taxes could be used to boost the economy fixing the failing infrastructure providing jobs for millions of unemployed workers. Another looming issue is whether the US will place tariffs on SA as that would be another nail in the coffin sending SA's economy spiraling downwards. I just don't see any coming back from that move if and when it happens and expect many businesses to shut down and move permanently elsewhere outside of SA's borders.

Posted Using INLEO

Oh my God, raising VAT hurts poor people the most. The government should just stop wasting money instead of taking more from us.

https://www.reddit.com/r/worldnews/comments/1jq1x3g/1_vat_increase_will_not_create_more_tax_revenue/

The rewards earned on this comment will go directly to the people( @tsnaks ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.