Silver Portfolio Update

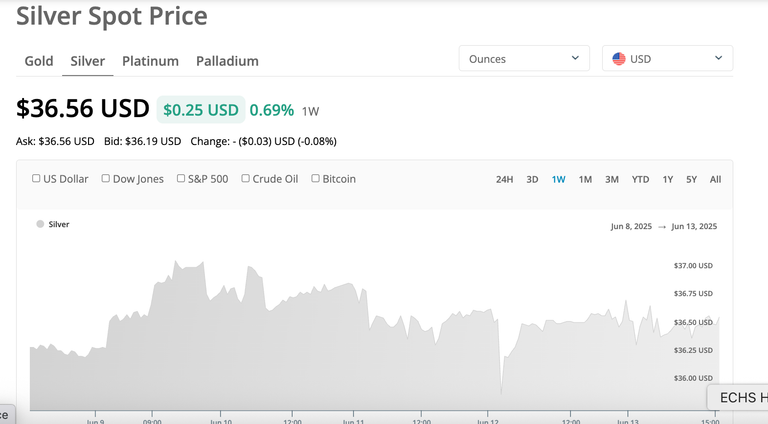

Silver Price Analysis

Gold and silver surged as investors sought safe-haven assets amid geopolitical risks and weaker U.S. inflation data.

The Producer Price Index (PPI) rose just 0.1% in May, down from a 0.2% decline in April, signaling persistent disinflationary trends. Combined with soft consumer price data, markets are now pricing in a 55-basis-point rate cut by the Federal Reserve in 2025. I will say silver’s upside remains capped by lingering concerns around industrial demand and global manufacturing trends. We will see what happens next week!

Silver Chart

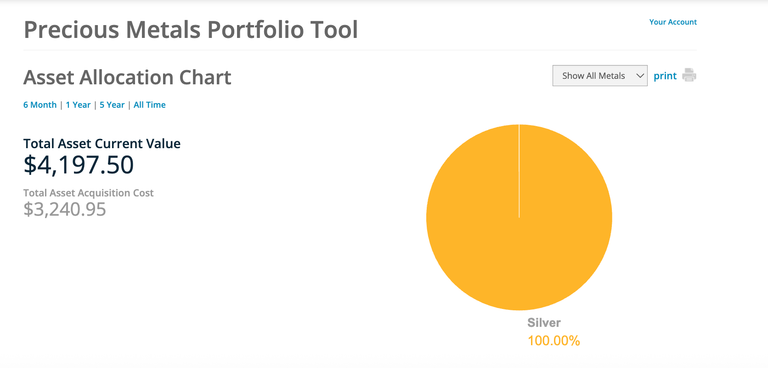

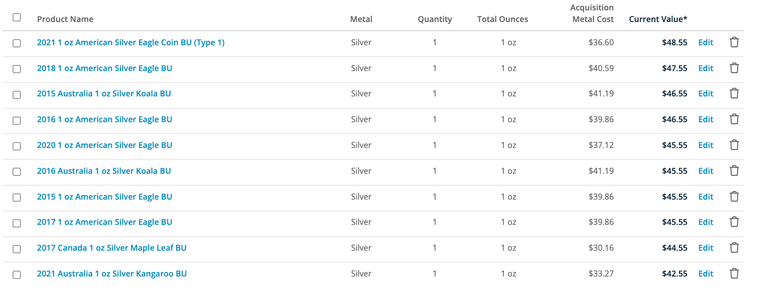

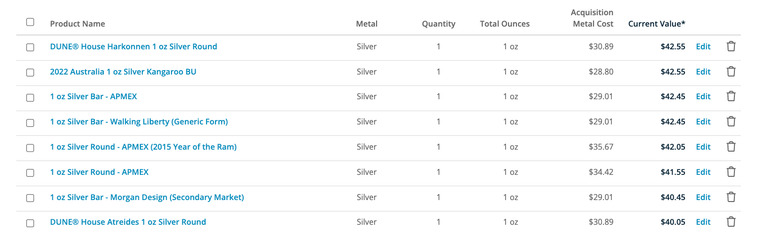

Portfolio Update

My current assets are valued at $4,197.50 with a total acquisition cost of $3,240.95.

Asset Allocation Chart

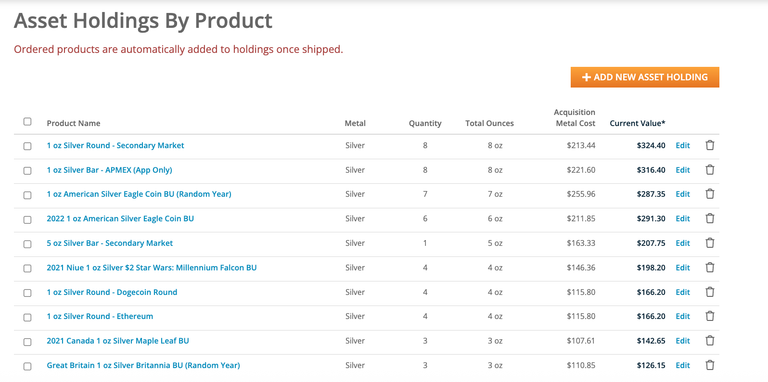

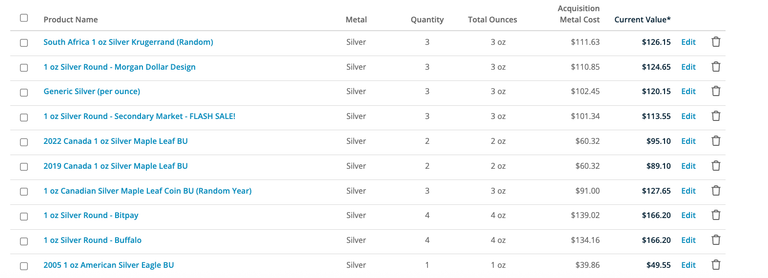

Asset Holding by Product

0

0

0.000

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Keep on stacking!

Always

I expected Israel Iran to pump it

Unrest does do that

Silver keeps going up and I am loving it. If I really have the money, I will have buy more silver token

Silver has been good

If silver doesn’t consolidate this week to $35, in my opinion $38 will be tested shortly

The price of gold and silver will continue to rise whenever there is a war