Silver Portfolio Update - Happy New Year 1/2/25

Silver Price Analysis

Silver price receives support from safe-haven demand amid increased geopolitical tensions. We saw it extends its gains for the third successive day, trading around $29.60 per troy ounce during the Asian hours on Friday. This sustained rally is attributed to strong safe-haven demand amid persistent geopolitical tensions in the Middle East and the prolonged Russia-Ukraine conflict. It looks like we may see a rise in tensions this year which is good for safe havens like metals so it will be critical to time buy this year.

If you check out my post form yesterday I took a look at the gold market if the shiny yellow stuff interests you.

Silver Chart

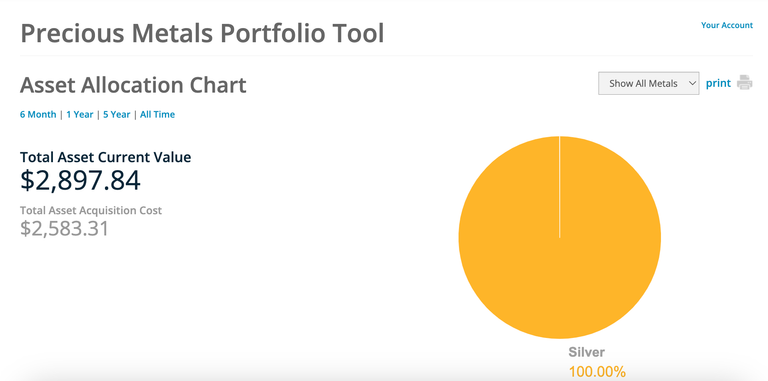

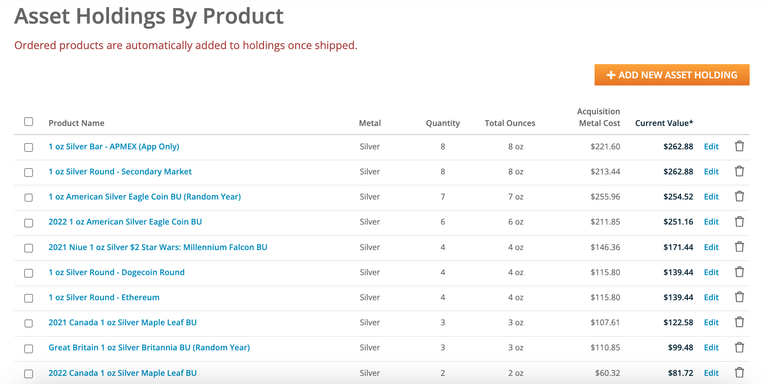

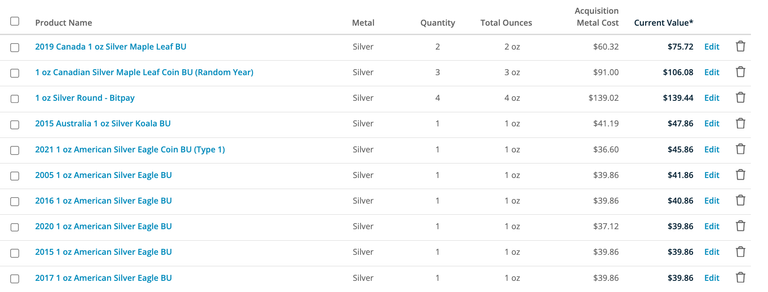

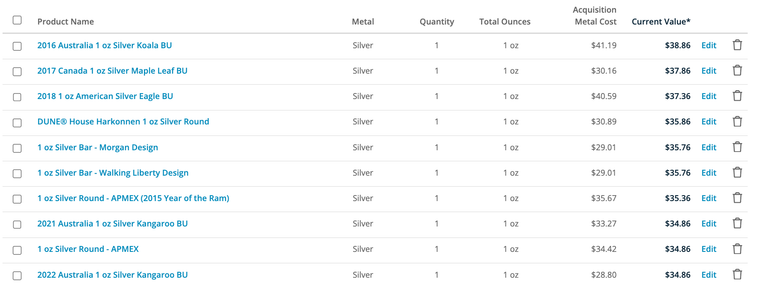

Portfolio Update

My current assets are valued at $2,897.84 with a total acquisition cost of $2,583.31. We are starting the year off right in the black with silver up 0.61% this week.

Asset Allocation Chart

Asset Holding by Product

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

In today's world scenario, investing in any metal is really important. This will not waste your money. It has a fixed price. Which is increasing day by day. So Silver, Gold, this is really good to invest in. #silvergoldstackers

It's good to be diversified.

Silver prices are expected to rise in the upcoming trading week.

I think so. I think $50 next year could happen.

A friend of mine and silver stacker bought me an ounce a couple of years ago for my birthday. It is neat and is my connection to your silver posts as I have a very small horse in the race!

I bet a shake up/crash of the American economy (which I think the rich people are orchestrating right now with an easily purchasable president) might do some neat things to the stable portions of your awesome portfolio!

That's one reason why I keep stacking it's a fun emergency fund! What did you frind buy you?

A little TD rectangle!

Now that's pretty!

I read an article on one of my e-magazines that I get. China is secretly hoarding silver and have been for over a year now. Silver is not like gold as far as reporting issues so it’s going under the radar to the mainstream. Keep an eye out, silver could go parabolic if this news comes out in the wrong way.

I think paper silver is also under reported. I don't think they have enough physical to cover all the paper they issue. If either or both of these come out I think $150 is not unreasonable.

Paper contracts work totally different. They only have to have 5% of the total contract in physical silver to have a contract started.

Wait what? I thought they needed 100% backing. I feel stupid that I have never actually googled this I just assumed.

That’s correct. They only have to put up 5-10% of the total contract

Sounds like a paper contract research post is coming on my part...

Enjoy

Silver contracts are on a Fractional Reserve system!

Doesn't that sound familiar?

The first eight months of the year can be quite special

Yes it can be we will see with trump coming into office

@cryptictruth, thank you for supporting the HiveBuzz project by voting for our witness.

Click on the badge to view your board.

Once again, thanks for your support!

Check out our last posts:

Ahh,the best might still come!

I think so I added another 6 oz yesterday.

A great analysis of silver's performance amid rising geopolitical tensions can be said to be that silver is a safe haven asset.

Thanks metals usually are good places to be. I like the diversification.

I personally am focusing on Gold this year. I think Silver will perform well but not outperform like usual. Adding these two to the stack for my January- June DCA gold addition.

I want to add gold but I can’t afford full coins. The 1/10 look nice I would love a full 1 oz maple

The important thing is you are in the money. With any luck we'll see a nice push in the next few months. Right now it seems complacent just below $30...

Yes I like being in the black but I'm counting to add here

'Life is either a great adventure or nothing' - Helen Keller | Adventure awaits 🗺️