Silver Portfolio Update 4/26/25

Silver Price Analysis

Stocks surged this week while silver dipped near $33.44 but held support above $33.18 amid conflicting signals from risk-on flows and Fed easing bets. Metals remain under pressure as investors tilt toward equities and higher-yielding assets. On any significant weakness it might be a good time to make another buy.

Silver Chart

Portfolio Update

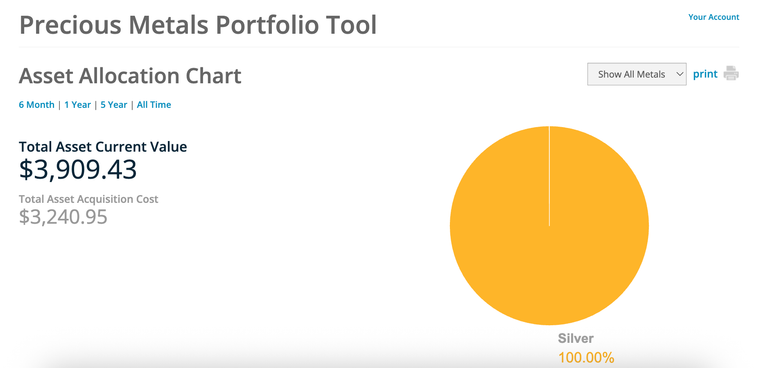

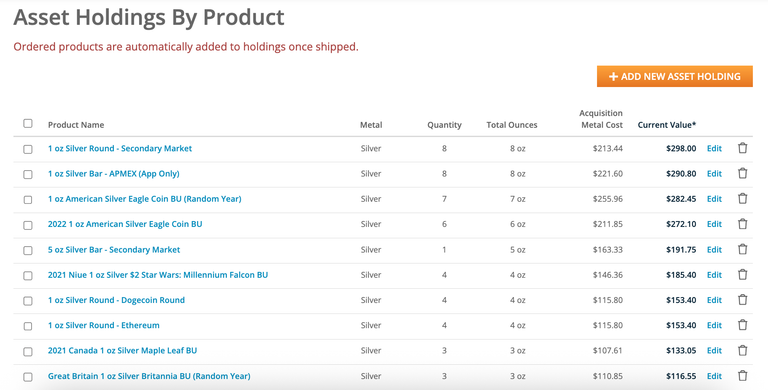

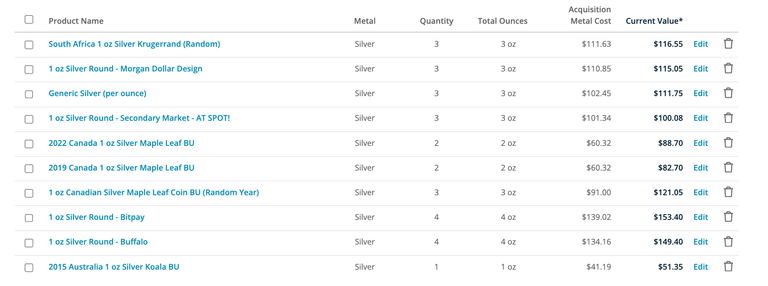

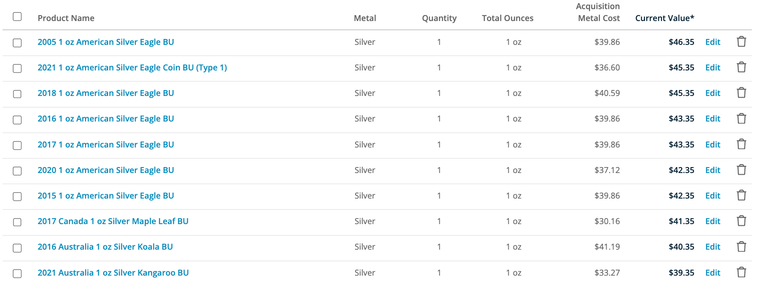

My current assets are valued at $3,909.43 with a total acquisition cost of $3,249.95. I'm also sitting on 350 shares of SLV so my paper and physical collections are doing quite well this week. I can get about $80/week from selling covered calls against this SLV position so I will be looking for a way to easily transfer that into my physical buys.

Asset Allocation Chart

Asset Holding by Product

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Not much moving on silver, seems pretty much same

Markets pumped this week

Congratulations @cryptictruth! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 14000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPhttps://x.com/jewellery_all/status/1916216298553675911

#hive

silver and gold are holding great.

I think this is the time to profit from gold

Silver is going to move…

Silver may be stalling with silver consuming industries slow or stopping production until the tariff issues are settled. When the public turns from unaffordable gold is when the public will flock to affordable silver.

The silver is definitely performing quite well and we hope it continues to increase