My Hyperliquid Journey #5 | Back To Reality...

Hyperliquid Journey

This was the first week where the market in general went down which kind of put me back with my feet on the ground even though the overall loss was limited. It's crazy in this crypto space how quickly the sentiment can turn around as everyone now seems to be shouting 'double top' and end of the bull market.

I'm still not taking Hyperliquid and leverage trading too serious and see it more as some fun on the side and a learning experience. It also gives some fun each mornig waking up to see if any of my positions got liquidated or skyrocketed. The main goal remains to be rather defensive and avoid losing money even though I initially kind of started it as a Yolo Moonshot. The reality though is that this extreme high risk gambling mindet is not something I have as I'm used to always apply proper bankroll manamegent with an eye to survive and grow in the long term.

Week #5 Trading Journey

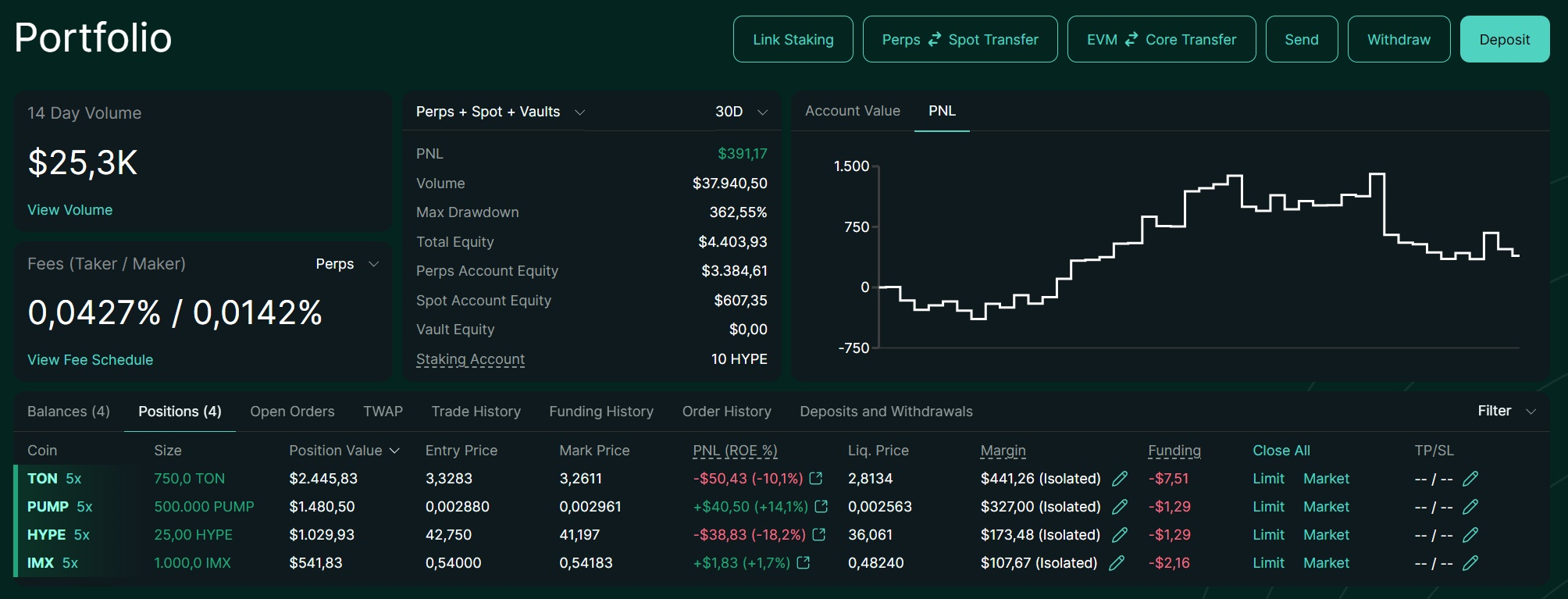

As my strategy is to only take long positions at 5x Leverage in the coming months in the hope to catch some crazy bull run in some altcoins, it's inevitable that there will be times when rather small corrections get me liquidated. I fired some bullets that got liquidates but make sure that I have enough on the side to have another go in case prices go lower and lower.

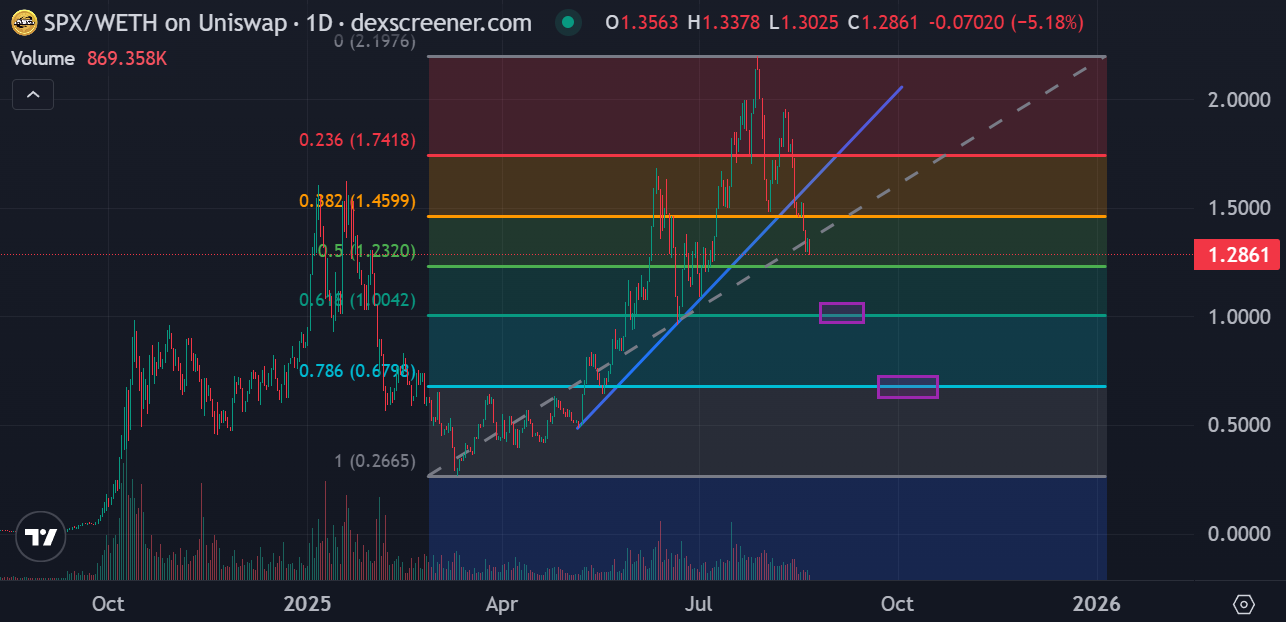

I put a 'low buy order last week' on <b$SPX which I kind of follow the thesis of Murad on. However, a 1-click big seller dumped the price which got filled at 1.60$ but instantly got liquidated at 1.416$ for a 165$ loss.

I opened another long later down the line but eneded up closing it again as the support line got broken which lost me another 85$. At this point, I'm waiting for a potential 1$ price and 0.70$ price to have another go at it.

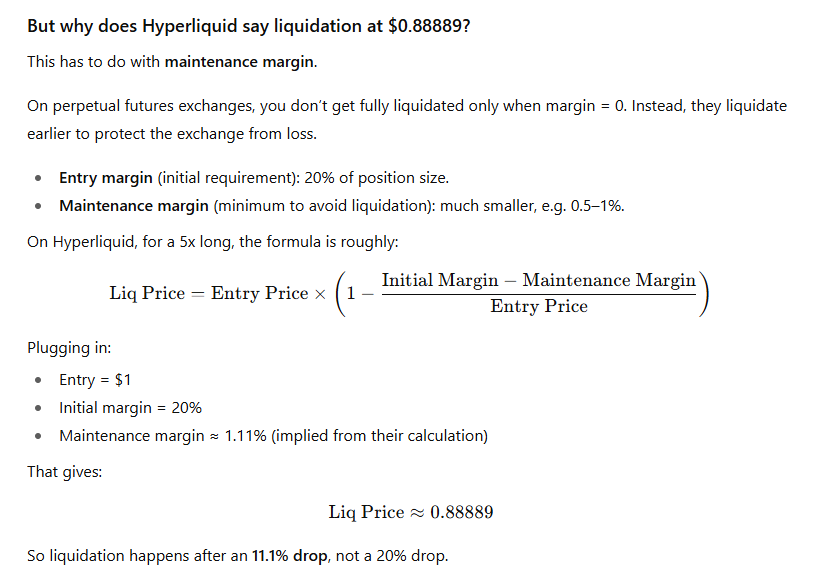

In fact, I should open buy order already at that price so they open automatically. However, while I tried to do that at a 1$ price right now it showed that the liquidation price is 0.88889$ which didn't really make much sense so me. So I asked ChatGPT about it and it was explained that there is some kind of maintenance margin which I'm still trying to make sense of.

So basically how I understand it all is that this puts the odds wildely against you since you earn slower and lose faster this way which chat GPT confirms.

It does look like the liquidation % on a 5x leverage also varies from coin to coin, so somethin liquid like BTC is way closer to 20% while something like SPX which can dump on a single candle like it did already liquidates at -11%.

One other thing I was thinking about was "if let's say I pay 1000$ for a 5x log position which is down leaving me with only 500$. Why would it not be better to close that trade and open a new one at that price so the risk of getting liquidated on that gets way smaller as the price is moved down by the new trade while the upside is the same"

This is what ChatGPT answered...

So yeah, I've learned a lot last week and became a lot less optimistic about Leverage trading than I originally was not only because things went down but because I'm better starting to understand the math behind it all.

Watchlist

With all this new info and experience I will avoid to overtrade and I will be picking my spots much more selective.

I opened a new long on $PUMP which dumped all the way down under 0.03$ again. The main thesis remains that 0.004$ was the ICO price with the team having tons of funds and the platform still making profit.

I also still have a long open on $TON patiently waiting for something to happen.

I also have a small long open on $HYPE s it dropped back to the 0.618 Fib Line.

I'm also keeping my eye on $FARTCOIN which feels like it will come back eventually, even if it goes down quite a bit more.

Results So Far

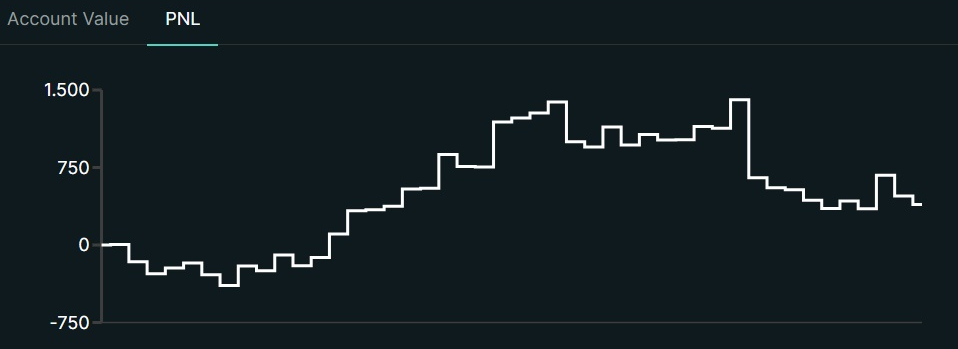

I pretty much gave back what I gained last week but I'm still up 400$ on my account since I started.

| Week | Total deposit | Total Balance | Week | Total |

|---|---|---|---|---|

| #01 | 500$ | 500$ | 0$ | 0$ |

| #02 | 1000$ | 959$ | -41$ | -41$ |

| #03 | 4000$ | 4384$ | +415$ | +384$ |

| #04 | 4000$ | 5250$ | +866$ | +1250$ |

| #05 | 4000$ | 4404$ | -846$ | +404$ |

Conclusion

I'm still having fun with Hyperliquid even though I became a lot more realistic this week. I also understand much better why the majority of people actually lose with leverage trading.

This was a nice read, and I like how you gave a breakdown on liquidation and recorded the wins and losses in the crypto space.

Congratulations @costanza! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 3300 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP