GambleFi | SX Pump & WINR Liquidity Pool Earnings!

It was another week with good stable combined dividend earnings from the different platforms that I'm invested it while things continue to move forward.

I'm getting increasingly sold on WINR Protocol as I'm testing things out to better understand how it all works. This week also set a volume record of around 14 Million as there are some whales active who take 500$ bets.

It can easily be tracked how much profit or loss the site is making and with relatively low liquidity pools compared to the volume, those who provide liquidity either make big wins or big losses. However, since there is a mathematical edge it for sure is +EV to provide liquidity to the pools. This is what I tried out adding 6000 BRETT to the pool which just in a matter of days is now worth 8400 BRETT. I plan to add 4000 more but want to see some winnings from gamblers first as the variance has been against them and should regress to the mean.

Overall WINR PROTOCOL is just a good solution for people who want to use their crypto to take a gamble in a decentralized way without losing ownership of their funds and without getting hit by transaction gas fees. Anyone who wants to earn yield on USDT/USDC/ETH/WINR/BRETT also can provide that to the liquidity pool even though that does expose them to potential losses. Basically providing liquidity equals gambling with a small edge in favor instead of against.

For as far as dividends go, they are quite high now mainly because the vWINR has not been merged yet as only 11.19% of the total supply is actually staked. So I do expect this to come down quite a bit unless it gets offset by increased volume.

Sportbet.one (SBET)

More positive stability from SBET as the price went up a bit while dividends continue to come in steadily. For some reason SOL was not paid out this week but it is adding up and I expect it to be paid next week. The APY after a 5.69% price increase without the SOL payout still was 48%.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

As I no longer hold NFTs because of the KYC, I mainly will be tracking the RLB along with the burn and I have visualised it better in a new chart.

vBookie (NFTs)

The price of SCS slowly but surely keeps trending down as the ones earning it from their NFT's either dump or stake it putting pressure on the price and the USDC Pool. This while the burn doesn't fully offset it.

Solcasino.io (SCS)

More of the same from Solcasino with the price of SCS having a hard time to keep up as NFT holders continue to hold to either sell which pushes the price down or stake which reduces the APY from the USDC pool.

There was a bigger burn last month as the team used some earnings from I believe WIF to burn some more. in total 130M SCS was SCS was burned which equals 420k. This didn't keep the price from falling and with the total supply now at 6.5 Billion it has a ~22 Million market cap.

If it drops a bit further I might buy some extra. I'm not down a big amount on my buying price and I didn't buy too much to start with so all is still fine.

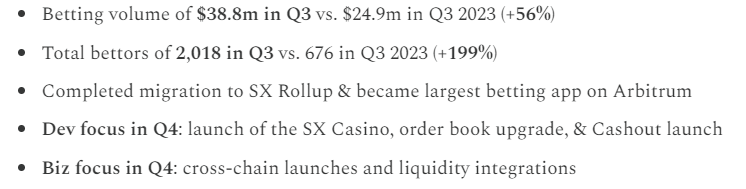

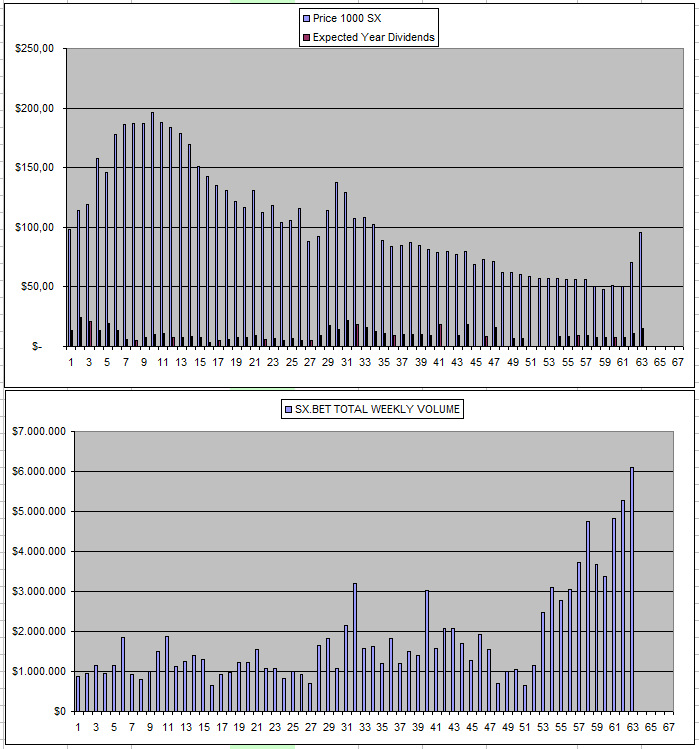

Sx.Bet (SX)

The volume seems to be picking up now reaching 6 Million in the last week which I guess is one of the reason why the price of SX kept increasing. There was a report on Q3 (Link) which showed growing numbers. It also looks like it was integrated some way into Molly bet which is using similar software compared to what I have available with Sportmarket Pro and I guess that could drive quite some volume. Right now there is also a trading competition and some upcoming things are integration on other chains and also an onchain SX Casino which could rival WINR Protocol.

At the same time; I don't think any actual feels are collected so earnings still fully come from inflation which will ramp up as SX is given out for the trading competition.

Owl.Games (OWL)

There was the usual 3-week dip in returns as the dividend pool refill delay happened and that was about it for Owl.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

| 28/05/2024 | 600k | 3179$ | 2035$ | 32.81$ | 1104.49$ | 34.74% | -40$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 11/06/2024 | 600k | 3179$ | 2035$ | 32.60$ | 1170.57$ | 36.8% | +27$ |

| 18/06/2024 | 600k | 3179$ | 2029$ | 33.22$ | 1203.79$ | 37.86% | +53$ |

| 25/06/2024 | 600k | 3179$ | 2039$ | 24.55$ | 1228.34$ | 38.64% | +88$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 09/07/2024 | 600k | 3179$ | 2519$ | 33.17$ | 1294.26$ | 40.71% | +634$ |

| 16/07/2024 | 600k | 3179$ | 2519$ | 33.38$ | 1327.64$ | 41.76% | +667$ |

| 23/07/2024 | 600k | 3179$ | 2394$ | 25.35$ | 1352.99$ | 42.56% | +568$ |

| 30/07/2024 | 600k | 3179$ | 2673$ | 14.85$ | 1367.84$ | 43.03% | +861$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 13/08/2024 | 600k | 3179$ | 2544$ | 29.92$ | 1428.42$ | 44.93% | +793$ |

| 20/08/2024 | 600k | 3179$ | 2551$ | 30.78$ | 1459.20$ | 45.9% | +831$ |

| 27/08/2024 | 600k | 3179$ | 2546$ | 24.58$ | 1483.78$ | 46.7% | +850$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

| 10/09/2024 | 600k | 3179$ | 2451$ | 31.28$ | 1538.99$ | 48.41% | +811$ |

| 16/09/2024 | 600k | 3179$ | 2388$ | 30.83$ | 1569.82$ | 49.38% | +778$ |

| 24/09/2024 | 600k | 3179$ | 2531$ | 30.00$ | 1599.82$ | 50.32% | +952$ |

| 01/10/2024 | 600k | 3179 | 2696$ | 14.77$ | 1614.59$ | 50.79% | +1131$ |

| 08/10/2024 | 600k | 3179$ | 2696$ | 27.38$ | 1641.97$ | 51.65% | +1159$ |

| 15/10/2024 | 600k | 3179$ | 2696$ | 30.54$ | 1672.51$ | 52.60% | +1189$ |

| 22/10/2024 | 600k | 3179$ | 2696$ | 30.13$ | 1702.64$ | 53.55% | +1219$ |

| 29/10/2024 | 600k | 3179$ | 2944$ | 30.22$ | 1732.86$ | 54.5% | +1497$ |

| 05/11/2024 | 600k | 3179$ | 2879$ | 16.13 | 1748.99$ | 55.02% | +1449$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

Betfury.io (BFG)

More of the same also for BFG and I earned enough dividends to the point where I will make my next withdraw to re-invest into other crypto.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +48% APY |

| Betfury.io (BFG) | +33% APY |

| Owl.Games (OWL) | +26% APY |

| Sx.Bet (SX) | +16% APY |

| WINR Protocol (WINR) | +51% APY |

| Solcasino (SCS) | +31% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

Last week I earned 330$ in passive earnings for holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 26 Defibookie NFTs | 600k OWL | 27k SX | 100k WINR | 60k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using InLeo Alpha

How many frontends does utilize Winr now? I have it my potential investment but havent made the move yet.

It's mainly just.bet which run on the winr protocol. All was also moved to the WINR chain and the degens/bet leverage trading will also be moved there. From what I understand, everyone can build on the protocol making use of the liquidity pools as long as there is a confirmed mathematical edge. I do wonder how they will do it when they release their sports betting platform and fear it will very much show in the odds way too much to be competitive.

This said, I winr has really grown on me and actually trying it out and tracking the results while following the development was really needed for that. They still have a long road ahead though but I'm glad to be invested at the moment. Once the vWINR gets bridged, the returns likely will be a lot lower. It's one of the things with gamblefi that it doesn't run as hard in the bull market since it's limited by actual profit but in the bear it is way better protected against the downside. All while each week you just earn some good yield that comes from actual returning customers without the need for exponentially more new people coming in to hold up prices.