GambleFi Portfolio | WINR Value Calculations...

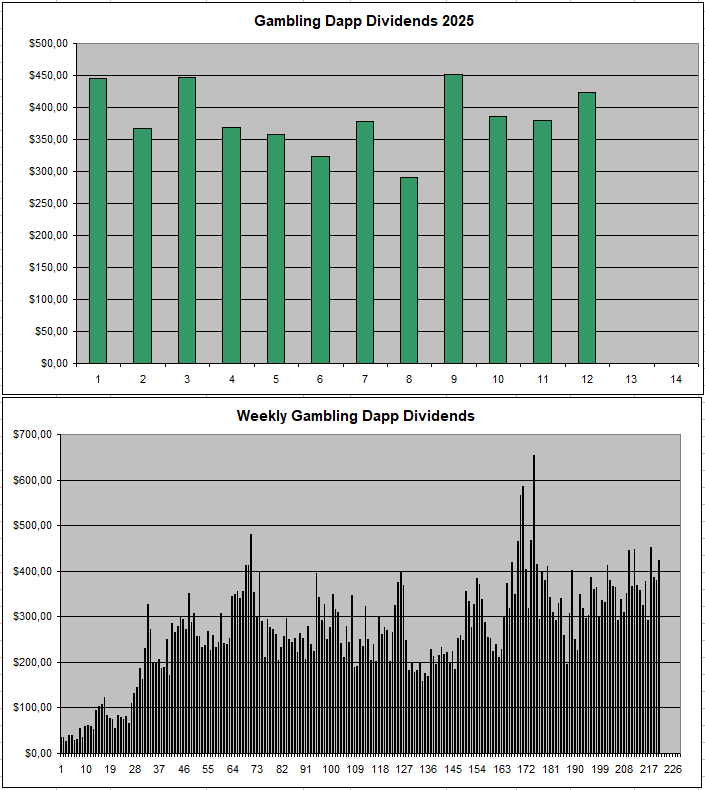

It was another great week for the GambleFi Portfolio which generated 423.95$ in passive earnings. I also added to my WINR position with another buy

WINR Protocol

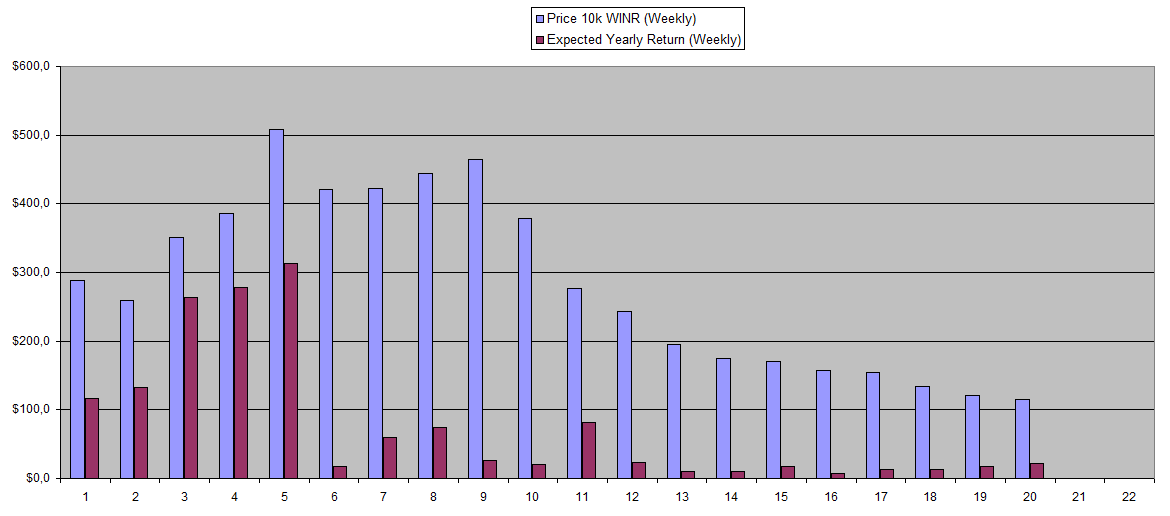

I have reached the minimum amount of WINR I wanted my bag to be at which is 400k at this price buying 125k more at the average price of 0.0116$ which gets my average buying price down to 0.019$. I'm tempted to buy more to really have a stake that is somewhat considerable and might do another purchase this week at the current price as I do like what they have build and see potential more adoption and volume in the coming years.

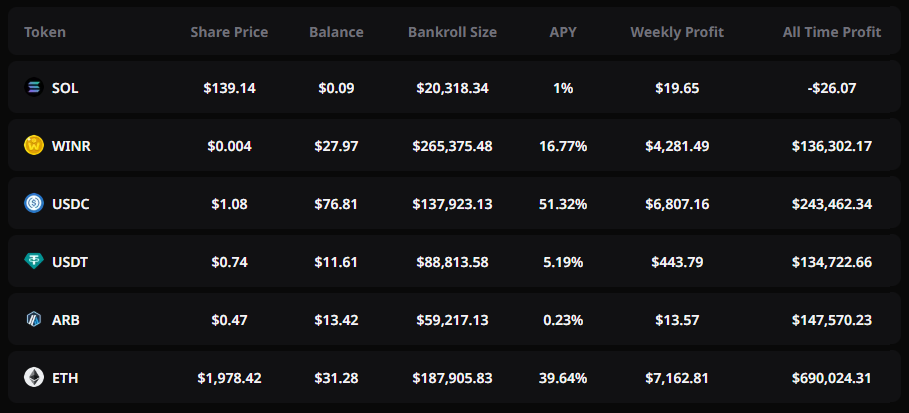

The Calculations: There is a maximum of 909 Million WINR which currently brings the Fully Diluted Market Cap at around 11 Million. Only 20% of the revenue actually goes to those who stake WINR while there always be liquid WINR, WINR in the main Liquidity pool or on exchanges / people providing WINR Liquidity in the Gambling Pool / People staking for less than 180 days, WINR that gets burned, ...

Right now, 18.6% of the supply is staked that receives part of the earnings. Let's say this maximum goes to 75% of the supply over time to base the core calculations on. So far this week after 4.5 days into the WINR Week (it starts on Thursday when dividends are paid out.)

The Earnings right now in total add up to 15726$ which means 20% of that goes to the Stakers which is 3145$. This means 100000 WINR which costs 1200$ would on a weekly basis earn just 0.72$ on a weekly bases in case 75% of the supply was staked. That is 37.44$ a year or 3.12% APY.

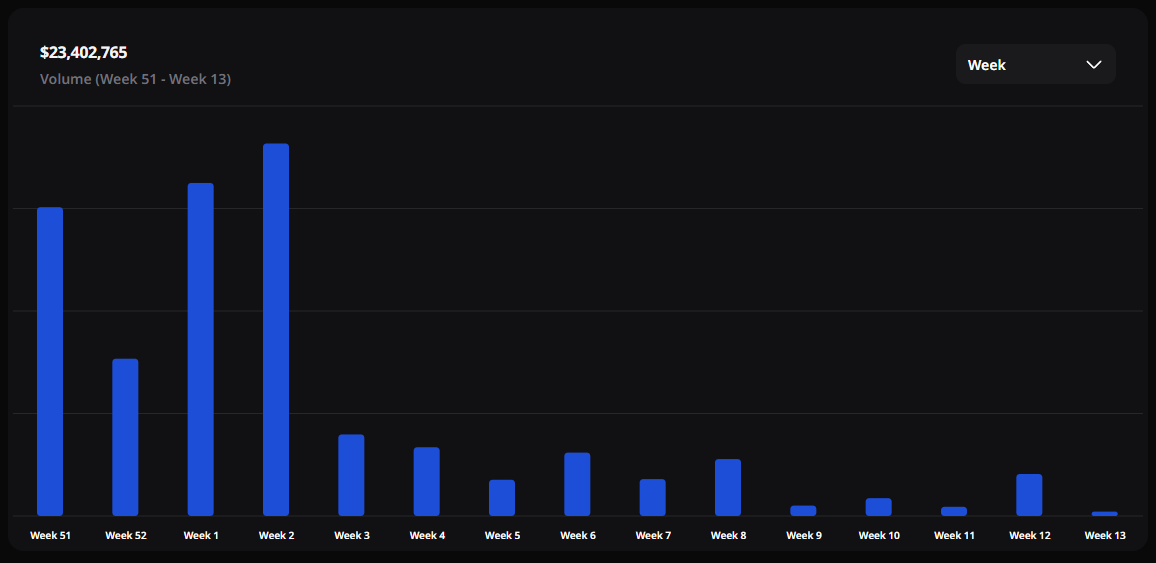

However, the volume right now is really low and all the marketing still needs to properly roll out while there are multiple partners who will use the WINR Protocol as the backend for their casino.

They are also making a Sportsbook so it should be possible given more adoption to easily do the volume and revenue x30. This would mean the protocol still only needs to make under 40 Million in yearly revenue. As a comparison, Rollbit right now burns around that number in a year just as a fraction of the revenue. If WINR could get there which to mee feels like a conservative bottom prediction, the APY at the current price level would be around 100%, assuming all WINR gets staked. So for a long-term investment, it feels like a price point currently where it's a good risk-reward to accumulate and get a definite bag filled to profit from in the future both from dividends and potential price increase.

However, the risk remains there as always with these smaller projects.

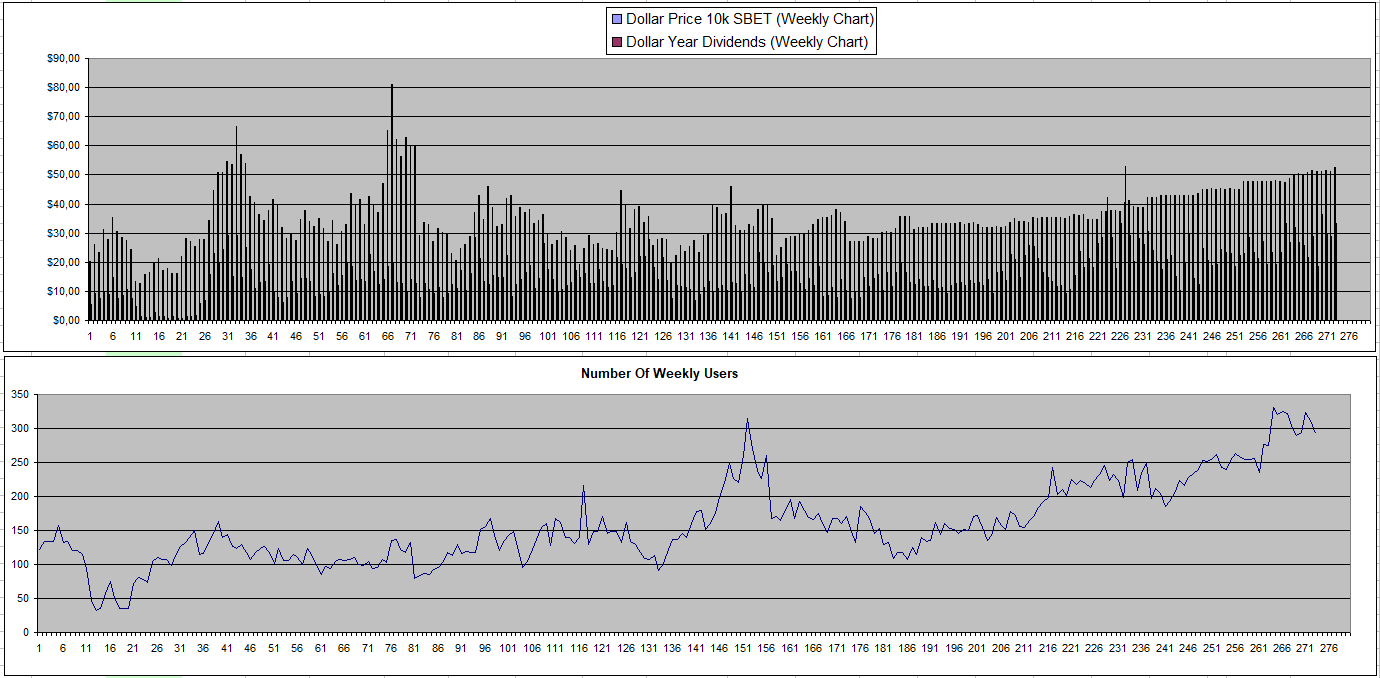

Sportbet.one (SBET)

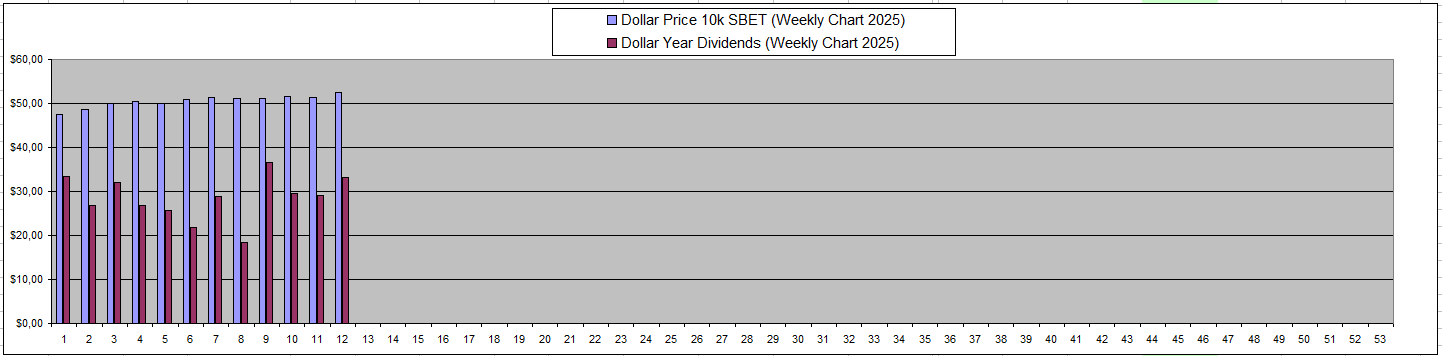

Yet another excellent week for SBET despite the fact that it was an international week and the price really feels undervalued at the moment as it hasn't yet went up along with the increased APY. 4 weeks in a row not this has been over 1% in a week that you get paid back of your investment on a platform that has been stable for 5+ years in the payouts.

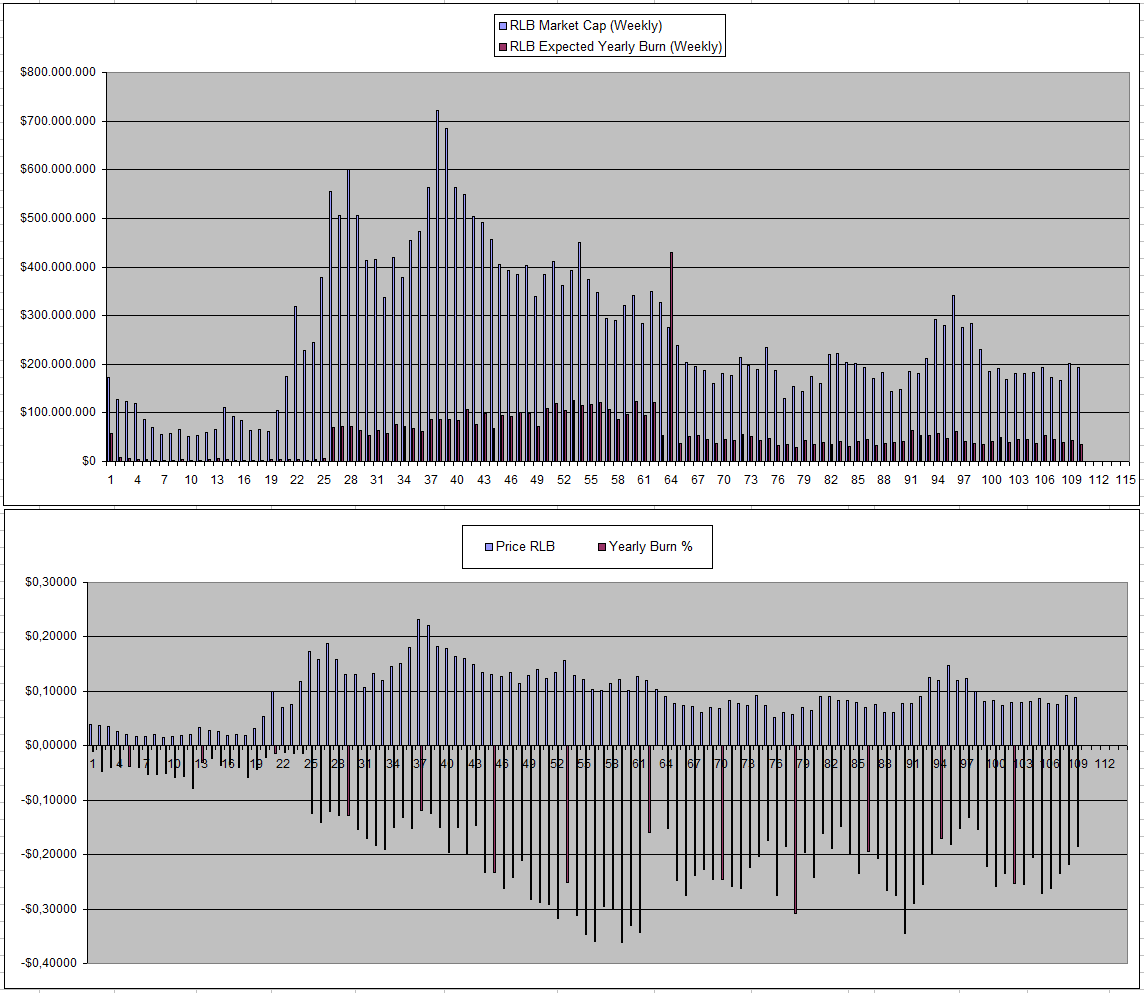

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

The RLB Burn last week came down to 18.416% so if it goes down some more I might sell part of my position unless the price really gets a hit.

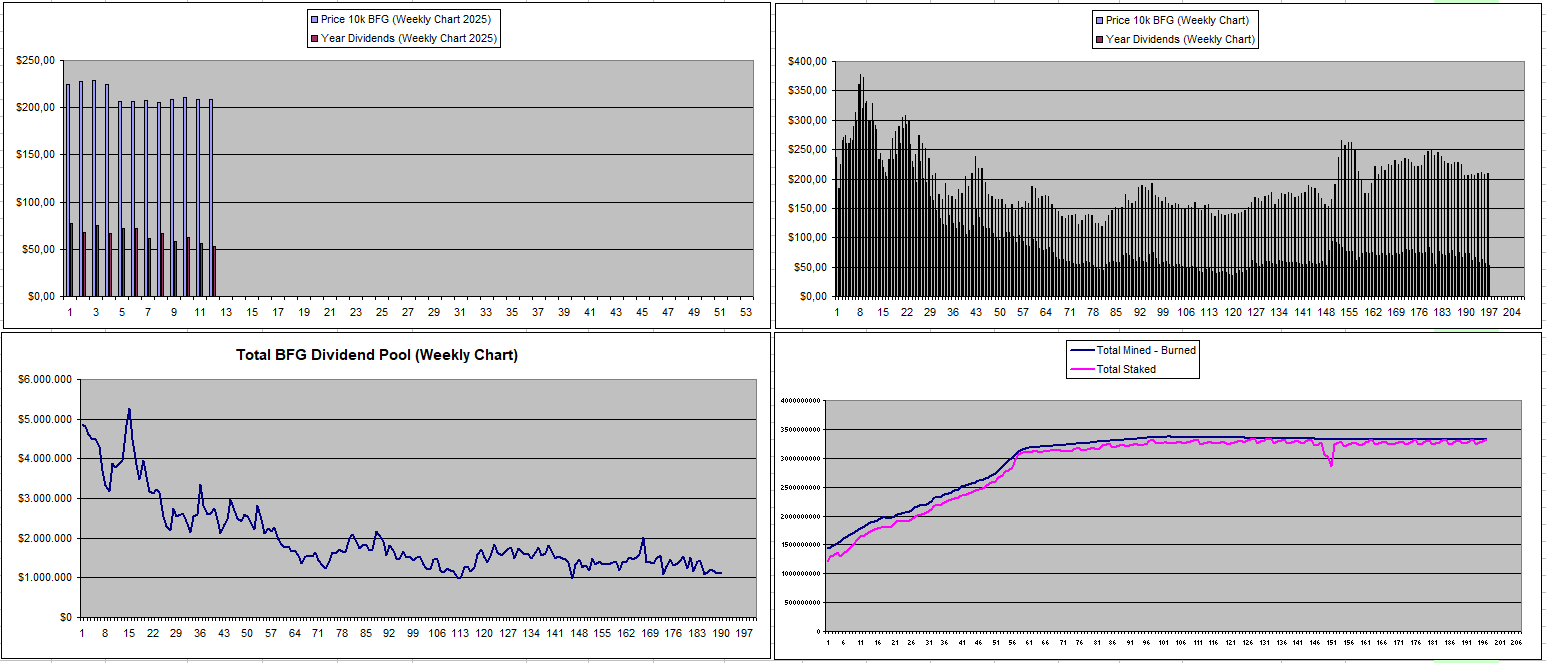

Betfury.io (BFG)

It was another rather disappointing week for BFG where the expected dividends seem to have shifted from 70$ in the past to now 50$ as the dividend pool fails to get much higher than 1 Million.

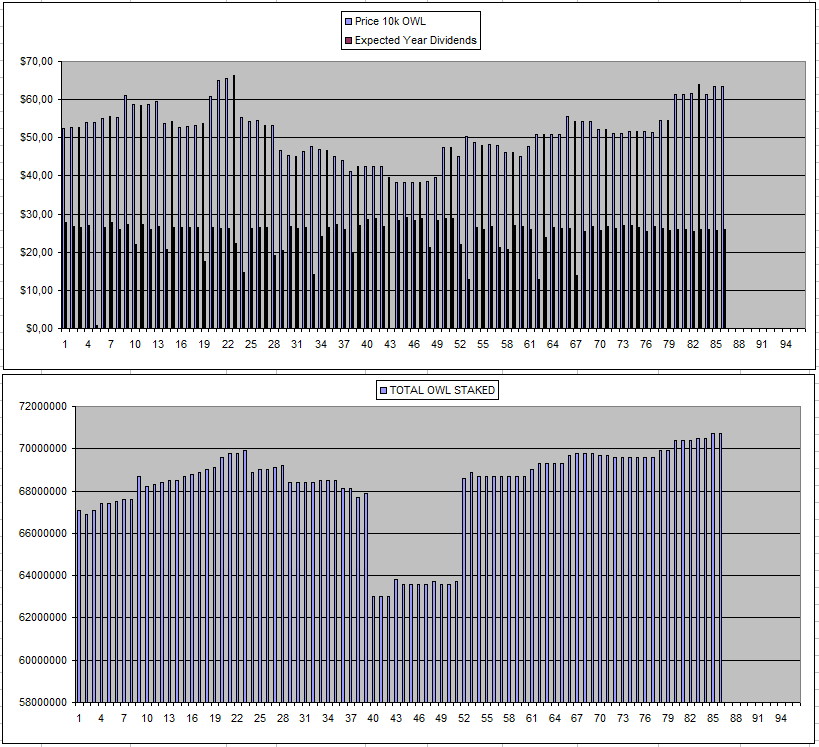

Owl.Games (OWL)

Each week I'm getting closer to having earned back 100% of my initial investment and I'm now at about 74% which is increasing each week.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/01/2025 | 600k | 3179$ | 2731$ | 29.46$ | 2021.79$ | 63.59% | +1573$ |

| 14/01/2025 | 600k | 3179$ | 2729$ | 30.75$ | 2052.54$ | 64.56% | +1602$ |

| 21/01/2025 | 600k | 3179$ | 2889$ | 30.31$ | 2082.85$ | 65.52% | +1793$ |

| 28/01/2025 | 600k | 3179$ | 2887$ | 29.58$ | 2112.43 | 66.45% | +1820$ |

| 04/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2142.50$ | 67.39% | +2212$ |

| 11/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2172.57^ | 68.34% | +2242$ |

| 18/02/2025 | 600k | 3179$ | 3271$ | 29.37$ | 2201.94$ | 69.26% | +2294$ |

| 25/02/2025 | 600k | 3179$ | 3387$ | 29.81$ | 2231.75$ | 70.20% | +2440$ |

| 04/03/2025 | 600k | 3179$ | 3247$ | 30.05$ | 2261.81$ | 71.14% | +2329$ |

| 12/03/2025 | 600k | 3179$ | 3361$ | 29.64$ | 2291.44$ | 72.08% | +2473$ |

| 18/03/2025 | 600k | 3179$ | 3357$ | 29.98$ | 2321.42$ | 73.02% | +2499$ |

| 25/03/2025 | 600k | 3179$ | 3357$ | 29.40$ | 2350.82$ | 73.95% | +2529$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

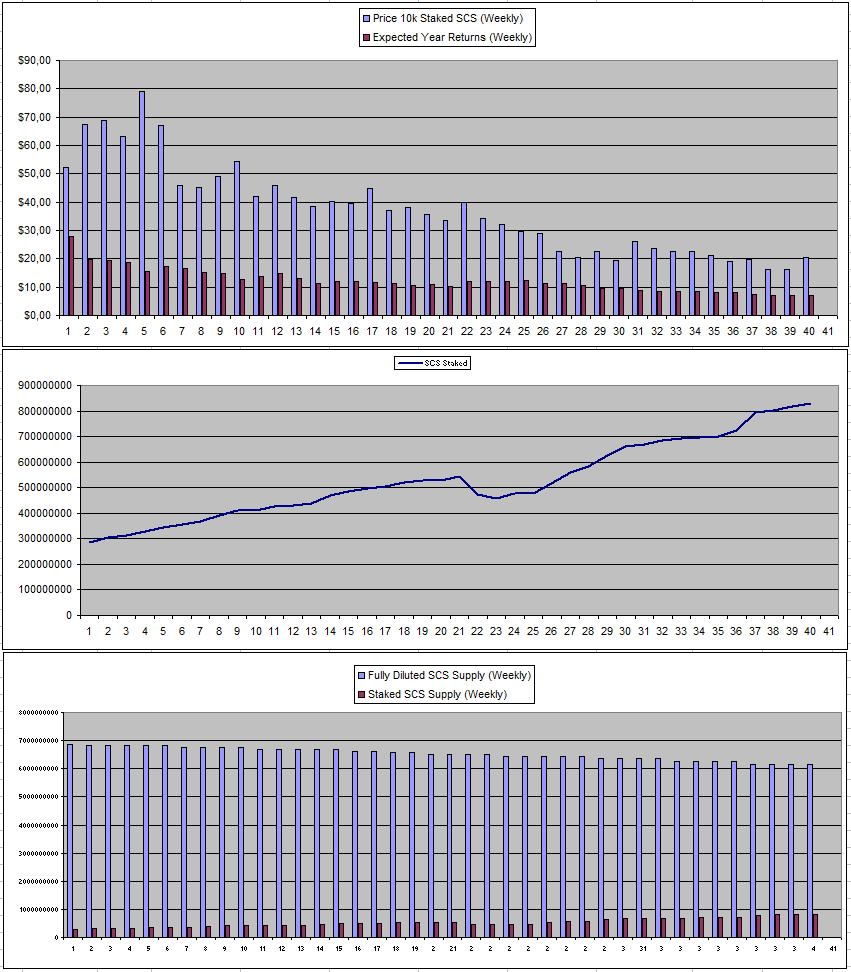

Solcasino.io (SCS)

The price of SCS for some reason went up from 0.00157$ to now 0.001889$ which is a +20% increase while the earned dividends went down from 6.89$ to 6.64$. So the overall APY dropped down.

This is currently showing 38.32% while staking does require a 2% fee already and unstaking also requires a feel. This with right now only 13.49% of the supply staked and already quite some revenue that they are making which I can't see exploding over time.

Basically, I need a much better price at current return levels to be able to buy more SCS and I'm patiently waiting for it as it feels like a matter of time for the sell pressure to kick in.

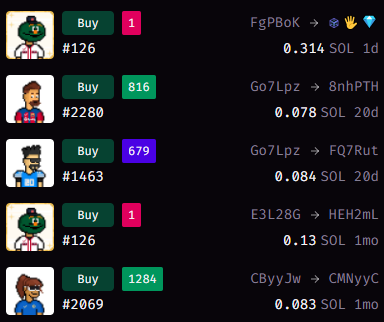

vBookie (NFTs)

Still no updates on vBookie and also no new sales so things are looking pretty dead.

| Last Week | This Week |

|---|---|

|  |

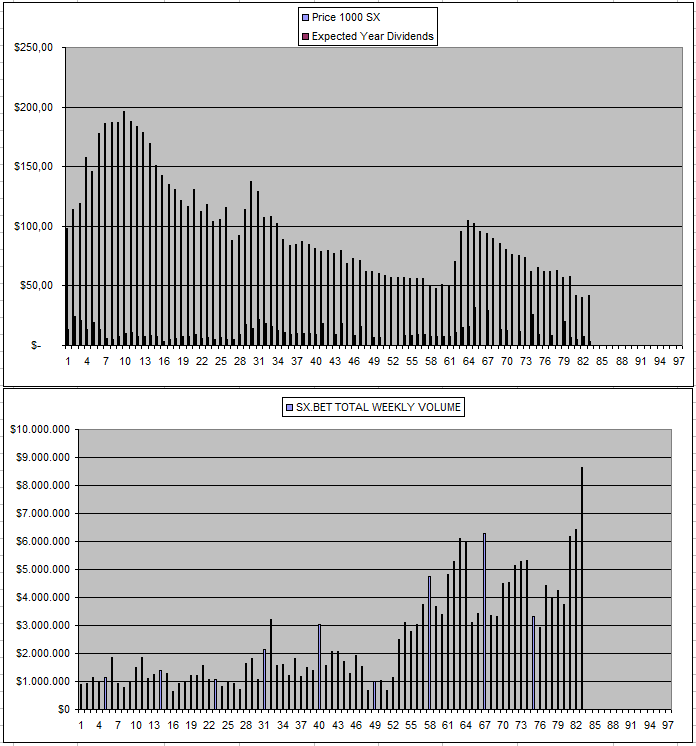

Sx.Bet (SX)

From what I understand, SX is already integrated in Mollybet which is a web2 sportsbook aggregator and this is the reason why there is millions in actual volume. However, with the fee switch not turned on it makes no money so the tokens are pretty useless and mainly just suffer from inflation which is paid out to stakers. I don't expect the upcoming casino to do much in terms of actual revenue. So it remains a double edged sword and it looks like nobody right now really is willing to invest which makes it that the price just keeps dumping while the fully diluted market cap is actually still quite high.

At the same time, I still see the potential for this to be the Crypto Betfair which would make it dirt cheap in case the fee switch at some point would be turned on without a loss of volume.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +63% APY |

| Betfury.io (BFG) | +25% APY |

| Owl.Games (OWL) | +40% APY |

| Sx.Bet (SX) | +9% APY |

| WINR Protocol (WINR) | +14% APY |

| Solcasino (SCS) | +19% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

Personal Gambling Dapp Portfolio

I earned 424$ in dividends last week for holding and staking 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 28.5k SX | 400k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using INLEO

Is there any betting platform thats tied to Hive?

None of them accept Hive as a currency at the moment, maybe when VSC for Hive becomes operational it will be easier to get implemented somehow. There are a couple of native gambling projects ho Hive but they haven't really captured my interest (https://hiveprojects.io/categories/gambling/)

Still didn't understand anything but hope so u make lot of money out of it.