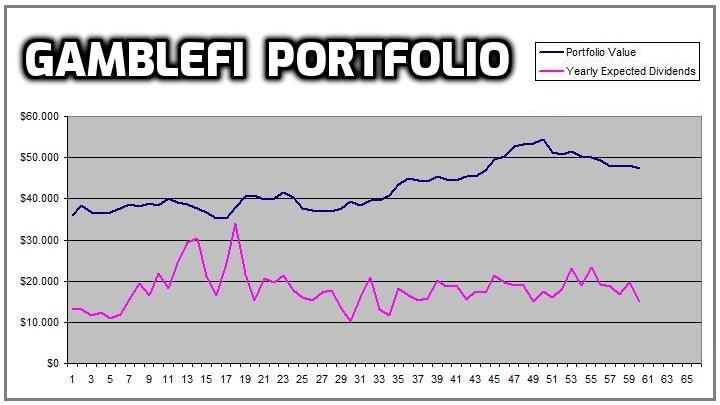

GambleFi Portfolio | Stability in Shaky Market!

My GambleFi Portfolio continues to hold strong while the market is very shaking as everything is dumping hard. It's the benefit which comes with having an actual product with real customers and revenue that gets shared and in times like these it brings a lot of stability. by now there are so many vaporware altcoins / memecoins that it kind of feels impossible to pick the right one while in 2017 with a limited number who were listed on the centralized exchanges with far lower marketcap valuations, everything went up. Now there are too many, they are no longer linked to BTC and BTC/ETH no longer seems to flow in them to the point that it feels like a thing of the past to 'get rich quick' with crypto.

This makes the 'Get Rich Slow' coins which I consider GambleFi to be part of more viable and attractive and I'm glad that I hold my bag with an eye to even increase it over the coming years.

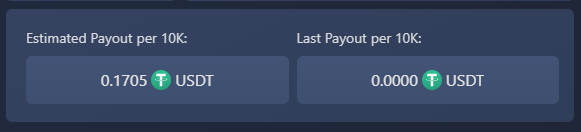

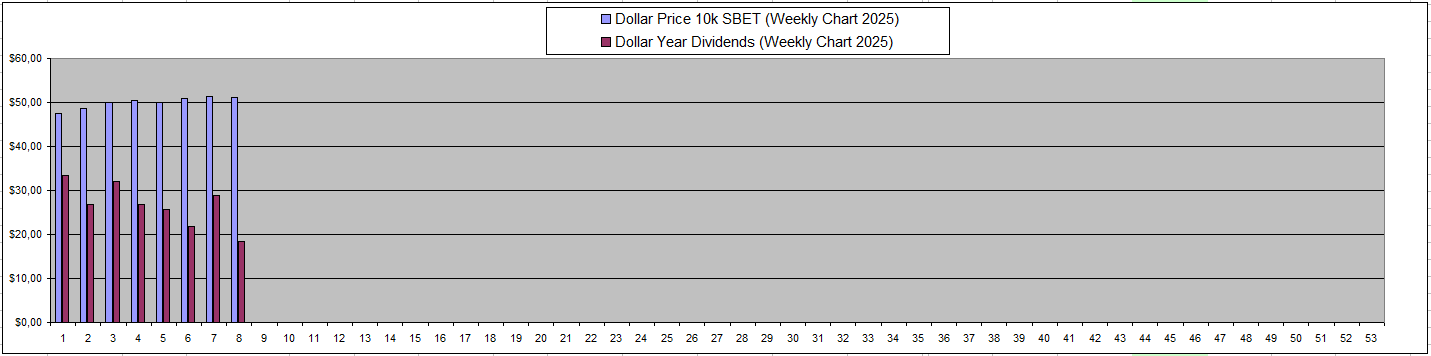

Sportbet.one (SBET)

Again good divdends from SBET even though the USDT pool was not released and I assume it will just be done next week. At 0.1705 USDT for 10k SBET that is another 85$ which should have been part of the dividends this week so next week there should be a nice payout.

I'm getting more an more tempted to increase my SBET holding as the passive earning which have been reliable for many years just are really nice to have and give a lot of piece of mind.

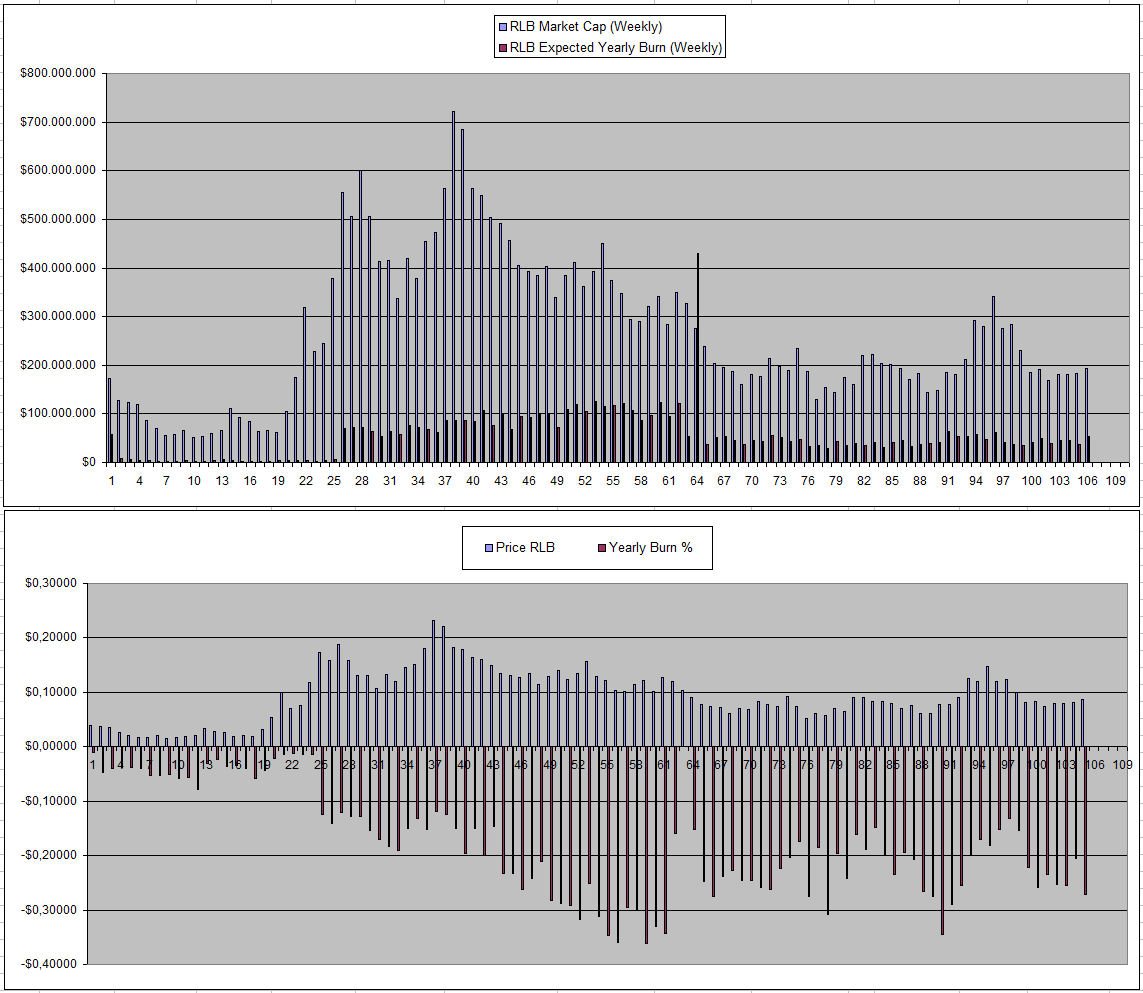

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

RLB is also holding up pretty well in this current market crash and the burn actually was up to 27% yearly as a price that was a bit higher than it is today. The more time passes by, the more RLB kind of proves itself against all the fud of numbers being faked.

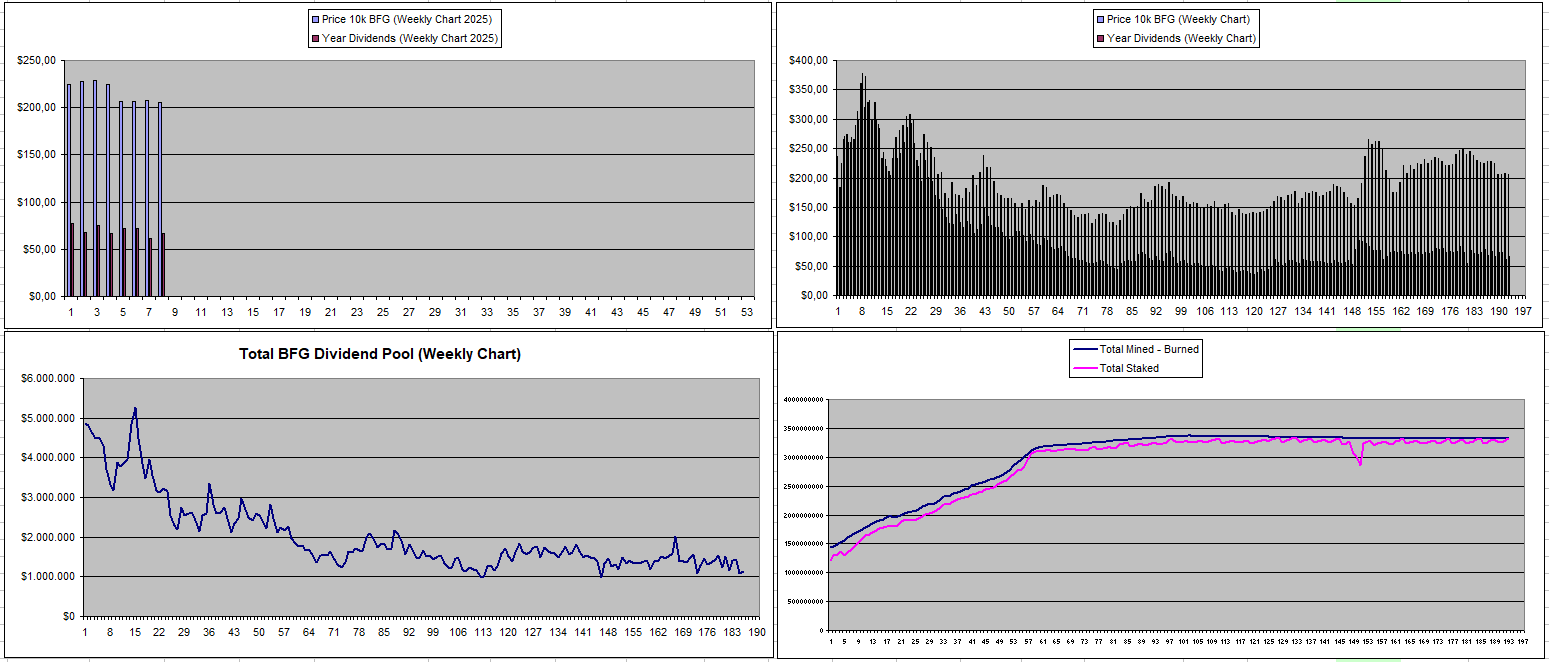

Betfury.io (BFG)

Last week, the dividends got a hit but now they have already recovered a bit and the Dividend pool is back a bit higher. The BFG price also remains a stable coin around 0.02$ with a 30% Yearly return.

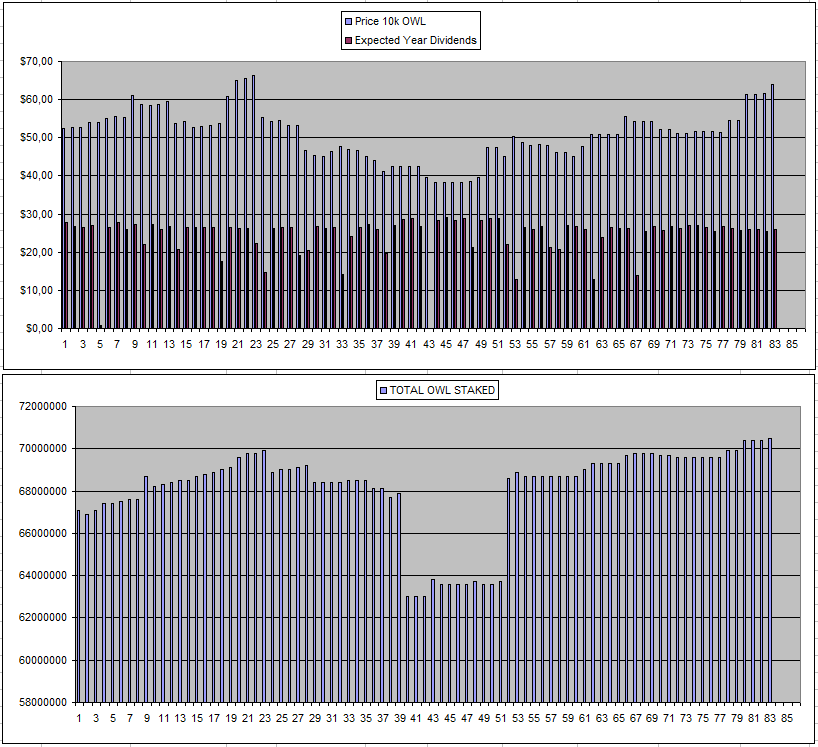

Owl.Games (OWL)

Owl also remains to be a reliable earner and the price actually went up a bit as someone bought more OWL and staked it. The good thing about this is that it supports the price but at the same time, the dividends go down a bit as the number of coins to get a share of them goes up. I still hold 0.851% which equals just below 30$ on a weekly basis in dividends.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/01/2025 | 600k | 3179$ | 2731$ | 29.46$ | 2021.79$ | 63.59% | +1573$ |

| 14/01/2025 | 600k | 3179$ | 2729$ | 30.75$ | 2052.54$ | 64.56% | +1602$ |

| 21/01/2025 | 600k | 3179$ | 2889$ | 30.31$ | 2082.85$ | 65.52% | +1793$ |

| 28/01/2025 | 600k | 3179$ | 2887$ | 29.58$ | 2112.43 | 66.45% | +1820$ |

| 04/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2142.50$ | 67.39% | +2212$ |

| 11/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2172.57^ | 68.34% | +2242$ |

| 18/02/2025 | 600k | 3179$ | 3271$ | 29.37$ | 2201.94$ | 69.26% | +2294$ |

| 25/02/2025 | 600k | 3179$ | 3387$ | 29.81$ | 2231.75$ | 70.20% | +2440$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

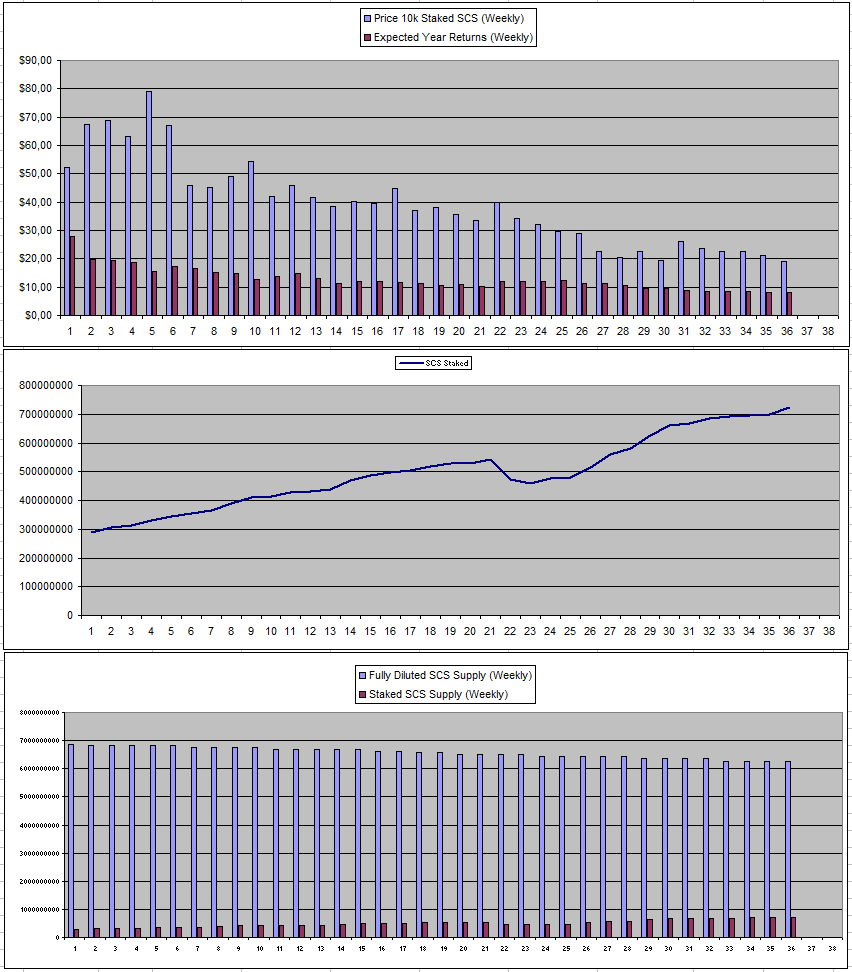

Solcasino.io (SCS)

The dividends seem to have stabalized just below 8$ for staking 500k SCS but there is a long way to go in pressure on the dividends as only 11.56% of the supply is staked. I basically need the price to go lower and APY to get well above 50% before I potentially add to by bag.

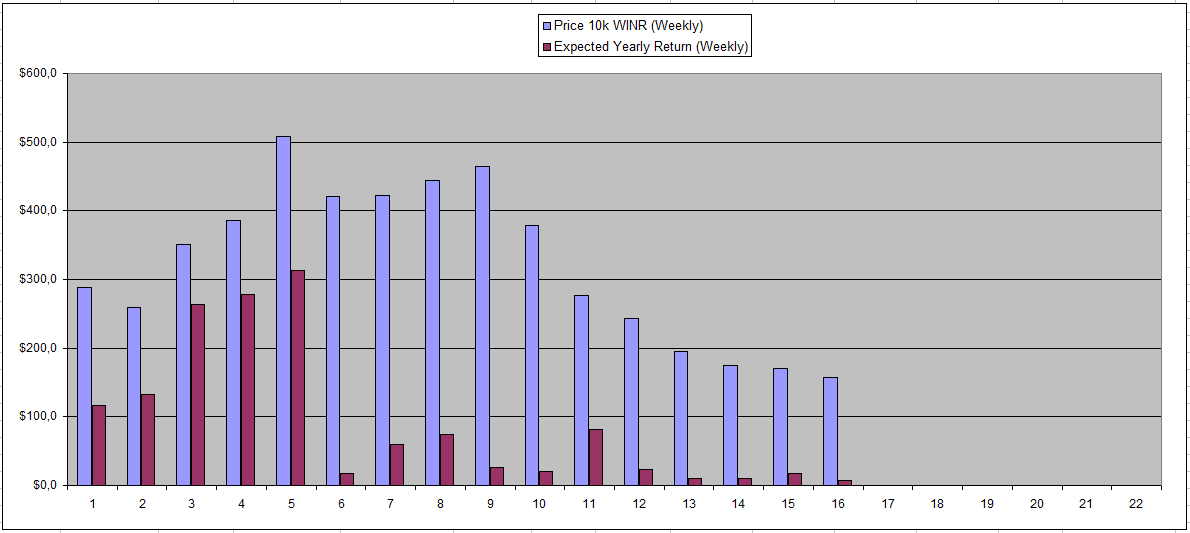

WINR remains sitting at a rather low price now betwen 0.015$ and 0.016$ and I'm tempted to buy more but I'm waiting for a market recovery assuming it won't rise as much since it barely dropped. The dividends were again dissapointing this week but at the same thing everything continued to work and advertisement still has to start. At the current price it feels like a nice accumulation zone and I'm tempted to double or even tripple down on my position keeping it as something for the long term.

vBookie (NFTs)

It's will likely be 2 more weeks before the numbers of February come out but I'm not expecting anything spectacular and them not losing money or volume would already be a win at this point.

| Last Week | This Week |

|---|---|

|  |

Sx.Bet (SX)

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +36% APY |

| Betfury.io (BFG) | +32% APY |

| Owl.Games (OWL) | +40% APY |

| Sx.Bet (SX) | +12% APY |

| WINR Protocol (WINR) | +5% APY |

| Solcasino (SCS) | +43% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

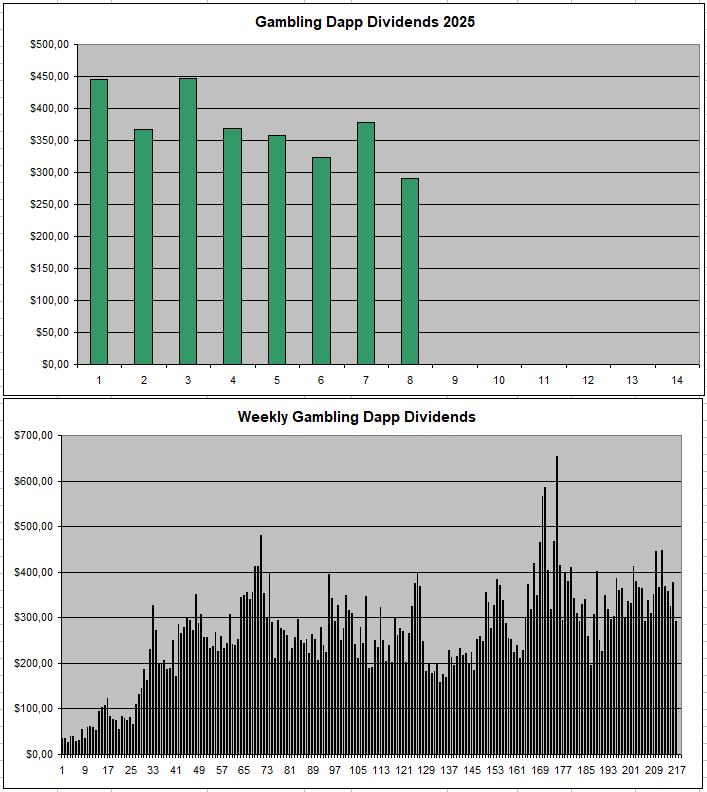

Personal Gambling Dapp Portfolio

Last week, I passively earned 290$ with 85$ still having to be paid out which will be added next week for holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 28k SX | 150k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using INLEO