GambleFi Portfolio | Exploring Solcasino.io SCS !

GambleFi continues to be a perfect hedge against downside crypto volatility as everything is holding up quite well compared to all other coins as there is actual revenue which supports the actual value of the coins. I am also again exploring SCS as it is back in a price range where it starts to become a bit more attractive.

Solcasino.io (SCS)

I had a look at this project quite a while back coming to the conclusion that it was somewhat overpriced while the centralization risk wasn't fully worth it. The price has made some crazy jumps often totally out of nowhere and quick but the sell pressure of people who earn SCS inflation from the NFTs always pushes things down again eventually.

I do see this as a serious project even though they rely on Owldao for their gambling site and infrastructure. The team is doing what they can to get the Max supply of SCS down as all the proit from gambling on the site in SCS is burned. I believe 40% of the revenue is put in the USDC dividend pool which currently earns 37% ROI ( before the 2% staking fee and unstaking fee)

While SCS the coin has a fully diluted value of ~44 Million, the NFTs also add 12M+ of value to this which actually isn't that crazy high. In the end the thing that gives SCS value is the combination of the burn and the USDC Pool. in that pool now that gives 37% APY, only 3.8% of the total supply is staked which potentially put that APY under serious pressure if more gets staked over time. This is mainly what holds me back. Also when all SCS is mined, a new usecase will need to be found for the NFTs which will take part of the profit away from the SCS token. At the same time they have a dynamic where SCS needs to be staked on top of the NFTs so it's not too bad.

However, given that the price previously saw carzy spikes out of nowhere, I got interested again at the current price range and I started cost averaging a tiny bit.

The idea I'm considering now is to get some more, keep half liquid and stake half so I have enough to sell in case the price would double to have a free bag afterward.

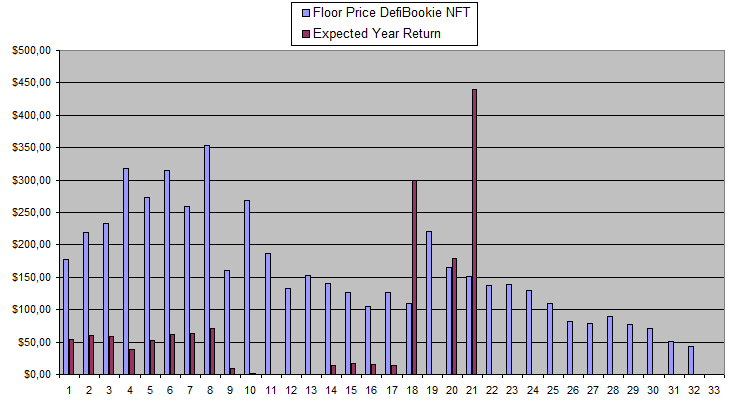

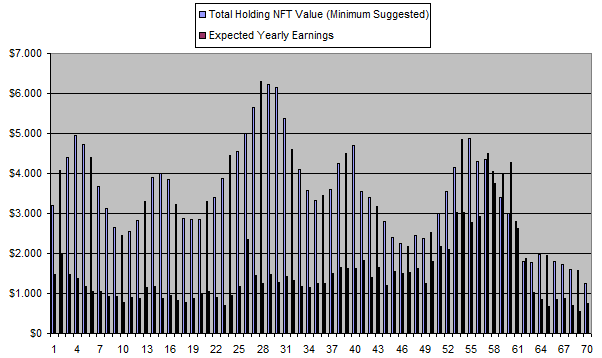

Defibookie (NFTs)

I'm tempted to buy more Bookie NFTs but right now I have just too little confidence in the team. There were some issues apparently with Bet grading and deposit/withdrawals but communication around it was just non-existent until the point where the fud in the discord got a bit too big. The revenue share drop of May which was small also hasn't started yet for some reason with zero communication around it. So the devs really need to do a lot better here if they want to get my confidence back. For now I kind of consider this as a failed project and will try to keep myself from putting more funds into it.

There is also no news on any promotional events or partnerships that will give another airdrop. I do own 26 NFTs which I paid 2511$ for while right now they are worth around 1000$

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.000$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.000$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

| Week 17 | 1421$ | 127$ | 1564$ | 4.410$ | 124.88$ | 8.78% | +268$ |

| Week 18 | 1421$ | 102$ | 1287$ | 3.850$ | 128.73$ | 9.06% | -5$ |

| Week 19 | 1421$ | 126$ | 1561$ | 3.320$ | 132.05$ | 9.30% | +272$ |

| Week 20 | 1421$ | 110$ | 1361$ | 74.680$ | 206.74$ | 14.55% | +147$ |

| Week 21 | 1421$ | 221$ | 2730$ | 0.000$ | 206.74$ | 14.55% | +1515$ |

| Week 22 | 1421$ | 164$ | 2044$ | 44.626$ | 251.36$ | 17.69% | +874$ |

| Week 23 | 1421$ | 151$ | 2008$ | 118.52$ | 369.88$ | 26.03% | +956$ |

| Week 24 | 1710$ | 137$ | 1956$ | 0.000$ | 369.88$ | 21.6% | +615$ |

| Week 25 | 1822$ | 139$ | 2114$ | 0.000$ | 369.88$ | 20.3% | +661$ |

| Week 26 | 1822$ | 129$ | 1968$ | 0.000$ | 369.88$ | 20.3% | +515$ |

| Week 26 | 1822$ | 110$ | 1673$ | 0.000$ | 369.88$ | 20.3% | +221$ |

| Week 27 | 1822$ | 81$ | 1242$ | 0.000$ | 369.88$ | 20.3% | -211$ |

| Week 28 | 1993$ | 78$ | 1338$ | 0.000$ | 369.88$ | 18.56% | -285$ |

| Week 29 | 1993$ | 90$ | 1537$ | 0.000$ | 369.88$ | 18.56% | -285$ |

| Week 30 | 2149$ | 77$ | 1458$ | 0.000$ | 369.88$ | 17.21% | -322$ |

| Week 31 | 2336$ | 71$ | 1551$ | 0.000$ | 369.88$ | 15.83% | -415$ |

| Week 32 | 2511$ | 51$ | 1267$ | 0.000$ | 369.88$ | 14.73% | -875$ |

| Week 33 | 2511$ | 42$ | 1058$ | 0.000$ | 369.88$ | 14.73% | -1083$ |

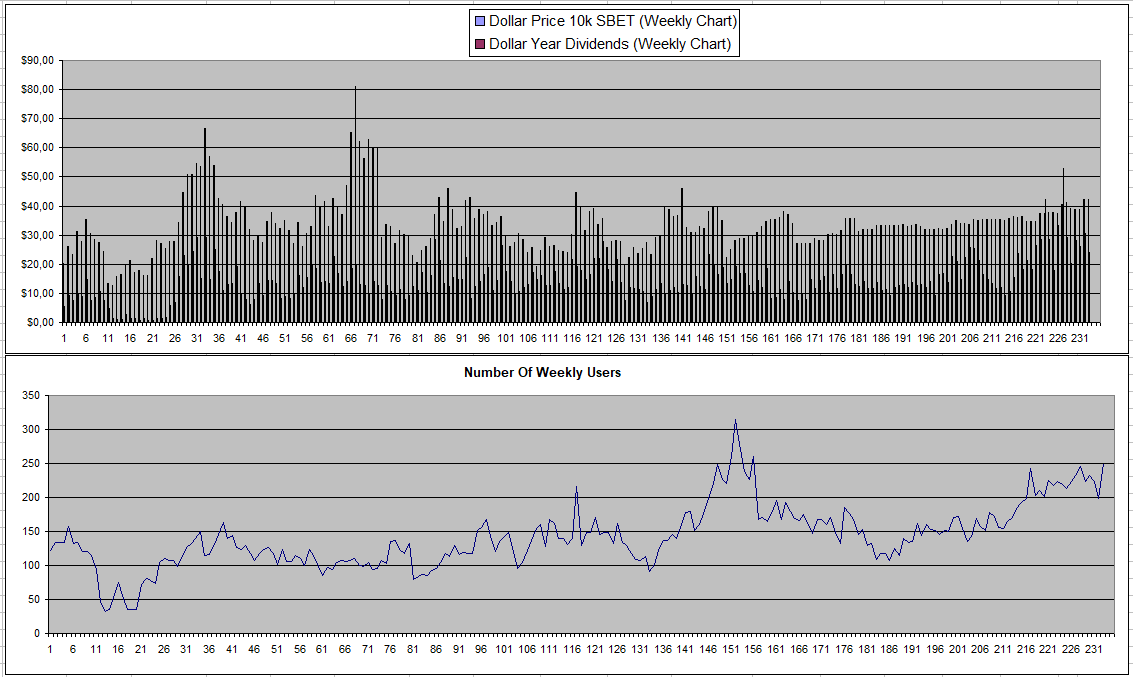

Sportbet.one (SBET)

More reliability from SBET and a slight increase of weekly users because of the European Football Championship similar to what happened during the previous World Cup. Also since SBET is trading against USDT on just 1 exchange, it has fully held up this week while the crypto market was blood red.

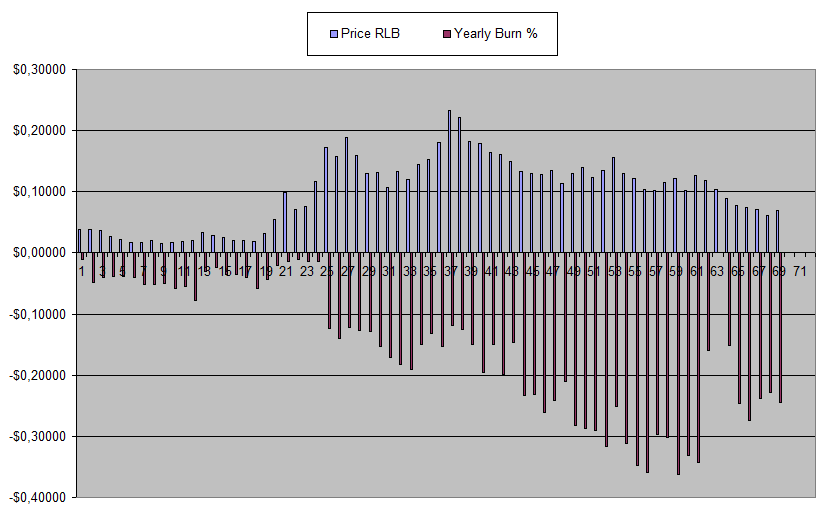

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

On Paper; RLB continues to be a no-brainer coin with so much of the supply expected to be burned on a yearly basis.

The price however of RLB and the NFTs continued to go down

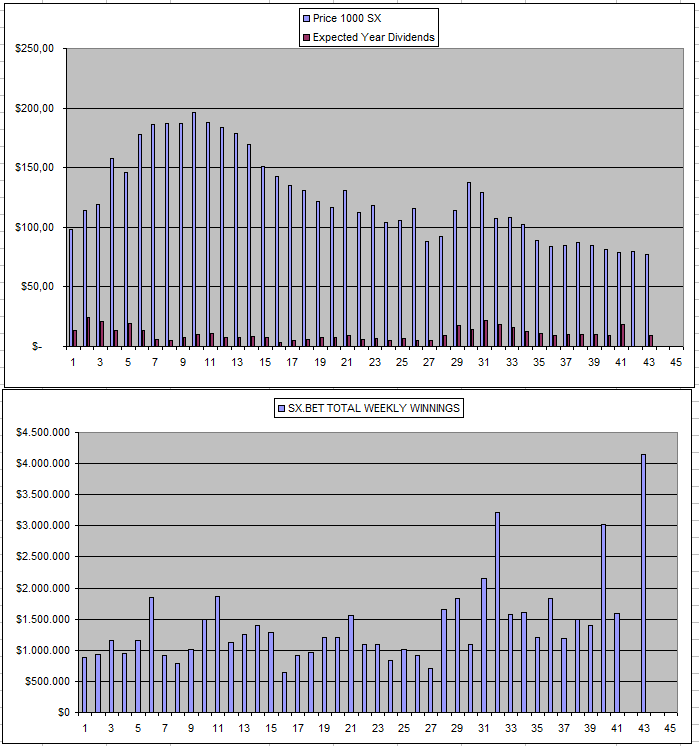

Sx.Bet (SX)

Last week there were no dividends because the ones of the week before came early which made them double. This week things were back to normal and I also managed to find the page where the volume shows again which was up considerably. I guess a lot of that has to do with the ARB grant the project got which gives player incentives to bet on Arbitrum. For how far I know, fees are also still turned off.

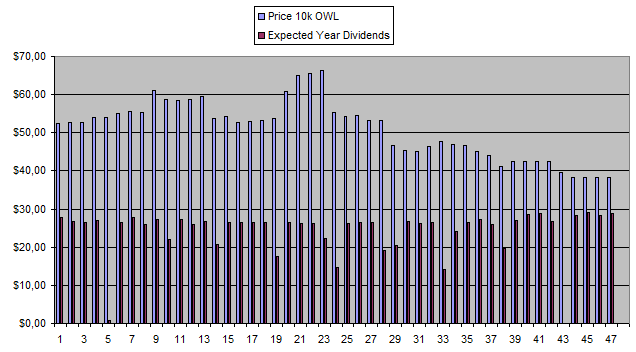

Owl.Games (OWL)

Another reliable week of OWL which is the only real good thing about this project as I continue to earn back my original investment week after week.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

| 28/05/2024 | 600k | 3179$ | 2035$ | 32.81$ | 1104.49$ | 34.74% | -40$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 11/06/2024 | 600k | 3179$ | 2035$ | 32.60$ | 1170.57$ | 36.8% | +27$ |

| 18/06/2024 | 600k | 3179$ | 2029$ | 33.22$ | 1203.79$ | 37.86% | +53$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

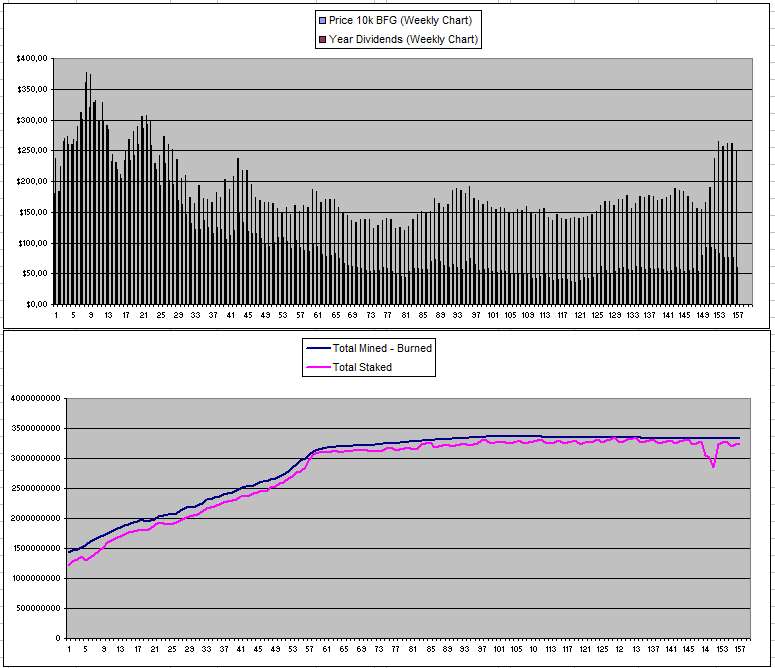

Betfury.io (BFG)

Dividends seem to be going in a downtrend again I assume as more BFG gets staked. It went from 73.49$ last week to now 58.18$ so quite a big drop off.

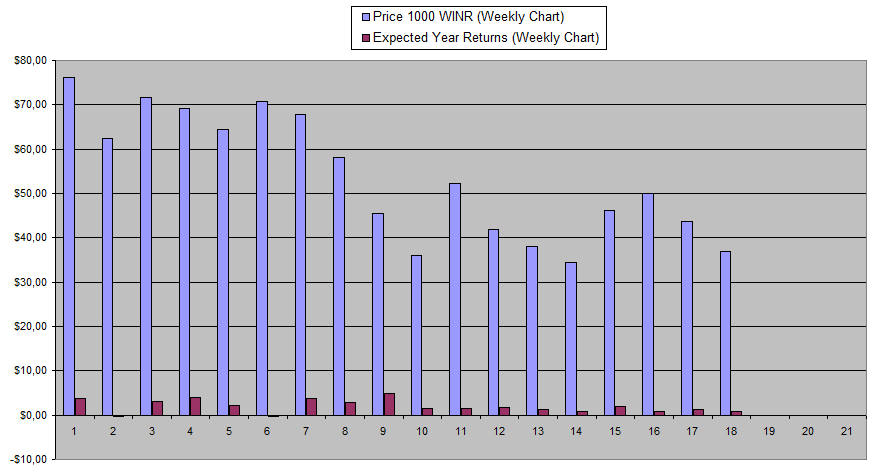

Not all too much movement in WINR where the overall returns continue to be very low. At this point, I'm just waiting for lower prices to potentially add some to my small bag.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +57% APY |

| Betfury.io (BFG) | +24% APY |

| Rollbit.com (NFTs) | +61% APY* |

| Owl.Games (OWL) | +75% APY |

| Sx.Bet (SX) | +11% APY |

| Defibookie.io (NFTs) | +0% APY |

| WINR Protocol (WINR) | +2.4% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

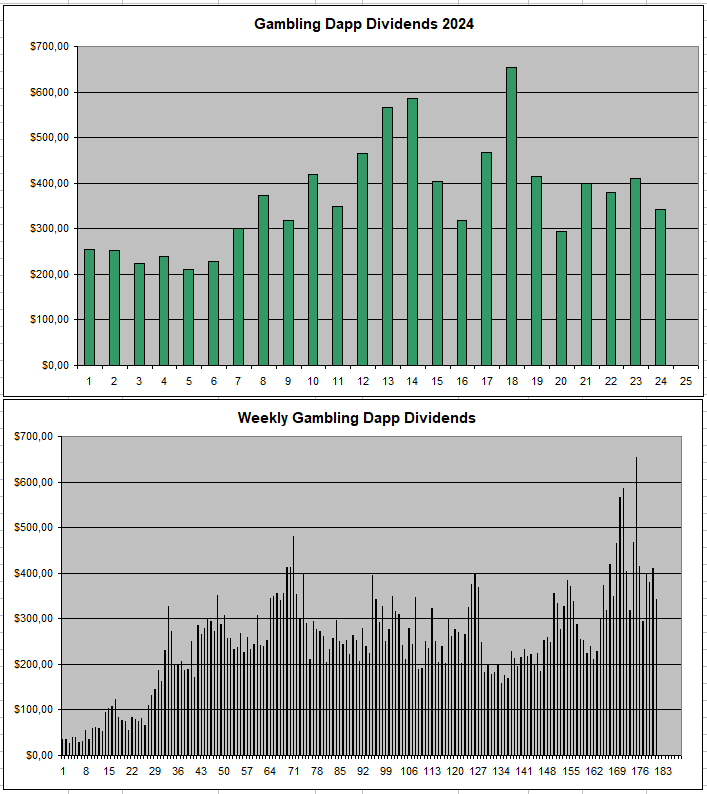

Personal Gambling Dapp Portfolio

I still managed to get 343$ of passive earnings in this red crypto week for holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 600k OWL | 25k SX | 26 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Yeehaw! This here blog post is like a wild ride through the frontier of GambleFi! Keep on trailblazing and diversifying that portfolio, partner!