Sui Weekend: Pawtato Finance & Magma

Happy weekend, everyone!

This morning I came across an X post about Pokémon entering the Sui ecosystem, and while not sure how big Pokémon is these days, I do remember it being huge with Pokémon Go AR game, trading cards and all. One thing is for sure, though: if this comes through, it might bring in a whole new user base and be huge for not only Sui but for the whole crypto itself.

Sui is one of the three ecosystems (others are Hyperliquid & Solana) I'm mostly focused on and growing more and more interested in each day. A lot of positive buzz around Sui all the time. We got the ETF speculations, BTCFi integrations, and so much defi and NFT stuff to choose from.

In this post, I'm going to do a little update on a couple of my favourite Sui protocols. Let's take a look!

Pawtato Finance

This is something I've mentioned on my previous posts. Pawtato Finance is sort of a Sui hub where you can keep track of your activity on chain, make swaps, monitor airdrops, and more.

One of the most important and interesting parts of the platform is the Land integration.

Potato Land is an NFT collection with a total supply of 15,000, which seemed a bit high at first, but when I took a look at their roadmap, I realised that the supply will decrease in the future with the upcoming merging feature where users get combine 4 plots into an estate or 9 plots into provinces.

This, and the now live staking option, should increase the demand and therefore increase the price as well.

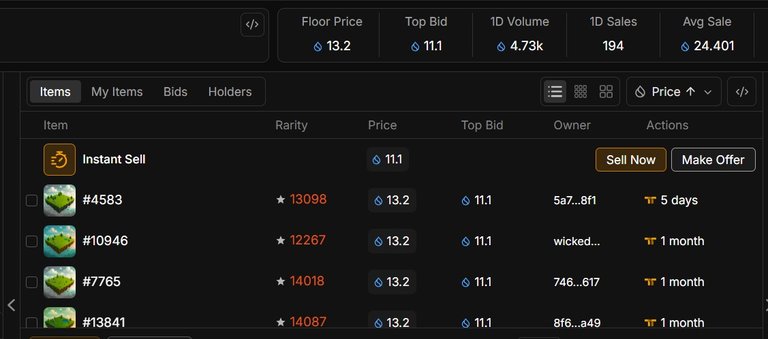

The mint price of a single land plot was 7 SUI in the whitelist phase, and I decided to buy 3 lands, hoping the price would go up from there once staking & merging features are rolled out. Just a couple of days ago, staking went live, leading people to pull their lands from TradePort and to stake for resources.

The percentage of listed Land NFTs has since dropped significantly and now stands at only 2.2% while the floor price has now risen to 13.2 SUI.

I'm not really a NFT guy, but I do understand the laws of supply & demand. Even though the market for resources isn't open yet, I can imagine demand forming for those. Resources such as stone, wood, iron, etc, will be used to craft different artefacts that give boosts. All of these can then be sold for SUI, which could make the Land NFTs quite desirable compared to NFTs with no use cases whatsoever.

I also believe there's a lot of upside room for a single land plot price, as the Merging feature hasn't been rolled out yet. Once it's live, we might see a big boost in demand for single plots. As a holder of only 3 Lands, I can't merge, so I'm looking to sell 1 or 2 of my plots and targeting a 3-4x amount of the mint price (7 SUI). That being said, things can change along the way if they become some sort of SUI printing machines.

Pawtato Finance is a really good app even if you don't own a single Land NFT. It's got a lot of cool features, such as a notification system that lets me know whenever there's a transaction on my wallet, and sends a breakdown to my phone. Also, there are many mini-quests we can complete to farm the upcoming airdrop. Worth checking out!

Magma

If you've been reading my articles before, you know that concentrated liquidity pools are my thing, and the current favourite place for those is on Magma. If you have no idea what I'm talking about, I'd suggest reading my tutorial post about concentrated liquidity pools and how to play with them.

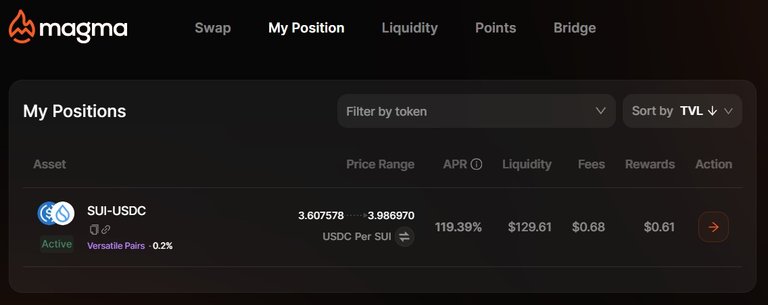

As for Magma, I first joined mainly because of its tokenless protocol with an airdrop points program, but pretty soon realised that the rewards are also very decent.

The APR you see in the pic above is ever changing and depends on the volume, so I wouldn't pay too much attention to that, but instead keep focusing on the already accumulated fees and rewards.

One thing I've learned recently is to keep on rebalancing almost immediately after the price has gone out of the range. At some point, I was waiting for the trend to shift with my assets 100% on the other side, and as we know, trend shifts might take some time. This will lead to missing out on rewards unless we are willing to eat the impermanent loss and that's not an option, at least not for me. Also, we might argue that if the waiting game is our strategy, it would perhaps be better to be just spot trading all along.

By constantly rebalancing, the rewards we earn will eventually mitigate the losses that occur from volatility, and if we keep on compounding, our position will be stronger when we go up again, earning even more rewards.

If you want to check out Magma, consider using my referral code: DTNYBZ.

That's it for today, let me know what you think in the comments and be sure to follow for more defi, trading & airdrops content!

🔹 Hyperliquid - the best perp DEX out there. Trade, stake & farm the next big airdrop!

🔹 Hybra Finance - New protocol! earn points by providing liquidity, we're still early

🔹 HyperSwap - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 HypurrFi - farm airdrop points with stables by entering ref code BRANDO28

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 VOLO - stake SUI to earn APR & airdrop points!

🔹 Pawtato Land - very useful SUI dashboard, earn XP for the airdrop by completing small tasks

🔹 Huma Finance - easy to farm an airdrop on Solana. Deposit USDC, earn APR % points

🔹 Kaito - monetize your X activity by creating quality crypto content

tag list: @gentleshaid

Posted Using INLEO

Thanks for the tag. I'm taking notes.

Glad to hear it, more to come! 👍