RE: LeoThread 2024-12-17 10:37

You are viewing a single comment's thread:

Welcome To Greener Candles #13!

This crypto-focused #threadcast is packed with news & hot topics inviting all crypto enthusiasts to engage.

Newbie friendly, ask questions, share your stuff!

Also serves as a newsletter (switch to 'oldest')

Curated alpha

Join the fun and let's get this up there! 🟢

0

0

0.000

Ripple Enters Stablecoin Markets

#crypto #stablecoins

Avalanche9000 Upgrade

Link to article: https://www.coindesk.com/tech/2024/12/16/avalanche-blockchain-s-largest-ever-upgrade-avalanche9000-is-live

#avalanche #crypto

AI16z Partners With Stanford

Link to article: https://www.theblock.co/post/331115/team-behind-blockchain-powered-ai16z-bot-partners-with-stanford-to-study-autonomous-crypto-ai-agents?utm_source=twitter&utm_medium=social

#ai #aiagents #crypto

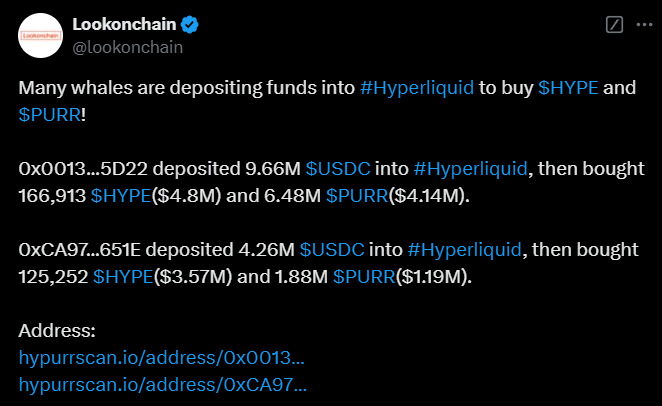

Whales Buy $HYPE & $PURR

#crypto #hyperliquid

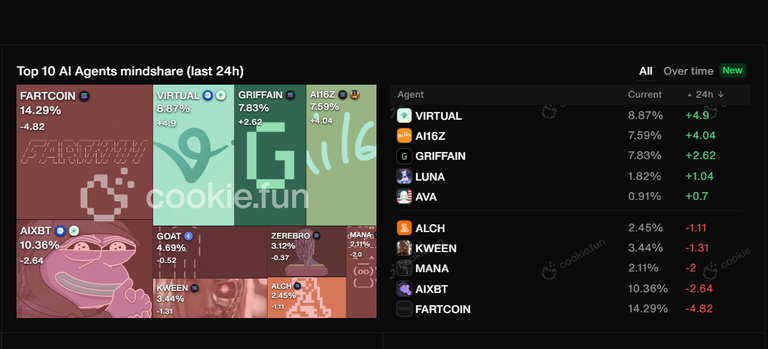

AI Agent Mindshare

#ai #aiagents #crypto

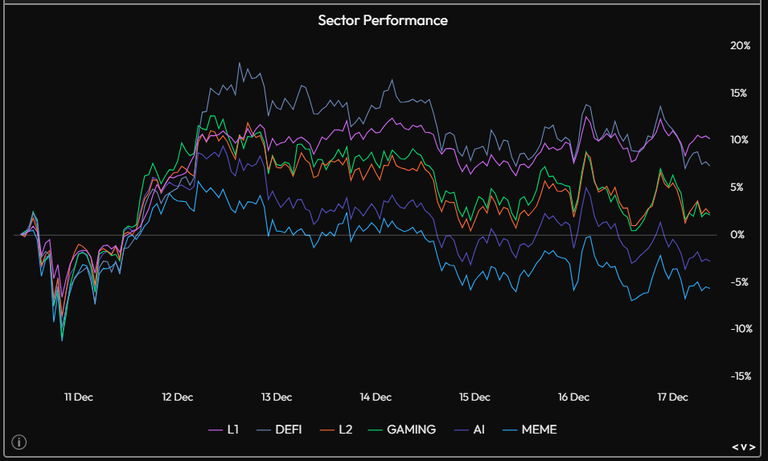

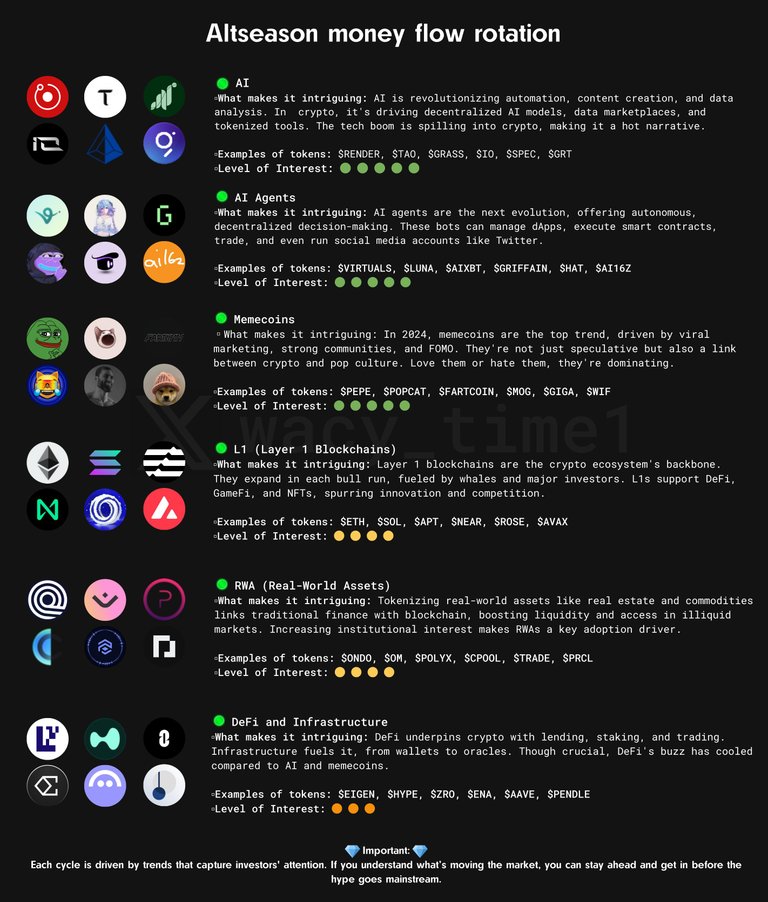

Sectors

#crypto

A Bit Of A Rude Comment...

#crypto #altcoins

Altseason Money Flow Rotation

#crypto

Pudgy Penguin Airdrop

#airdrops #nft

I don't even know if I am eligible for that. I should check my wallet.

I'm not sure either. Need to wait for further info

waiting for further info on this threadcast. tag me :D

Sure thing!

What are your recent picks? I need to get ready for the next bull top.

There are so many! 😀 My advice would be to look at the different sectors and try to pick winners.

Here are my picks:

I was looking into SUI for sure. I will need to read about others

What's HYPE?

Check out my latest blog post 🙂:

https://inleo.io/@brando28/hyperliquid-will-rule-dwf?referral=brando28

thanks

RUNE/BTC Comparison

#crypto

Today's Bubbles

#crypto

A lot of Red!!!

Yeah! 😀 BTC.D is still up. It is not good for alts in short-term but excellent news in the long-term 👍

Breaking Airdrop News!!!

Check out $PENGU airdrop:

Nigeria arrests nearly 800 in crypto-romance scam that targeted Americans, Europeans

Once victims were hooked, they were pressured to transfer money for fake cryptocurrency schemes and other non-existent projects.

Nigeria’s anti-graft agency said it had arrested 792 suspects in a raid on a building believed to be a hub for fraudsters who lured victims with offers of romance, then pressed them to hand over cash for phony cryptocurrency investments.

The suspects, including 148 Chinese and 40 Filipino nationals, were detained on Dec. 10 at the seven-story Big Leaf Building in Lagos, Nigeria’s commercial capital, Economic and Financial Crimes Commission spokesperson Wilson Uwujaren said.

The luxury building housed a call center mostly targeting victims from the Americas and Europe, he added.

#nigeria #crypto #arrest #scam

Staff there would make contact with people through social media and messaging platforms, including WhatsApp and Instagram, them seduce them online or offer them apparently lucrative investment opportunities, Uwujaren told reporters.

Once victims were hooked, they were pressured to transfer money for fake cryptocurrency schemes and other non-existent projects.

“Nigerian accomplices were recruited by the foreign kingpins to prospect for victims online through phishing, targeting mostly Americans, Canadians, Mexicans and several others from European countries,” Uwujaren said.

!summarize #microstrategy #bitcoin #ethereum

Part 1/9:

The Investment Landscape: Bitcoin, MicroStrategy, and the Future of Cryptocurrency

The cryptocurrency market, particularly Bitcoin, has been a focal point of both enthusiasm and scrutiny. At the heart of this discussion is MicroStrategy, a prominent business intelligence firm led by Michael Saylor, which has strategically adopted Bitcoin as a core component of its treasury policy. This article delves into the motivations behind investing in Bitcoin through MicroStrategy, evaluates the prospects for Ethereum, discusses the potential for a U.S. strategic Bitcoin reserve, and examines regulatory implications for the broader cryptocurrency industry.

Investing Through MicroStrategy: The Rationale Behind the Premium

Part 2/9:

One of the intriguing aspects of investing in Bitcoin through MicroStrategy is the ability to gain exposure to Bitcoin indirectly. Saylor's effective utilization of fixed-income markets to issue debt for Bitcoin purchases has turned MicroStrategy into an appealing vehicle for investors who may not be able to directly buy Bitcoin for various reasons. Many investors are drawn to the company's trajectory, believing that it could continue to share in Bitcoin’s value appreciation despite inherent risks attached to structured investments.

Part 3/9:

However, potential investors must tread carefully. The premium at which MicroStrategy’s shares trade compared to the net asset value (NAV) of their Bitcoin holdings could lead to volatility. While the company has performed remarkably under Saylor’s leadership, external factors could prompt convergence toward NAV, leading to fluctuations in share price.

Ethereum: An Emerging Opportunity

Part 4/9:

While Bitcoin continues to garner attention, Ethereum is also positioning itself as a significant player in the cryptocurrency landscape. After lagging behind Bitcoin for an extended period, Ethereum has seen renewed interest due to its foundational role in various digital applications, including decentralized finance (DeFi) and non-fungible tokens (NFTs). The robust ecosystem of Stablecoins built on its blockchain places it at a competitive advantage. As a result, the prospects for Ethereum's growth remain promising in the coming years.

The Debate Over a Strategic Bitcoin Reserve

Part 5/9:

A point of contention among cryptocurrency enthusiasts is the possibility of a strategic Bitcoin reserve under future U.S. administrations, particularly under Donald Trump's anticipated administration. Some experts contend that the notion of the U.S. government significantly acquiring Bitcoin lacks realistic support in Congress, given the country's established fiat currency system. Arguments against establishing a Bitcoin reserve often cite the potential risks to the U.S. dollar as a global reserve currency and the implications such a decision might have for national solvency.

Part 6/9:

Discussions have circulated about utilizing seized Bitcoin as a stockpile; however, this remains speculative. Ultimately, the absence of a strategic reserve could lead to significant market corrections, especially if current optimistic pricing is driven by unrealistic expectations.

Regulatory Landscape and Market Risks

Part 7/9:

As Bitcoin's price continues to soar, discussions about regulatory frameworks surrounding cryptocurrencies intensify. The potential for changes in Washington could present significant shifts in the entrenched banking practice, notably concerning Bitcoin’s custodianship. The volatility surrounding crypto-centric banks like Silvergate and Signature has created uncertainty; both establishments faced challenges due to mismanaged exposure to the cryptocurrency sector. As regulatory bodies impose strict guidelines, banks may struggle to engage effectively in crypto banking.

Part 8/9:

The anticipated regulatory changes could both create opportunities and expose risks for the cryptocurrency industry. For instance, if larger banks gain the ability to custody cryptocurrencies, it could foster greater institutional participation in the market. However, the balance between allowing banks ample discretion to invest in cryptocurrencies while maintaining financial integrity remains delicate.

Conclusion: Navigating an Evolving Landscape

Part 9/9:

In summary, the cryptocurrency market, particularly Bitcoin and Ethereum, presents exciting opportunities for investors as well as inherent risks due to regulatory scrutiny and rapid market fluctuations. While MicroStrategy's strategic approach to Bitcoin investment raises pertinent questions, Ethereum continues to carve its niche in the digital economy.

As we anticipate the potential impacts of shifting regulatory landscapes and the policies of a new administration, investors must remain vigilant—judging when to take bold steps forward while also preparing for possible corrections in a market laden with speculation and uncertainty.