My Top 3 Favourite HyperEVM Protocols

Yesterday, we saw some nice pumps with $ETH and $SOL. I made a pretty decent profit by going long with both of them: $SOL on GRVT and ETH on Hyperliquid. As for these perp DEXs, while GRVT feels promising, the reason I'm still trading there is the ongoing airdrop campaign that feels like it's never-ending. Still, I've been farming it for so long that I feel I can't back down now.

However, the airdrop force is probably a lot stronger on Hyperliquid, and I've been moving funds from CEXs to Hyperliquid as it just makes a lot of sense to focus my trading there: creating volume for the airdrop and much lower fees with a wide selection of tokens.

Trading perps, using leverage, isn't for everyone, and I can relate to that. I stayed out of it myself for many years after first discovering crypto. Fortunately, Hyperliquid has much more to offer, and the most interesting stuff is happening on the HyperEVM layer.

In this post, I'm going to introduce 3 protocols which I'm mostly using and believe will have huge potential.

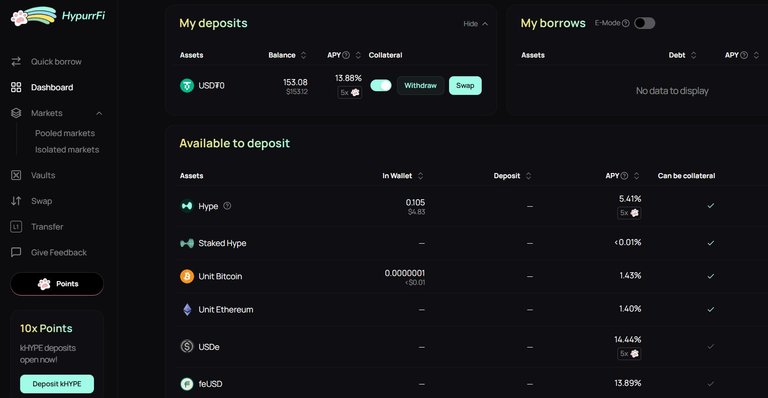

HypurrFi

There are a few lending/borrowing protocols on HyperEVM, but I chose HypurrFi because I feel we might still be early with this one in regards to the points system.

The concept is very simple: you deposit(lend) crypto or stablecoins, earn APR and points for that, and can use your deposit as collateral to borrow more assets.

I recently received a decent airdrop from another project and decided to sell it all and park my stables here to farm the airdrop and earn some APR. The plan is also to use these funds as a "major dip reserve", meaning if a black swan event of some kind were to occur, I would be able to instantly borrow stables against my collateral and buy cheap BTC, ETH, SOL or HYPE and stake (lend) those here on Hypurrfi for extra points & APR. So it would become a basic looping strategy. Once the crypto market is back up again, I would then pay back the loan.

So far, there's been no need to do that, but it's best to be prepared while still farming the airdrop safely with stables.

Hybra Finance

I just wrote about Hybra Finance in one of my recent blog posts, so you might wanna check that out as well if you are interested, but basically, Hybra is:

Public liquidity layer on @HyperliquidX Upgraded ve(3,3) flywheel CL & intent-based gasless trades.

If you have no idea what that means, no worries, they have good docs where everything is explained and also, Hybra Discord is very helpful.

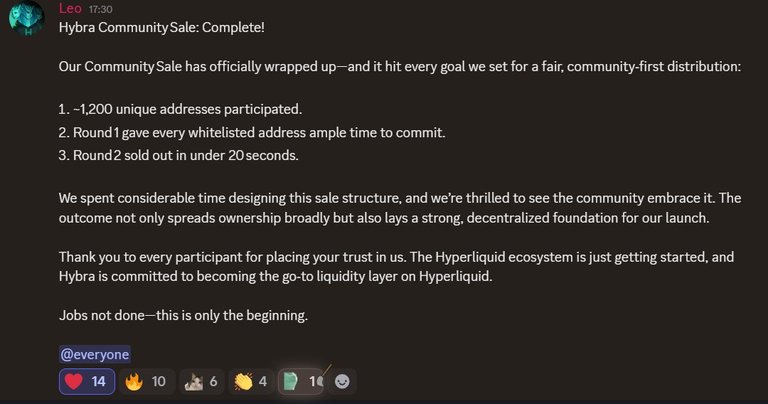

Since my recent post, Hybra has conducted a pre-sale of their $HYBRA token, and honestly, this was one of the smoothest pre-sales or TGEs I've ever taken part in.

The actual airdrop is separate from this one, and besides, there will be another one before the actual token genesis event. The idea of the pre-sale is to get $HYBRA tokens cheaply while the FDV is still low, and why even buy $HYBRA?

Staking $HYBRA will earn protocol fees and emissions. This is sort of owning a part of the protocol and therefore benefiting from trading that is happening on Hybra. Yes, it requires a bit of faith in the protocol, but I do believe we are still very early with HyperEVM and that Hybra will be one of the top DEXs on it.

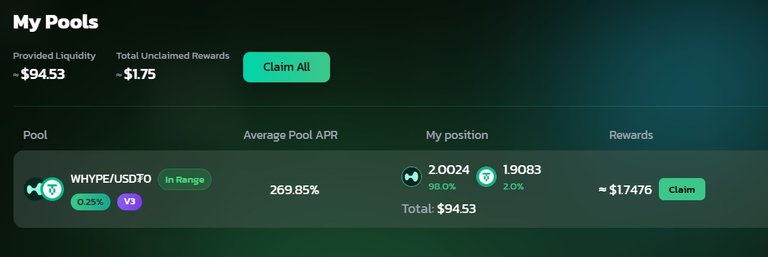

While waiting for all of that, I'm comfortably providing liquidity in the HYPE/USDT pool and earning an average APR of 269%. Very easy and good, especially during the uptrends. Just don't forget to rebalance if you are out of range.

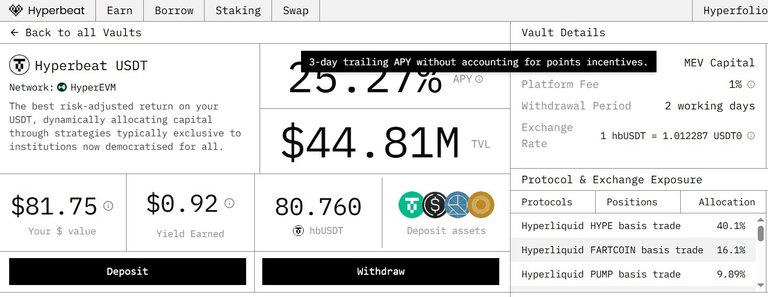

Hyperbeat

If you are into more passive stuff and still want some Hyperliquid exposure, Hyperbeat might be the right choice for you.

Here I am staking USDT for a bit better than normal APR. This is beceause it's used for different defi strategies, and yes, this obviously carries some risks, but I also get more exposure to different protocols and therefore passively farming those airdrops as well.

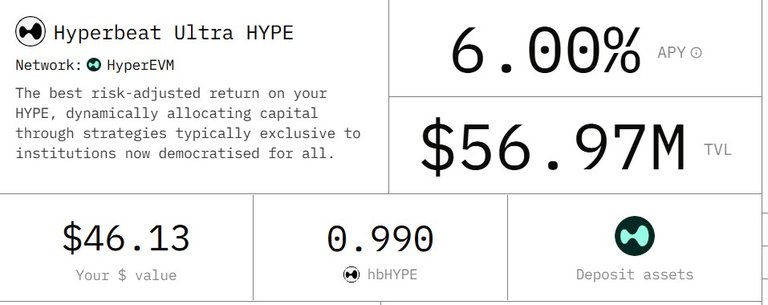

I've also parked some $HYPE on the Hyperbeat in their Hyperbeat ULTRA vault. This works in the same way as Hyperbeat USDT, as the capital is allocated in different strategies, earning us better APR and more points on different protocols.

Conclusion

Why Hyperliquid and HyperEVM then?

Simply put, it all feels very much like early Solana with better tokenomics. There's something for everyone: lending/borrowing, concentrated liquidity pools, staking, NFTs, memecoins. Meanwhile, the airdrop narrative is super strong as the Hypercore still has plenty of tokens allocated for the community, and every protocol on HyperEVM is doing its own airdrop as well.

Some of these are passive, while some require a bit more attention. Also, some are riskier than others, and therefore, I encourage you to read the docs carefully before joining. That being said, if you do decide to join, consider using my referral links 🙏. They are all legit and tested.

Finally, if you want to stay updated on defi, trading and airdrops, let me know if I can tag you in future posts so you don't miss any alpha! 🟢

Thank you for reading!

🔹 Hyperliquid - the best perp DEX out there. Trade, stake & farm the next big airdrop!

🔹 Hybra Finance - New protocol! earn points by providing liquidity, we're still early

🔹 HyperSwap - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 HypurrFi - farm airdrop points with stables by entering ref code BRANDO28

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 VOLO - stake SUI to earn APR & airdrop points!

🔹 Pawtato Land - very useful SUI dashboard, earn XP for the airdrop by completing small tasks

🔹 Huma Finance - easy to farm an airdrop on Solana. Deposit USDC, earn APR % points

🔹 Kaito - monetize your X activity by creating quality crypto content

tag list: @gentleshaid

Posted Using INLEO