HyperEVM - An Opportunity You Don't Want To Miss (Tutorial)

Happy Sunday, frens!

You have probably heard of the massive Hyperliquid airdrop that happened on November 29th, 2024. This was one of the most significant events in DeFi history, both in scale and impact. What made it so unique wasn't just the sheer size of it (310 million $HYPE), but the fact that there were no allocations for venture capitalists, private investors, or centralised exchanges.

This has been working out very well for the $HYPE token as well, since there hasn't been the normal "VCs dumping on us" effect that happens with most of the airdropped tokens that have now lost 99% of their value.

Farming the first Hyperliquid airdrop was pretty simple: trading and creating volume on their perp DEX. Even though I missed it, I am now a daily user of Hyperliquid, which is undoubtedly the king of perp DEXs.

Now here's the thing, Hyperliquid DEX is also a layer 1 blockchain, and just recently they launched their second layer, HyperEVM, which we are going to farm today.

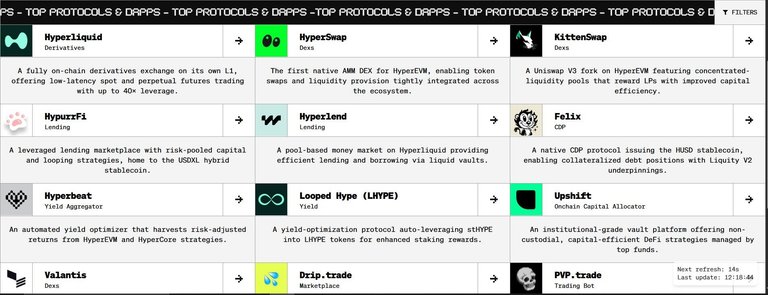

It's good to keep in mind that Hyperliquid still has 31% of their total supply left to be allocated for the community, and the future airdrops could be substantial. Besides, HyperEVM is full of tokenless protocols with their own point systems, so we would be farming multiple airdrops simultaneously.

Where To Start?

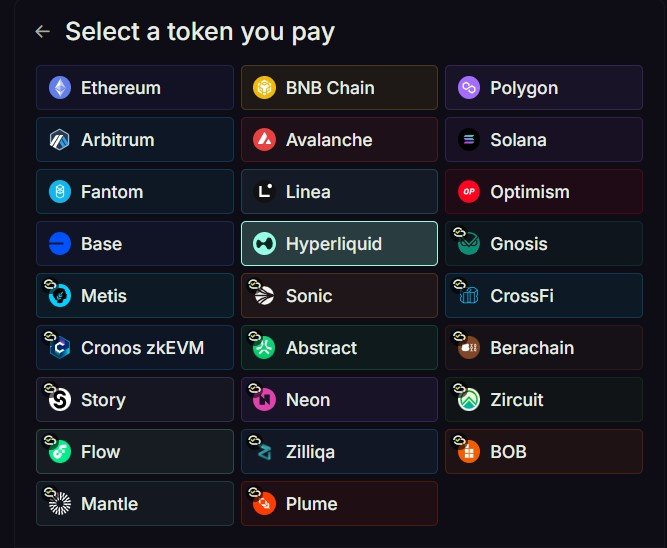

There are a couple of ways to get funds on Hyperliquid.

The first route is to access the Hyperliquid L1. Just log in with your EVM wallet (Rabby, MetaMask, etc), deposit USDC on Arbitrum, Bitcoin, Ethereum or Solana. Now you can use the DEX for staking or trading spot & perps, but if you want to continue to HyperEVM, buy some $HYPE and click 'Transfer to/from EVM'. You can now see your tokens on your Rabby wallet.

If you want to swap your tokens right away, I'd recommend using HyperSwap or, if you want to explore the whole ecosystem, HyperGas is a great site to help you navigate further.

Another, more direct way to get funds on HyperEVM is to use bridges. One such can be found on HyperSwap while others that I know of are HyperUnit and HyBridge.

HyperSwap

The first place I visited on HyperEVM was HyperSwap. Here, I made some swaps to create volume and collected some HyperSwap points as well, although points will be updated only on Sundays, which is today, so later on it'll be interesting to see how much I've accumulated already.

Here you can also create your own username and see which other HyperEVM protocols add up to your points.

I am presuming providing liquidity on HyperSwap is an action that'll add most points, as some pairs are incentivised with points multipliers as well.

The APRs are obviously ever changing, but so far, they seem to be rather good, like the HYPE/ETH pool here. It's good to keep in mind, though, that some of the pools here can be very volatile. For example, if HYPE surges a lot and the ETH price doesn't follow, you would need to be constantly adjusting your position, so they might not be as passive as they may seem.

Upshift

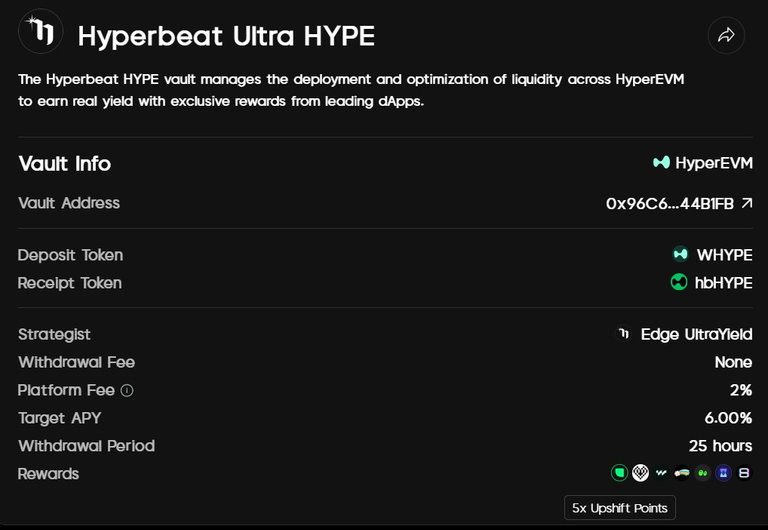

As for more passive stuff, I'd recommend single stake options on Upshift or Hyperbeat.

Even though the 6% target APY here on Upshift isn't so much, the Upshifts Hyperbeat Ultra vault could be a great, passive choice for airdrop hunters, as additional rewards are paid in points of 6 different HyperEVM apps, plus 5x Upshift points for a limited time.

Note that you can deposit directly into the same vault on Hyperbeat, but you'd be forfeiting the Upshift points in this case.

Hyperbeat

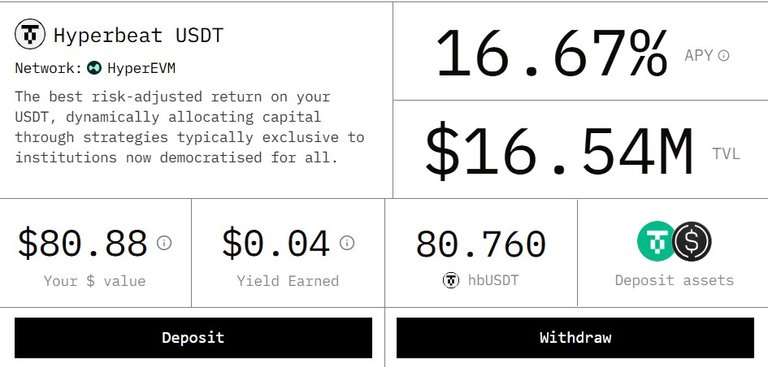

Speaking of Hyperbeat, if you think the $HYPE price is a bit too high at the moment and are looking for a more stable solution, Hyperbeat USDT vault might be a good choice.

With this vault, you would be earning a 16.67% APY as well as Hyperbeat, Hypurr.fi, and HyperSwap points. I just deposited into this vault myself and think it's a good way to gain exposure on different HyperEVM apps while remaining in a stablecoin position.

HypurrFi

Lend and borrow -strategies are also a good way to create volume while passively collecting points. On HypurrFi you can deposit assets such as $HYPE, $BTC, $ETH and stablecoins and use them as collateral to borrow more assets.

You can use some looping strategies here, for example, supply HYPE and borrow some stables to buy more HYPE, which then again deposit here, or if you want to expand your HyperEVM surface, do it on some other lending platform. Just remember to monitor your health factor so you won't be liquidated.

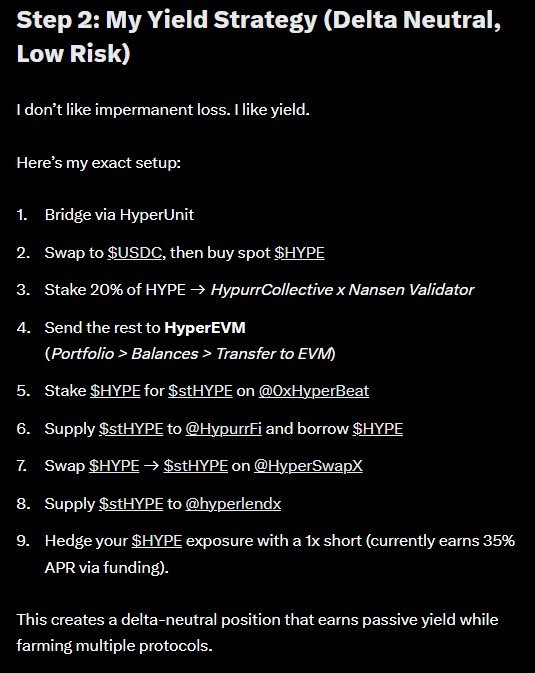

Delta Neutral Strategy

Finally, here's an interesting delta neutral strategy I came across on X that you might be interested in if you don't like volatility.

Even if you wouldn't suffer any impermanent loss with this strategy, keep in mind that this carries smart contract and other risks, like on-chain activities in general. Still, it's something to think about if your approach is passive farming.

Conclusion

Remember the time when everyone was bashing Solana and the $SOL price was under $10? "It's not decentralised enough, it's going to die", they shouted. Well, retail don't give a crap about what's the most decentralised chain and what is not, instead, Solana became a huge hit and those who were onboard early on sure did well.

Imagine if you'd had a chance to farm all those new apps on Solana again... I'm already hearing the "not decentralised enough" mantra again.

Now, I think we might have our second chance with Hyperliquid here. While HL is already a winner, the fact that it still has so much $HYPE to share with the community and that so many HyperEVM protocols are tokenless makes me think that this could be the very best crypto opportunity of 2025.

We are still so very early.

Apps and Airdrops:

🔹 Hyperliquid - the best perp DEX out there. Trade, stake & farm the next big airdrop!

🔹 HyperSwap - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 VOLO - stake SUI to earn APR & airdrop points!

🔹 Grass - $GRASS token launch surprised everyone, don't miss the second season!

Posted Using INLEO

This sounds good, I see you have quite a flare of doing crypto research and making it profitable.

How about fees, what do a user has to pay for $100 trx?

Thanks, this is gonna be my main focus in 2025. High hopes!

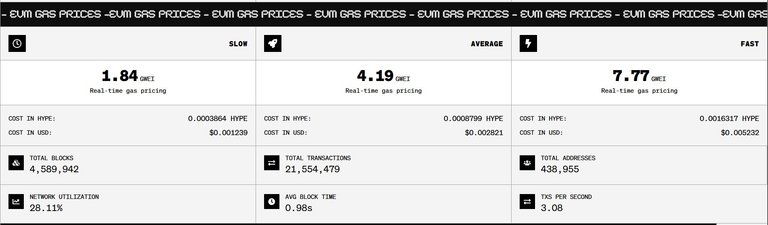

Fees on HyperEVM are very low. Currently, the fastest option costs $0.0005. https://hypergas.vercel.app/ is also a good site to monitor GWEIs as well as check out the apps.

It's quite low less than 1 cent, nice! But, I doubt with those high APR, I assume $16 price might not withstands in the long run, it will probably drop.

$16? Do you mean the 16% APY or $HYPE price? HYPE is currently at $33, could still surge much higher cos there are no VCs. If you mean the APY, yes, it can fluctuate a bit and probably drop when more people deposit. Still, I see much more value in the earned ecosystem points.

The price my bad I wrote the APR lol. APR is indeed volatile so does the price.

Congratulations @brando28! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: