Greener Candles $HYPE Analysis - 06/06/25

This week has been even more volatile than I expected. Yesterday, the BTC price dipped more than 5% while most altcoins followed on the way down, dropping much more as is tradition. Some people on CT believe the feud between Trump & Musk is the reason for the crypto market decline, but I'm not sure about that.

Nevertheless, dips like these are great opportunities to observe and compare alts to BTC and other altcoins. The ones showing strength during dips usually do well in uptrends.

Today's market analysis will be focused solely on $HYPE, the native token of Hyperliquid L1. After doing some research, and even after a great month, I still think $HYPE is showing huge potential in both fundamental and technical sides, and is an opportunity we might not want to miss.

Let's have a look!

HYPE Supply Declining

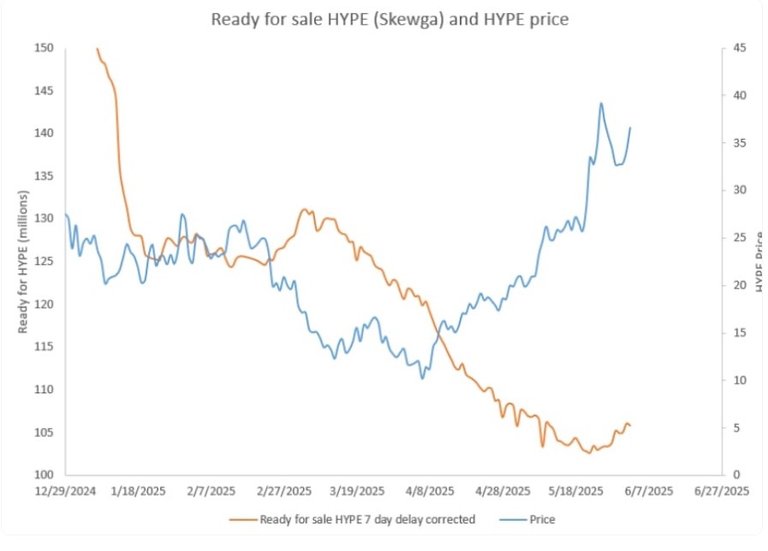

Since the April lows, the $HYPE price has been steadily climbing up while at the same time, the available $HYPE for selling is quickly decreasing, as seen in the chart below.

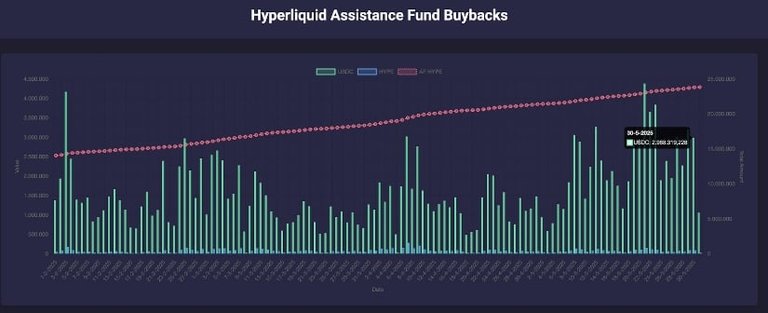

In other words, there is less $HYPE in circulation while the demand grows with the Hype assistance fund buybacks(~21% of available supply/year) in addition to organic demand.

HYPE Demand Growing

On the demand side, one factor that definitely shouldn't be overlooked is the HyperEVM. Just recently, I wrote this HyperEVM tutorial where I mention the many tokenless protocols people are currently farming in addition to the main Hyperliquid airdrop.

Personally. I'm currently farming many of these with stablecoins, but most activities require staking or pooling $HYPE, which therefore creates demand for the token.

Also worth noting that Hyperliquid didn't receive any VC funding, so there won't be those typical unlock dumpings, even though there's still that ~30% reserved for community, but as Hyperliquid users, we're now going to be on the other side when the time comes.

HYPE Price

The $32 has become an important support level for $HYPE, and once again, it bounced back up from that area. As for the next stop, I'd be looking at the $38.2 resistance and eventually turning that into support.

Also, $HYPE could start ranging here between $32 and $38. In that case, I'd be looking to buy next time it hits $32. If that level were to break, the next support levels are at $31 and $28.5. On the upside, $39.68 is the all-time high, so after that, $HYPE would enter price discovery zone and in the long run, I wouldn't count out $50+ considering the tightening supply and increasing demand.

Conclusion

Even with such strong fundamentals and technicals, $HYPE still seems to be flying under the radar when compared to other larger-cap tokens. It's big on Crypto Twitter and huge among YouTube influencers, but it's not making that many headlines in crypto mainstream media.

One reason for this could be that Hyperliquid started as a perpetual DEX, meaning the entry level for regular crypto bros is a bit high, as leverage trading is considered to be something that you shouldn't play without knowing what you're doing.

As Hyperliquid expands with the HyperEVM to less risky crypto activities, I'm sure the masses will follow and eventually make Hyperliquid a household name in the crypto space.

Thank you for reading, and don't forget to like, comment and follow!

Apps and Airdrops:

🔹 Hyperliquid - the best perp DEX out there. Trade, stake & farm the next big airdrop!

🔹 HyperSwap - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 VOLO - stake SUI to earn APR & airdrop points!

🔹 Grass - $GRASS token launch surprised everyone, don't miss the second season!

Posted Using INLEO