Greener Candles Crypto Market Analysis - 24/06/25

Happy Tuesday to a little bit of a greener world!

By 'greener', I'm obviously referring to crypto markets that saw a nice relief pump after the situation in the Middle East seems to be de-escalating. It's crazy, though. Feels like I need to be constantly switching between TradingView and global news sources, as there is so much effect the war scenarios have on markets.

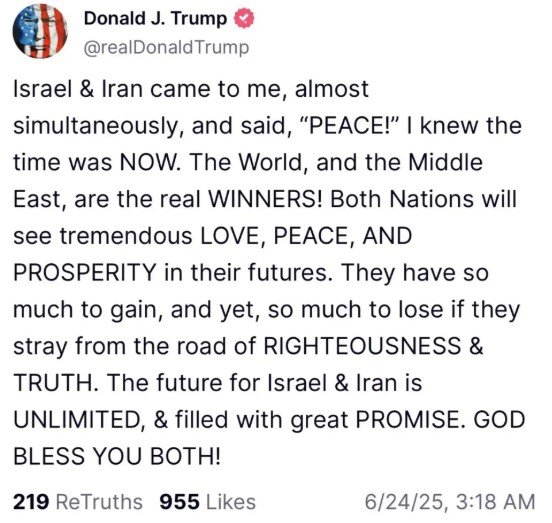

Donald here is, of course, taking all the credit, and I can almost see him dancing in green golf courses with happy little bunnies while writing this on his social media platform. By the way, I didn't know sharing these posts there are called 'ReThruths'... Yes, it's an absurd and volatile world we live in.

Gladly, no matter what happens, the crypto space always has interesting opportunities to offer. In this blog post, I'll take a closer look at Bitcoin price, share a trade I'm currently planning on and a liquidity pool with a very nice APR.

BTC

Now, let's cut to the chase. Bitcoin indeed bounced nicely after sinking as low as $98k-$99k levels. It then got rejected on 4-hour 200MA at $106.1k, but seems to have found support at $104.7k.

I would imagine BTC ranging between 104.7k and 106k until the NY market opens and Powell's speech later on.

As for the rest of the week, I would like to see a healthy pullback to test the 101k level, back up to 106k from there and holding that before moving higher.

INJ Trade

Injective is something I've been eyeing for a long time. It's got great tokenomics with 97% of tokens unlocked while touching the AI narrative and gaining some institutional interest.

INJ being one of the top gainers on my watchlist, I'm now planning a longer-term trade that I'll execute if it should pull back to test some key levels.

In the setup below, I would buy long just above the Fib level of 0.618 while setting my stop-loss $9.8. The initial TP would be set at $14.313.

Risk/Reward ratio for the trade would be 5.24, so SL could be lowered to $9.36 if we want more room on the downside. This would set the R/R ratio at 3.28, making it still a good trade to take.

If the overall market sentiment starts to look even more bullish, I'm considering taking the trade a bit sooner near $11.170 if we go down there and get a bounce. In this case, I would use a tighter stop-loss, making it a bit riskier trade.

With the first option, I would use 3x leverage and with the second one, 3x leverage. Note that this is not financial advice, and trading perpetuals carries big risks.

HYPE/USDT Concentrated LP

If you've been reading my posts before, you might have noticed that I'm very active on Hyperliquid and especially on HyperEVM. One of my most-used dapps is the HyperSwap DEX, where, in addition to swapping, we can also provide liquidity to several pairs.

Just yesterday, I re-entered the HYPE/USDT0 concentrated liquidity pool, which has an APR of 264% and besides that, it also earns us 5x protocol points that'll count toward the airdrop.

The idea of concentrated liquidity pools is that instead of settling for an infinite trading range, we can set our own ranges. It's simple: as long as the pair is trading within the selected range, we earn rewards, fees. If it falls off the range, we stop earning and have to rebalance or wait for it to enter the range again.

I always like to draw the range on TradingView so it's easier to keep up with rapid price changes and adjust correctly if needed. Here in the screenshot, you can see the HYPE/USDT pair trading on the top side of the range since yesterday, when I added to the pool.

Even though we want it to stay within the zone, the best earnings come from intense price action like the volatility seen at the beginning of the position. This is, of course, because we earn from the swap fees.

The APR I mentioned is definitely not fixed, as it depends on volume and how tight the range is. Still, with my custom range, I've already earned $1 in 12 hours with a $91 deposit, so yeah, rewards are rather good in my opinion. I also like the fact that they are paid USDT & HYPE, not in some reward token that just keeps on losing value.

Alright, that's about it! Are you planning on going risk-on mode again or still cautious about the market? Share your thoughts in the comments below, and don't forget to follow for more! 🟢👌

🔹 Kaito - monetize your X activity by creating quality crypto content

🔹 Hyperliquid - the best perp DEX out there. Trade, stake & farm the next big airdrop!

🔹 HyperSwap - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 HypurrFi - farm airdrop points with stables by entering ref code BRANDO28

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 VOLO - stake SUI to earn APR & airdrop points!

🔹 Pawtato Land - very useful SUI dashboard, earn XP for the airdrop by completing small tasks

🔹 Huma Finance - easy to farm an airdrop on Solana. Deposit USDC, earn APR % points.

Posted Using INLEO

Congratulations @brando28! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 17500 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP