Greener Candles Crypto Market Analysis - 04/06/25

Before looking at the charts, I want to share some of my thoughts about long-term plans, stablecoin holdings and airdrops. About a week ago, I received the long-awaited Movement airdrop, which was worth $280 at the time of dropping. In the past, I've been round-tripping many decent airdrops or just held on to those, watching the price drop 80-90%. Therefore, I've now decided to put most of my airdrop allocations into stablecoins and put those to work, to farm more airdrops.

I still don't believe we're that close to market top, but since most potential airdrops, such as those on HyperEVM, can also be farmed using stables, I thought, why not? Anything can happen in the crypto realm, and now I at least have a good hedge against sudden mega dips. And the bear market? I'll be ready for you.

The second part of my plan is to earn some chips by trading. Throughout the year, the market has been extremely choppy, which has favoured active traders. Although summers are usually pretty quiet, I do believe learning, staying focused and actively putting in orders will pay off in the long run.

Now, let's check out how those charts look today!

BTC

Bitcoin is clearly in an uptrend on the 4-hour chart, creating higher highs and higher lows. Even though it got rejected near the $107 level, it did manage to stay above the previous higher low near $105.2.

Next, I'd like to see BTC reclaim the $106.5 level and turn it into support before going for the $109 level.

BTC Dominance

In my yesterday's blog post, I drew my prediction of the potential BTC.D movement (blue arrow), and it has been fairly accurate, as you can see in the second picture.

The arrow is actually hitting the support line, which is right in the middle of a long inefficiency candle, so we might be expecting a bounce back up from there.

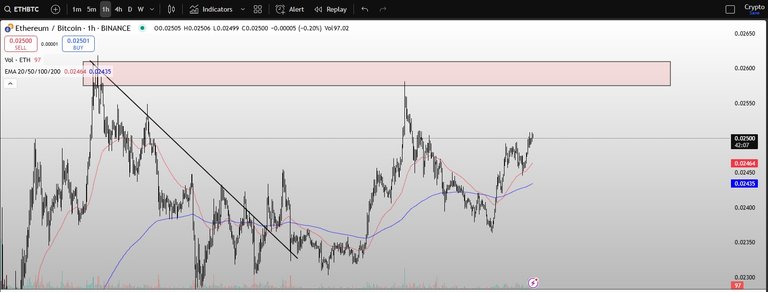

ETHBTC

While the BTC.D is still going down, it means money is flowing into other assets as well, and ETH is one of them. The ETHBTC ratio is currently up 1.67% in ETH's favour.

The red zone here is, of course, one to watch as ETHBTC has been rejected twice from there. On a positive side, ETHBTC made a higher low so this might be an early sign of further upside movement.

SOL

Going deeper into the altcoin sector, my SOL long trade was brutally stopped as SOL created this long, inefficiency candle, which was then filled.

Not sure if there was some Solana-related FUD event that helped to cause this, something to do with pump.fun, perhaps? Nevertheless, the bullish structure remains intact at least on the lower side as SOL bounced back, making a higher low. Not gonna revenge trade though. Not part of my playbook.

Conclusion

Back to my plan of using airdrop earnings (in stablecoins) to farm more airdrops. There's also a psychological factor, this calming feeling of having something in stables... At least it works for me, gives me more confidence, knowing that in a case of a rare total crash, I'd be able to seize the opportunity and buy the dip like I've never bought a dip before.

And those stables will be at work as well!

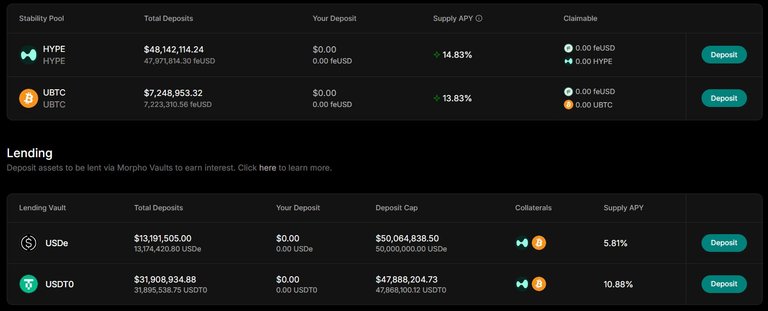

Next, I'm going to move some of my stablecoins into Felix, which is a lending/borrowing platform on HyperEVM.

Usually, APRs/APYs aren't that great on HyperEVM, cos it's all about the points, but besides earning points, Felix has some pretty good APYs for both stablecoins and HYPE & BTC as well.

This is it for today, thank you for reading and don't forget to comment, like and follow!

Apps and Airdrops:

🔹 Hyperliquid - the best perp DEX out there. Trade, stake & farm the next big airdrop!

🔹 HyperSwap - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 VOLO - stake SUI to earn APR & airdrop points!

🔹 Grass - $GRASS token launch surprised everyone, don't miss the second season!

Posted Using INLEO

Thanks for the update man.

Anytime! Every day. 👍