Concentrated Liquidity Pools: What Are They And How To Profit

In my previous article, I mentioned the concentrated liquidity pools briefly and have probably written about the subject some time before. Just yesterday, a new protocol offering LPs launched on Sui with an airdrop points program. Since we're very early with this one, I thought digging a little deeper into concentrated liquidity pools to find out whether they are worth it, what things to take into consideration, strategies, and more.

Let's have a look!

Concentrated Liquidity Pool Vs. Regular LP

So what's the big deal? Why concentrated?

The thing with old-fashioned pools is that they have a potentially infinite range. This means that when the price moves in a direction outside the effective zone, where most trading takes place, our rewards earned from fees drop. This is because we are not utilising most of our capital in regular pools.

With concentrated LPs, we get to set the effective range ourselves to maximise the earnings. We concentrate our capital into a narrower, more effective range.

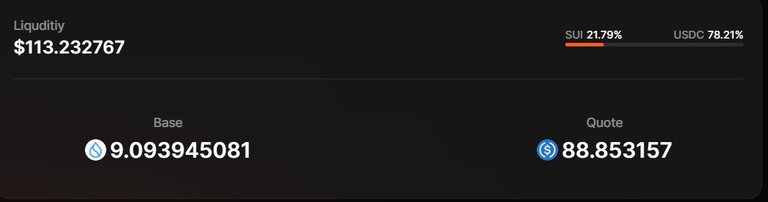

Here's a screenshot of the new Magma Finance pool on Sui, where I have set a tight range of +/-5%.

As you can see, I'm still within the range, earning rewards, but since the $SUI price has gone up a bit recently, my liquidity is turning more into USDC.

So if the $SUI price jumps even more from here, my LP position would then turn 100% into USDC. Of course, that would not be a disaster or anything like that, because I would then just rebalance my position. Until that happens, I'll just enjoy my rewards.

Concentrated liquidity pool in a nutshell: we keep earning rewards as long as the price is trading within the range.

APR & Ranges

Even though APRs are displayed next to the liquidity pools, I wouldn't pay too much attention to them as they fluctuate significantly all the time. This is because of trading activity, price volatility, and active liquidity in a pool are all factors affecting the APR. Not to mention the selected range.

Protocols offer preset ranges such as +/-10%, +/-5% or something crazy like +/1%. The narrower the range, the bigger your APR will be.

At this point, it's good to mention something that was puzzling me at first with this kind of LPing: if you fall out of the range, you don't necessarily have to rebalance(remove liquidity, swap, deposit again) if you believe it's only a temporary price deviation. This is because if you just hold on to your position and the price comes back within the range, the position becomes active automatically, and you begin to earn rewards again.

Choosing Your Range

Finding that perfect balance between passive position and maximising earnings can be a bit difficult at first, as with a wider range, you might not be satisfied with the yield, and with a more aggressive, narrower range, you might end up rebalancing way too often.

I'm using TradingView to zoom out in the chart and look at how the token has performed previously. If it looks like ranging in a certain area, we might assume it will continue to do so in the future. This might help you fit the range between the highs and lows of the range.

Remember that it's definitely not the end of the world if it falls out of range; you just need to rebalance or wait. Still, it's good to choose high-conviction tokens, tokens you believe will do well in the future (HYPE, SUI, SOL are my picks). Sure, these might surge a lot if we get anything that resembles an altseason, but until then, we are just taking advantage of the volatility.

Rebalancing & Strategies

Here's the tricky part, at least in my opinion. When to rebalance?

If we look at this $SOL 1-hour chart and imagine we have an x amount of SOL we want to put in a pool. If we had entered the LP after the initial price surge (green arrow) and chosen the grey areas as a range, we would have earned fees nicely for almost 3 days.

Then the price would have dropped (red arrow), and we'd have stopped earning yield. Now, if we had rebalanced right away using the same range, we would have continued earning fees, but would have come out of the range on the upper side (blue arrow), now with a position of 100% in stablecoins.

Instead, if we had waited and done nothing, we would soon have entered the range again and started earning rewards as well. Now the price would have been almost where it was when we entered the position, but we would have enjoyed the volatility and earned those fees.

I really can't say which way is the right one since it's all speculation and calculations we each have to do ourselves.

If I were now in this LP position with SOL, and it went out of the range high, I would probably wait for it to test the former resistance (blue arrow), now as a support. If it were to hold, I would rebalance here and now; the top of my range would be higher.

Another strategy that fits well with volatile times is to remove liquidity at one end and wait for a dip/surge before entering higher/lower than before. What I mean is sometimes it might be more profitable to wait it out than keep earning rewards while the price keeps going down and you need to constantly rebalance, making the initial deposit worth less and less.

Then again, if you have high conviction in a certain asset and zoom out to see major price fluctuation, a constant rebalancing could be a way to go as fees would stack up over time, and yes, the yields can get very good.

Conclusion

One might argue that better results are gained with constant spot trading, for example, and yeah, that might be true in some cases, but using concentrated liquidity pools is a pretty good, more passive, less stressful option to that, in my opinion.

Sure, there are risks such as impermanent loss and smart contract risks involved (DYOR, read docs on protocol pages), but I still find this much safer activity than leverage trading or memecoin casinos, for example.

Protocols need and value liquidity providers, so in addition to earning fees & rewards, you might be farming airdrops as well while providing liquidity. If not, you might want to consider moving your liquidity into newer protocols to take advantage of this, cos these airdrops might get pretty rewarding.

If you are on the Sui Network, I'd suggest checking out the Magma Finance pools as they just launched 2 days ago, so we are very early with this one. If you choose to join Magma, consider entering my ref link there: DTNYBZ. 🙏

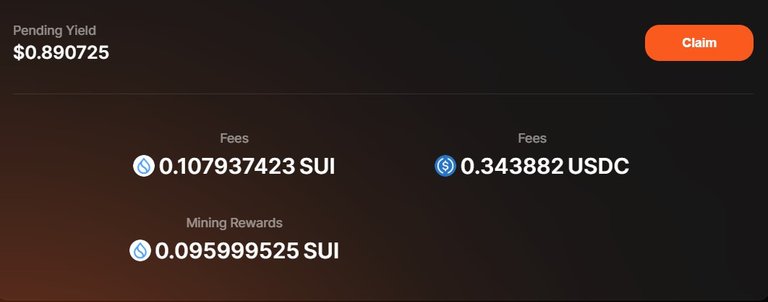

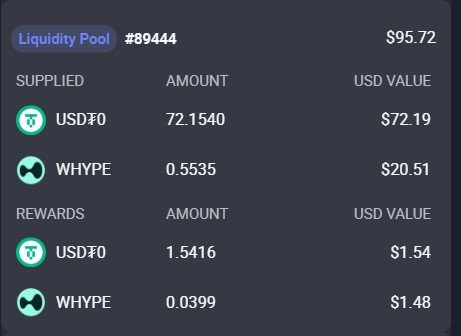

Another one I'm using is HyperSwap. This one is on Hyperliquid and there's also a huge airdrop potential: HyperSwap's own points program & HyperCore main airdrop. Besides, I'm pretty pleased with the 5-day rewards so far. 3$ earned with an initial deposit of $91.

All in all, volatility can be a bit shocking sometimes, but why not take advantage of it while it's happening anyway? We can't fight the market movements, but that doesn't mean can't keep on earning!

Thank you for reading, don't forget to like, comment and follow for more defi, trading & airdrops! 🟢

🔹 Kaito - monetize your X activity by creating quality crypto content

🔹 Hyperliquid - the best perp DEX out there. Trade, stake & farm the next big airdrop!

🔹 HyperSwap - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 HypurrFi - farm airdrop points with stables by entering ref code BRANDO28

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 VOLO - stake SUI to earn APR & airdrop points!

🔹 Pawtato Land - very useful SUI dashboard, earn XP for the airdrop by completing small tasks

🔹 Huma Finance - easy to farm an airdrop on Solana. Deposit USDC, earn APR % points

Posted Using INLEO