Concentrated Liquidity Pools - Maximize Your Rewards

Happy Boxing Day, crypto enthusiasts!

Christmas time has been great and I've been taking it easy, eating well, watching movies and just relaxing. However, in a couple of days, it got a bit boring and I found myself with my old crypto habits again. One thing I have been doing during the holidays was doing some research on concentrated liquidity pools(GoinGecko article).

The idea of these pools is rather new and before Uniswap introduced it in 2012, the regular liquidity pools worked within the range of $0 to infinity. This rewarded users at every price level but the problem was that most of the liquidity was unused resulting in lower rewards.

Concentrated liquidity pools now allow users to focus their capital within narrower price ranges and maximise their rewards.

Yesterday I opened one such position on the SUI blockchain using BlueFin's SUI-USDC pool. In this article, I'm going to show how to do that and share some ideas and strategies as well.

Let's have a look!

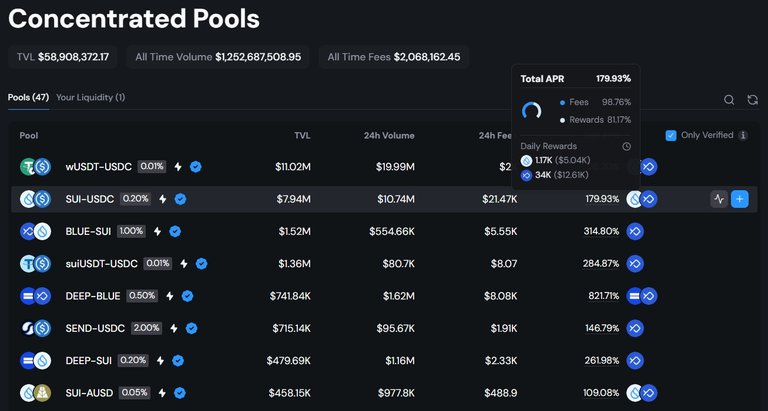

Concentrated Pools

When you navigate to BlueFin's pools section, the first things that will probably catch your eye are the very generous APRs. Don't let those fool you as estimating an APR in concentrated pools is extremely difficult, if not impossible.

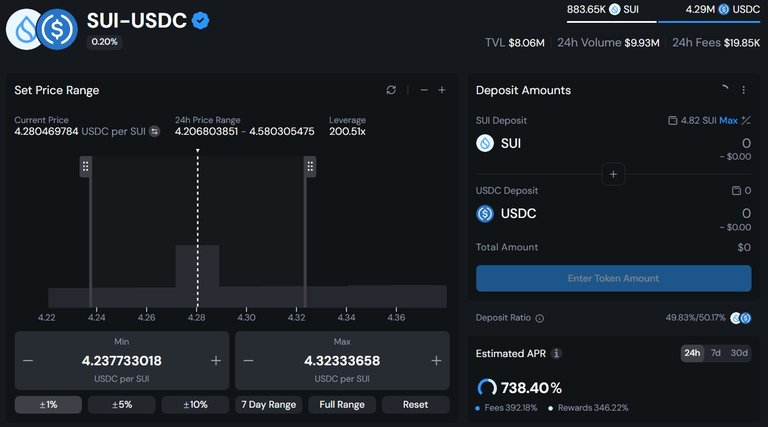

This is because everything depends on the risk level, and the price range, you are comfortable with. For example, if you would choose the +/-10% range, it would mean that the SUI price would have to remain within that range for you to keep receiving rewards. This strategy would give you an estimated APR of 73.86% in the 24-hour time frame.

If you would go down the degen way and choose a way narrower range of +/-1% in the same time frame, your APR would estimated to be 738.40%. This would mean $SUI would have to keep trading between $4.237 and $4.323. I think it goes without saying that it doesn't take long for the price to fall out of that range.

Instead of choosing from one of the presets, you can of course set the range manually and your APR will then be set according to that.

Out of Range

So is going off the range the end of the world? Absolutely not. This isn't similar to those liquidation events happening to leverage traders who forget to set their stop-losses. Instead, if you go out of range, your split USDC-SUI balance will be solely in USDC or SUI, depending on whether the price has dropped or surged enough.

To still receive rewards, you would now need to exit your position, rebalance(make a 50/50 swap) and re-enter the pool.

This is the reason you probably don't want to go with a too narrow range because even though the SUI network has low fees, constantly having to rebalance would eventually start to eat up your profits.

Strategies

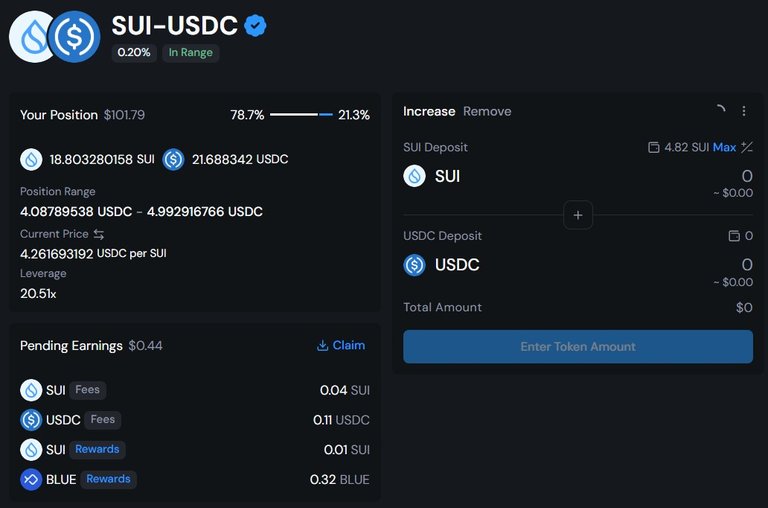

Because the SUI price has dropped a bit since I entered the pool yesterday, the weight is 78.7% on $SUI but I'm still in range and the rewards are stacking up.

However, if $SUI drops even more and goes off the range, my position will turn entirely to $SUI. In this case, I would've been DCAing in $SUI. One strategy now would be to wait for the $SUI price to go up and then open a concentrated liquidity position again which would then be a more valuable one.

If the $SUI price surged above $5 I would again be out of range but this time left with USDC as the system would've been constantly taking profit. Now it would be a good idea to wait for another dip before opening a new position.

The safest play would obviously be to re-enter the pool immediately after dropping out. This would reduce the possible impermanent loss if I manage to get back in right after being out of range.

Conclusion

Concentrated pools can be great tools when there's uncertainty in the air and the market is a bit choppy but not too choppy. For example, I remember some past summers lacking good price action as BTC was trading within a tight range and most alts were following that pattern. Those idle times would've been just perfect to put some capital in concentrated pools.

On the negative side, these strategies aren't very passive and even with the +/-10 range that I chose I need to stay alert and watch my position. Also, if you do it like I did and split your $SUI 50/50 to SUI & USDC, you'll miss part of the potential SUI surge although the value of your position would increase, just not as much as if it was 100% in SUI.

Then again, concentrated pools can be pretty good hedges against bearish trends as you wouldn't be entirely in SUI and would actually be DCAing more SUI as the price drops. On top of this, you would of course get to enjoy the rewards for providing liquidity.

I'm quite bullish on SUI in the long run so if I fall out of range, I will probably hold the amount of SUI I'm left with, which is now more than what I put in, and wait for the alts to pick up again and consider re-entering when the price has increased enough. In theory, this is a pretty solid strategy and I'm putting it to the test as I'm still just holding the same amount in SUI that I put in the LP. During the upcoming months, I'll be monitoring which side will increase more in value. Interesting to see how it turns out.

Thank you for reading!

🔹 Holozing is an upcoming play-2-earn game on Hive - get in before the launch!

🔹 Grass - $GRASS token launch surprised everyone, don't miss the second season!

DISCLAIMERS:

This is NOT financial advice.

Thumbnail image created with Canva

Posted Using InLeo Alpha

Their attempts to intimidate and silence their critics are equally concerning. The use of downvotes as a means of censorship is a clear indication of their desperation to maintain their grip on the narrative. But it's not working

https://hive.blog/hive-167922/@themarkymark/re-bpcvoter3-sp2q9h

That was very educating. Thank you

You're welcome, glad you stopped by 🙏🙂