The true owners of your money.

The true owners of your money.

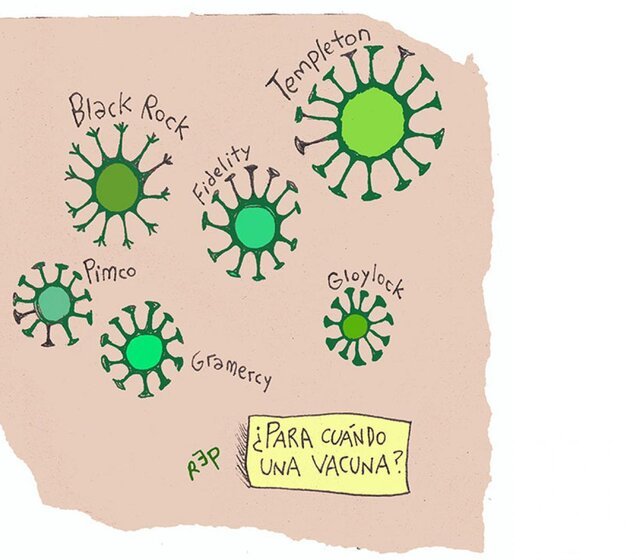

Klaus Schwab told us at the World Economic Forum, about the great reset, the great reset of the world economy, that we be prepared for that “you will own nothing and you will be happy”, and that is that we no longer own anything, our bank deposits and stocks and bonds, in case the depository institution had problems, actually belong to the depository institution's creditors, not us.

Souce klaus schwab

A “domestic bailout” is when depositors' assets are used for such bailouts; Paul Craig Roberts, an economist who is very critical of the economic model we are moving towards, indebted and in which no one has elected even by voting, tells us in some of his articles that the loss of property rights over financial assets is a case in all the Western world.

Souce Paul Craig Roberts

We must clarify some concepts that we are going to need, the first concept is “account holder”, an account holder is you, when you have money or investments in a specific place that is responsible for storing and managing these assets for you, this can include personal accounts, pension plans, whatever this place where you keep your money or investments is known as an account provider, it can also be called an intermediary and even a depository institution.

Souce Close to the greatest credits of the world

Here would also appear a concept on which many believe their stability depends in the event of a crisis, a financial crisis, the one known as the “guarantee fund”, the relationship between the concept of dispossession and the guarantee fund of banks in Europe, for example. , here it is called a deposit guarantee fund that guarantees up to 100,000 euros, it is very relevant because both concepts are related to the protection of your assets in adverse financial situations, but they work in a somewhat different way but they are related.

But dispossession would occur when your rights over your assets are subordinated to those of others, such as secured creditors in the case of financial difficulties of bankruptcy, failure or problems in the institution where your assets are kept, on the other hand, the limit of 100,000 euros in the guarantee fund since it implies that any amount above that limit is not protected and could be lost if the bank, as I said, went bankrupt; In this sense, the guarantee fund can be seen as a form of dispossession because it limits the amount of your money or money that is protected.

Souce Fonte Souce

Al cerdo que se hace llaman "@sunsetjesus" que le incomoda temas anti globalista, (me imagino que es pagado) te puedes ir mamar 1000 millones de huevos, pero solo eso, yo conozco muchos como tú, son golosos y quieren más. Maldito, no dejare que publicar temas que te incomoda por la estupidez que haces.

0

0

0.000

0 comments