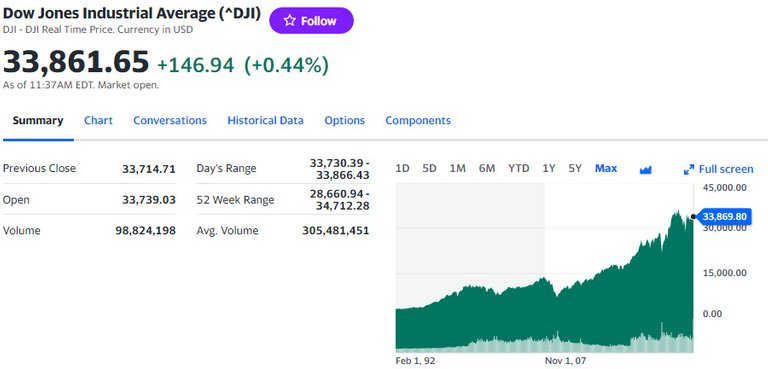

Is The Stock Market / Dividend Stocks A Good Investment Still?

What a wild three years it has been. From 2009 up to 2020 the stock market did only one thing and that was to go up. Covid shut downs look like a blip on the radar when you zoom out and still the markets seem to be doing half decent.

*Screenshot taken from Yahoo Finance

However from 2021 to 2023 things haven't really move on the dow. In fact we seem to be at the same levels or lost a bit. It's clear the recession seems to be a major call, high inflation is still there and overall things are just harder for everyone. That's now dragged on for a while but the stock market hasn't really shown it.

One thing I want to point out is there's been a lot of AI work on stats and history of the stock market and it's been noted that very few stocks actually move the markets while a vast majority fail, or underperform.

In this article I'm going to focus on Five stocks that are ETFs or Funds that hold multiple stocks within them and pay a dividend. A big thing while I was growing up was to invest in dividend stocks and live off the dividends. It's something I still look out for but honestly I'm not so sure it's worth it anymore or at least right now. Let's take a look.

*This article is for entertainment purposes only and is not financial advice. Do your own research before investing.

#1 VIG - Vanguard Dividend Appreciation Index Fund

*Screenshot taken from Yahoo Finance

Yield*as of writing this 1.98% Year over year dividend rate

In the last 5 years this stock has gone up around 40% but it closely seems to follow the dow in which it's been stagnant for the last two years. The dividend rate currently is just such of 2% which if inflation was targeted to 2% or less would mean you'd hold your value in money simply from dividends and earn about 8% a year over the last 5 years.

Not bad right? Only issue is that it's been stagnate. The stock market might soon fall and inflation is crushing this dividend yield. Investing in this stock today and if it held at current values you'd be looking at a loss of dollar buying power.

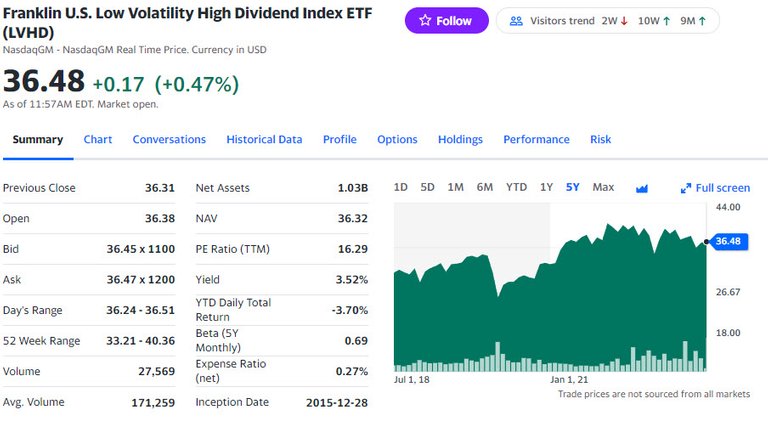

#2 LVHD - Franklin U.S Low Volatility High Dividend Index ETF

*Screenshot taken from Yahoo Finance

LVHD does a pretty good job at holding value over the last 5 years. With a half decent dividend yield you're mainly going off that and not so much a growth stock anymore. While there might be some growth it's rather minimal at about 2% a year over the last 5 years. However you'll also see once again it's been stagnant for the last two years and you'll notice this across most of these stocks. With a 3.5% yield this stock would be a good inflation but at the moment once again is being totally eaten up by inflation.

#3 VYMI - Vanguard International High Dividend Yield Fund

*Screenshot taken from Yahoo Finance

This one actually could be a winner over the last 5 years the stock price really hasn't moved. Sure you have the normal dips during heavy sell off periods but overall it's always returned back to around that $60- $65 level. That being said you wont really be earning or looking at growth on this stock but instead at the yield of which is pushed a healthy 4.6% at the moment. That beats current inflation levels by 0.6% (or so they say) Dividend wise and price wise this seems like a solid bet however in the current market conditions you can get 4.5% with no risk currently in a bank account.

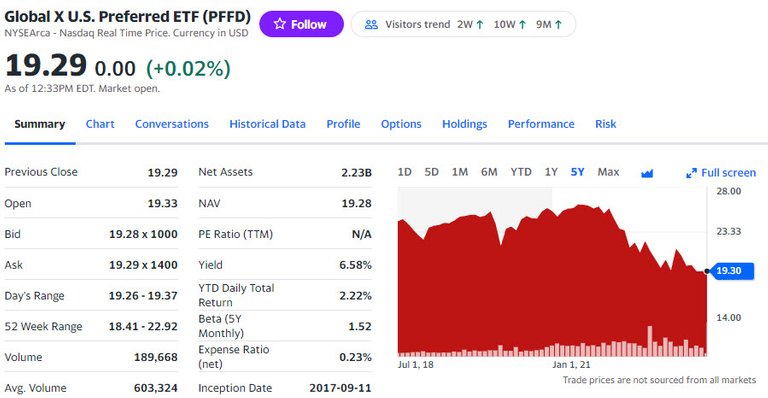

#4 PFFD Global X U.S Preferred ETF

*Screenshot taken from Yahoo Finance

Now we get into a etf that actually pays a pretty decent dividend yield at 6.5% It's said you need to make around 8% increase of your money to really be a good investor and start hitting it out of the park in terms of money coming in. At a million dollars in investment that would put you at around $80,000 a year of income to live off of with no other investments.

The only issue with this etf is it's been losing value and losing it heavily. Most if not all of your dividend yield earned over the last 5 years in this etf would have been eaten up from the falling price leaving you at most likely a 0% gain and actually losing dollar value.

#5 JEPI JPMorgan Equity Premium Income ETF

*Screenshot taken from Yahoo Finance

This ETF has actually done well and over the last 5 years has pretty much held it's value even though paying out a current massive 11.45% dividend yield. If I were to invest myself this might be one I would pick up with that type of yield and holding value. Of course I'll need to do some more research into what stocks are within this ETF and sometimes if you have enough funds you could simply mimic buying each of the stocks yourself and holding them in equal share.

Overall the markets seem to feel rather gloomy. With inflation still high, the talks of recession constantly at the doorstep, election year coming and fed interest rate hikes I'm not so sure that buying stock now is a smart move.

Let me know your thoughts down in the comments.

Posted Using LeoFinance Alpha

@tipu curate

Upvoted 👌 (Mana: 11/51) Liquid rewards.

I think dividend stocks are good for the cash flow. I prefer to choose my stocks individually instead to rely on an ETF for simplicity.

With the money, you can invest in more shares and repeat the loop until you cash out.