Credit Cards Made Simple: Save, Spend, and Stay Debt-Free

Hello friends, maybe last week I did make any post related to finance, So I will try to make more such posts so that I can share my financial experience with people because see, everyone of us struggles in terms of finance, but when we get some guidance and get to know the proper methods, then things become a little easier for us. Well, there are many ways through which we can save money and manage our finances a little bit. In my previous post, I talked about some such ways through which you can save your money. If you have not read anything there, then I will leave its link here. you must read it, I hope it will prove beneficial for you. Save More, Spend Less: Practical Tips That Actually Work

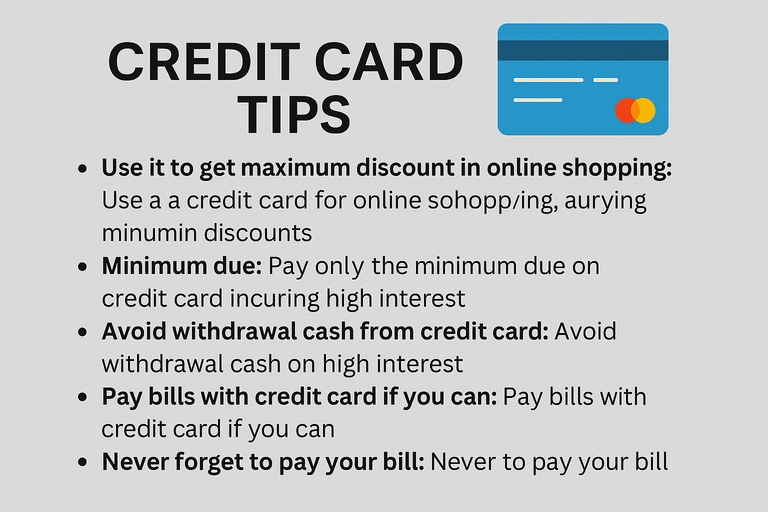

So today, as you might know from the topic, this post is going to be completely about credit card, so if you want to know more about it, then stay till the end, and I hope that you will learn something new from here today. Although there are many ways to use credit cards, today I will share some tips with you all, I hope you will like them

Use it to get maximum discount in online shopping:

Whenever you buy something from an online platform, you can use a credit card there, and you get to see huge discounts on it. Earlier, credit cards were not so popular, so their use was very limited, very few people had all these things. But look at the banks credit cards are a separate issue with banks, through which they give loans to people, so banks do not leave any opportunity for they can earn money. If you like to do online shopping, then whenever you find something right, wait for it because then you get a very good opportunity to use the credit card, and sometimes you get very good opportunities even without a sale. If you use a credit card, then just keep one thing in mind that you should not buy any product on EMI using a credit card because you have to pay many types of charges in it, due to which your product becomes more expensive than its MRP. So whenever you use your credit card, try to make the payment in full. If you are making EMI, then it might be a little more costly for you. Yes, if you don't have any other option, then nothing can be done.

Minimum due:

Whenever you get a credit card bill, you have two options: either you can pay it in full or you can pay the minimum due. People often think that if they pay the minimum due, then they won't have to pay any charges or they will have to pay only that much, but the reality is a little more serious, when you pay the minimum due, then you have to pay a huge amount of interest on the remaining amount. The due amount of your bill increases a lot, and credit cards charge a very high amount if you don't pay your bill on time.

Avoid withdrawal cash from credit card:

There are many options available on a credit card (on the application). You can correct all the settings of the credit card from there by installing the official app of the bank whose credit card you use. Many people mistakenly withdraw money from their ATM through credit cards. Yes, if you have not disabled this option on your card, then you probably cannot do this. But if you have enabled the option and you have withdrawn some amount from your credit card, then you have to pay a good amount of interest on it. So, try not to make such mistakes and use your credit card very wisely.

Pay bills with credit card if you can:

You can use a credit card not only for online shopping but also for merchant payments. If you have a Rupay card, then yes, I use Rupay card for online shopping as well as for purchasing a lot of things. If I have to make a merchant payment, I do it through the credit card only, and I pay only as much as I can make an effort to pay the bill. If you are using a credit card more than necessary, then you get caught in a kind of loop from which it becomes very difficult to get out. So you must keep this in mind as well.

Never forget to pay your bill:

And never forget to pay your credit card bill. If you do so, you will be charged a huge amount on this too, and you will come to know about it only when you miss the bill. If you have a credit card, then nowadays there are many applications available through which you can track your bill and also pay on your due date. You are paying with a credit card of a particular company, you can choose a fixed date for it when you want to generate the bill. And even after that, you have some time to pay your bill. If you are not able to pay your bill, then it can bring some financial burden for you. I use a Cred application to pay all my credit card bills, but nowadays, there are many other applications available in the market. For now, I have not exported them, but I will explore them because whenever a new application comes, you get very good offers in it and also very good rewards.

I hope that through this post today you have learned something new. Please share your thoughts in the comment section below. Thank you.

If you are not on Hive, you can use these links to join Hive (it is all free, with no hidden charges xd.), You can thank me later :

Join Via peakd

Join Via peakd

Join via inleo

Call this an Action:

If you are not playing the Splinterlands and Golem Overlord games then feel free to join my referral 😁

My splinterlands referral

My Golem Overlord referral

My HoloZing Referral

My kryptogamers Referral

see you in the next post. Keep learning and keep exploring...

All the Images are Made Via Canva unless otherwise noted.

Translated via Google Translator, The content is original.

Thanks a lot for staying till the end 😃🙏, Let me know what you think.

Never forget one thing you should be grateful for because someone has a dream of what you have. So learn to be grateful. Be Thankful.🙏😀

|

|

|

) |

Thanks & Regards

@bhattg

-----Together we will make this a better place-----

░░░░░░▄▄

░░░░░█░░█

▄▄▄▄▄█░░█▄▄▄

▓▓▓▓█░░░░░░░█

▓▓▓▓█░░░░░░░░█

▓▓▓▓█░░░░░░░░█

▓▓▓▓█░░░░░░░░█

███▀▀▀███████

Thanks 🙏

Nice post at the right time

!HBIT

!ALIVE

Credit cards can be tricky if we’re not careful, but your tips help a lot.

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 20.00% vote for delegating HP / holding IUC tokens.

Thank you so much

!PIZZA

I have never have one, but at the moment, i am not planning to have one either, my compulsive buying can get in the way, and put me in a debt if I am not careful.

but yeah, there are some advantage of it when you want to use it, and really make a very good calculation as well.

!PIZZA

$PIZZA slices delivered:

@bhattg(3/15) tipped @indiaunited

intishar tipped bhattg

ekavieka tipped bhattg

Come get MOONed!

Credit cards aren't a huge concept here in the UK, don't get me wrong they are used by many still, especially those aiming to pay off via instalments or incredibly slow but I think the majority of us stick with our debit card only and the funds we truly have access to!

Ohk, in india banks are giving credit cards by force 😅. It is quite handy for me.

I agree with you and it can give us lot's of facilities but mobile banking can also offer similar facilities. That's good for us and it's more easier than using credit card.

!PIZZA

Yes you are right, brother, mobile apps are more useful and comparable these days.