The world needs decentralized finance more than it realizes

Just to be clear, for the purpose of this article, decentralized finance is an umbrella term describing the crypto ecosystem in entirety, considering that it upholds the values it was created on, not just a pointer to some DeFi protocols like Uniswap.

What we consider DeFi these days is actually questionable. We look at yield farms and dexes with LP incentives and we think that's DeFi. No, that's just what a product of DeFi should look like — if the base network is decentralized of course.

Decentralized finance is fundamental to blockchain technology, meaning that it exists on the base layer. So if a blockchain lacks decentralization across its fundamental structures, it essentially cannot house anything that would qualify to be addressed as a product of DeFi because the ecosystem doesn't quite support the concept.

For instance, the obvious centralized reality of Ethereum makes everything built atop it essentially not qualified to be addressed as a decentralized product because the base layer is not. It's a rather simple design, if you built on a crappy system, you expose yourself to crap.

Build on a centralized platform or ecosystem and you sign up for all associated flaws of a centralized system.

But we surely can turn a blind eye to these truths, and act like it's all DeFi when there are underlying flaws that can pull everything down. Partly, the ideology that certain things are too big or have too many vested interests to fail plays a role in why we look at these ecosystems and say: it's not worth debating.

Many times we are tempted to say that centralized systems have performed well over the years, but is this really true? What verifiable data is there to back up these claims?

Have we truly stepped back to factor in the cost of all we've accomplished through centralization? Obviously we've not, hence the delusion, now look how over-expectant and entitled the young generation is as they've been falsely led to believe that:

When wealth is concentrated

Crypto has come in such a crucial time, we don't realize how lucky we are. The game master has blessed us with a solution to what's about to come. We can either run with it and establish stability or fuck it up regardless.

I can only imagine that even him(God?) is open to the possibility of us all being absolute morons and sliding into ruin regardless.

What even am I talking about?

What I am saying in essence is that we are heading for tough times. There's a great chance a major financial crisis awaits.

Many economists have labelled so many things to be bubbles these days, but the major problem isn't even any of these technological breakthroughs and booms. So no, this isn't a speculation of crypto or AI being in a bubble and popping, essentially leading to a major financial crisis, no.

Even if major players could be involved in this field, none of this would be the case for why a crisis would ensue.

I imagine that most people are conversant with the inequality of wealth distribution or at least have once or twice heard or read about it. Yeah, it's a major problem because it's an economically expensive reality. History tells us this through two major financial crisis.

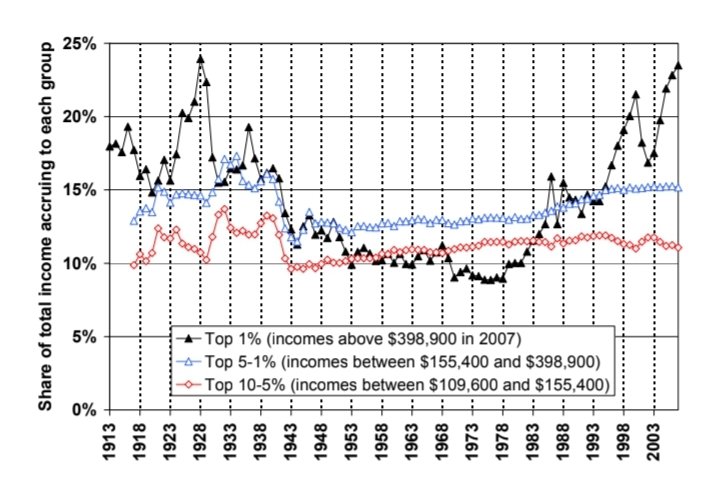

In 1928, before the Great Depression, the top 1% of Americans controlled 24% of the country’s wealth, almost the same percentage as in 2007, right before the 2008 financial crisis. Wealth concentration has often preceded major economic downturns.

Wealth inequality in the United States has exhibited significant fluctuations over the past century, with notable peaks occurring in 1928 and 2007. In 1928, just before the Great Depression, the top 1% of earners held approximately 23.9% of the nation's total income. Similarly, in 2007, on the eve of the Great Recession, the top 1% accounted for about 24% of total income.

These parallels suggest a recurring pattern where substantial income concentration at the top precedes major economic downturns.

Data doesn't lie right? — PDF report

Based on tax reports, as of 2021, the top 1% of earners in the United States held approximately 26.3% of the nation's total adjusted gross income (AGI). This represents an increase from 22.2% in 2020.

Projections indicate that income inequality in the United States is expected to grow to uncontrollable levels over the next few decades. Given the source of this data, being a tax report essentially, we can expect that the true wealth gap is much larger than the report data reveals and this means trouble, in essence.

It means trouble because most others are essentially struggling and this concentration of wealth despite the size of the economy leaves the masses in a high-cost living reality which means more debt is being acquired, effectively inflating the economy even more.

Access to value matters most

Back to decentralized finance yeah?

The wealth problem can be solved through decentralized finance. As biased as this might sound, the system near as effective for this doesn't exist on Bitcoin or Ethereum, only on Hive.

Hive's biggest value proposition isn't feelessness as many assume, I've personally had instances where I believe introducing some layer of fee would be fine and more economically responsible, but it would have to be a multi-layer fee system so as to enable an exclusion of the social layer, in some form.

Speaking of the social layer, this is what Hive has that is crucial to solving the wealth problem. The social layer is “access to value” from 0, essentially.

A truly decentralized system needs a structure that enables anyone to access value(income) in exchange for labor or offered services. This is a job market offering equal opportunities for people to tap into value.

The merit system is left to individuals to decide, essentially decentralizing the process of distributing value(income) to participants. In the beginning I said that we were lucky to have crypto at these times, what we are really lucky to have is Hive.

Our ecosystem becomes much stronger if we can create more equally accessible channels of income for our users because by doing so, we establish a system that allows the masses to challenge wealth concentration. The system works because the already wealthy here are forced, through incentives, to engage in activities that effectively deconcentrate wealth distribution.

Posted Using INLEO