The more you learn about traditional money, the more you hate it: Inflation is lost yield

One of the most debated topics when it comes to traditional money and economy is inflation and contrary to popular views, this feature — because it isn't a bug — is simply a byproduct of a tool the government uses to grow its social and economic power.

The tool is its monetary policies.

Inflation does not happen because the government is randomly printing money to make itself rich as we most times make it out to be. Contrary to our idea of “riches,” power is the wealth the government is after when it prints money.

The highly debated inflation happens because the government's monetary policies set to expand its power forces a consumer and business action that expands the money supply.

The action in mention is essentially taking out a loan, creating demand for debt.

The government does not just print from thin air, it forces the hands of consumers and businesses to take actions that create new money.

The policies facilitate debt(money is debt) creation and said debt leads to what is understood as inflation.

When you pay a great deal of attention to how traditional money and the economy works, you may come to the conclusion, as I have, that inflation is just lost yield, and I'll be explaining how this is the case shortly.

One of the hardest truths I've come to terms with is that money is generally a broken concept and it cannot completely be fixed, it's always going to be a never ending journey but the essence of crypto and blockchain technology spans much further than just fixing the devaluation of money because this is always bound to happen.

The government understands this, hence why I'd argue that they generally are never after fixing the devaluation of its money. So while crypto and blockchain technology can aid control devaluation, its core mission would be decentralizing power from generated economic value.

Certainly, most people have heard the saying that money is power but no one has ever understood where the power comes from, ultimately.

Power generally is leverage and the one thing that offers leverage when it comes to traditional money is yield, and this is something the government controls through inflation.

Without yield(inflation) the government(at least the central banks as the federal reserve) have no relevance to the people. As such, they have to ensure the leverage remains a thing and that should tell you a lot about what they do.

Inflation targets are power growth targets

Something caught my attention today and it was the prohibition of stablecoins issuers from paying interest or yields to its stablecoin holders in the Stable Act Bill by Bryan Steil.(pdf)

At first, it did not make sense to me why they'd want to restrict stablecoin issuers from offering yield to holders. Then I realized that it would indirectly hurt TBills if that happened and also cost the government a chance to create more debt and expand its power.

Stablecoins are essentially USDs on the blockchain. If issuers offer yields on them, it has a significant effect on the banking system and economy at large.

Direct yields on stablecoins could potentially create a pile of stagnant USD that neither creates additional debt which in turn creates lost yield(inflation).

Also, this would lead to less economic value being created through spending in addition to also potentially hurting the expansion of money through fractional-reserve banking because stablecoins are not deposits at traditional banks.

By prohibiting yields, stablecoin holders have no reason(incentive) to hold these USD-backed tokens and the economy benefits from larger value flow, TBills gain potential liquidity when people seek low risk yield and debt growth does not stagnate.

Certainly, people may be tempted to say that issuers can create the same economic value because they hold the USD that mints these stablecoins but that isn't really true. The value generated by holders directly will be much larger, plus issuers will still be able to make and create money with the deposits minting these stablecoins. Tether already earns over $13 billion in revenue, annually and that's more than what fuckin Blackrock makes.

That being said, how is inflation lost yield and how is it really a by-product of a power tool?

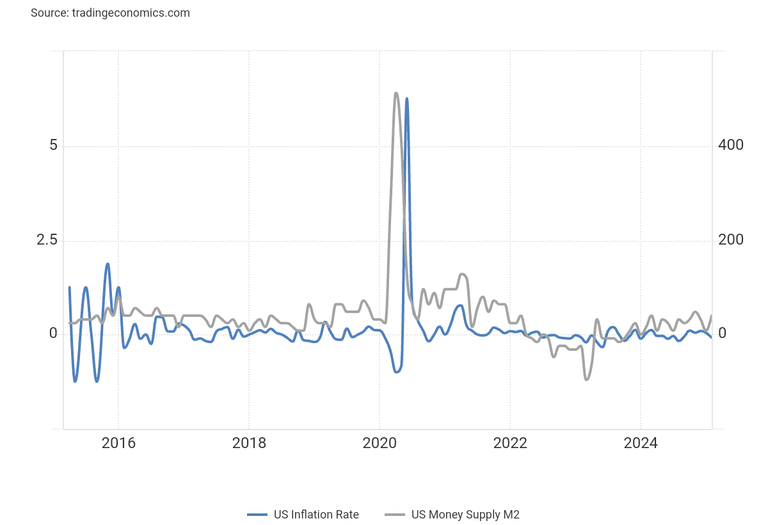

Looking at this chart, we can determine that there's a strong correlation between rising M2 money supply and inflation.

But this is old knowledge because everyone understands that money printing creates inflation, right?

Wrong!

The concept that creating new money hurts the value of the old money in circulation is false. Why would that even happen? I mean, let's be reasonable.

We can try to explain it through the concept of supply and demand but that would only make us look stupid because if we actually consider that we constantly demand more money and that such demand should only cause a price appreciation, then the idea of money printing causing inflation would be defeated.

The truth is that money is a broken concept and our belief in the system is what backs its value ultimately. That said, what truly devalues it first is the government, then us, the citizens.

The government(central bank) devalues fiat through interests applied on it. Every fiat currency is essentially debt owed back to the government. When we understand that money is debt and all money in circulation has an interest owed plus the principal, is it still so hard to understand why inflation is a thing?

Inflation occurs because the central bank created something that does not exist and essentially sold(loan) it to you via(with) interests. The more you learn about traditional money, the more you actually will hate it.

The money never existed, yet it is now being sold to you but you can't afford to buy it because money doesn't exist yet, but you need it, so how can you pay?

Generally, you take out the loan and promise to make more money and pay back with applied interest, but the fucked up reality of this is that it necessitates many others defaulting on their loan, which only leads to them acquiring more debts and piling up interests.

To you, you feel you should be ok because you could pay back yours but the reality is you're on the same boat as everyone else. The vast majority defaulting on their loans is a cost that will be shared amongst everyone.

This cost is inflation, because since you cannot afford to pay back, the government has to devalue your money and create more. It devalues your money by telling you that your money has lost value, forcing a market reaction that hurts your finances and leads you to wanting more loans, essentially aiding them to print more money and increase their power over you.

I call it a lost yield because if the debt(cost) is for everyone, so should the better side of the yield. But this is not how it works. Now it might sound like there's some contradictions there so let me just clear up a couple of things.

Yield(inflation) to the government is power because to you it's a higher cost of living, making you constantly reliant on them.

So whilst both the citizens and the government get the yield, they are getting different parts of it, and the better part, is what is referred to as the lost yield.

That said, one thing is true about the government when it comes to its monetary policies, it absolutely keeps to its promises long term, we just don't usually understand the cost.

In the last 10 years, the US GDP has grown by 25%, that would never have happened without inflation growing by 34% and the M2 money supply growing by 30.5%(excluding growth during Covid which sets it at 81.8%) cumulatively in the same period.

The United States economy literally has debt to thank for its growth but the citizens bear the costs while the government harvest the power. With more people in debt and distraction by various propaganda, the government secures more social and economic influence and the citizens drown.

The system has been designed to reduce you to nothing.

Posted Using INLEO