SURGE & LSTR brings perpetual contracts to LEO: a comprehensive overview

Anyone who's read some of what I put out daily on hive would know that I frequently talk about perpetual trading and I've occasionally talked about how a lot of things will have perps on-chain, greatly expanding the prediction markets.

Recently, I've seen a couple of figures on X with similar sentiments and I'll probably write about that later, but let's talk about what's happening with LEO!

I had to read every single post on @leostrategy's blog to understand what is being introduced and I quite frankly, find it appealing. Although, personally, what's most appealing for me is that once again, there's been a mention of lending that involves Leo tokens and as someone that's vastly exposed to lending contracts across DeFi and TradeFi, this one gets me optimistic.

I initially expected this in the days of Polycub, as it was teased, so hopefully it happens this time.

With that said, what is SURGE and LSTR?

Let's start with LSTR. Note that if you're looking for the technical details, best to visit the Leostrategy blog, this piece is meant to be a brief highlight of what these new adds mean for those looking to buy.

Throughout this article, I will be completely unbiased in my analysis and in the end, you should understand how both are valuable and which is generally more valuable.

LeoStrategy is a Hive blockchain-based vehicle that acquires LEO and aims to generate a LEO Yield of 10-20% annually to create accretive value for LSTR holders. All LEO acquired is instantly staked as LEO POWER in the @leostrategy account. The goal is to increase the LEO-denominated value of circulating LSTR tokens.

This is an excerpt from the announcement post of LSTR.

But let me translate:

LSTR is how you can long LEO, on-chain!

LEO currently doesn't have a centralized exchange listing, neither spot nor perpetual, but with LSTR, you can long LEO!

This is because LSTR is designed to mirror the growth of its LEO stake (that will never be sold by the way). That means that if you buy LSTR today, and Leostrategy doubles its LEO holdings, you would be up 100% in LEO exposure and whatever the price of Leo is at that time, this can amount to a significantly large ROI.

If you want some performance porn on Leostrategy, you can follow the Leostrategy threads here

Now, what is SURGE?

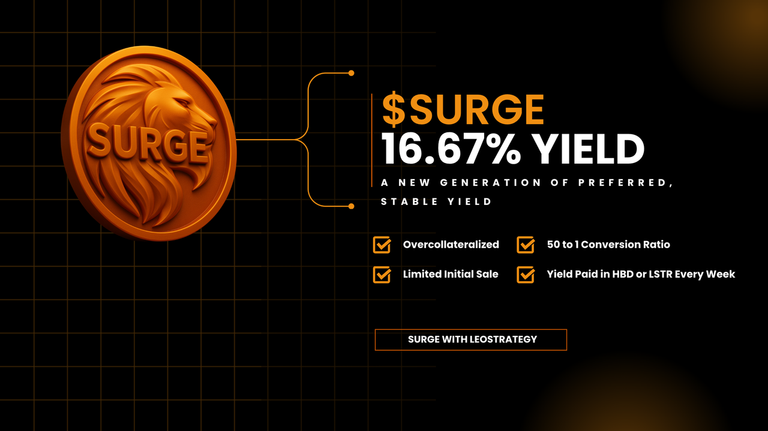

SURGE is a perpetual preferred offering that LeoStrategy is bringing to the Hive Engine marketplace. This perpetual preferred token carries a 15% stated yield that is paid out weekly in HBD (16.67% effective yield if acquired during the limited initial sale).

Now this one is a bit tricky. If you noticed, I called LSTR a LEO perp, meaning that buying LSTR means leverage trading LEO with significant upside potential.

SURGE is a perpetual preferred token because unlike LSTR, it acts like a bond with fixed dividends and isn't meant to grow beyond $1 or fall below it. Now note that it isn't a stablecoin, but the general design aims to have it trade around $1.

This means that if you're looking for a significant upside exposure to Leo's growth, just buy LSTR.

But if you're looking for stable returns tied to LEO's growth, then buy SURGE as that will yield 15% annually or 16.67% if you buy in the initial sale.

One could ask, which is best to buy?

Personally, I'd say LSTR. This is because Leo is evidently on a growth trajectory and buying LSTR would be positioning for higher gains with every price gain registered by LEO. However, hedging with SURGE would also be smart as it offers a way to take profits on the way up through yield.

I'm optimistic to see what revenue-focused products Leostrategy brings, as aforementioned, especially lending. Some time back, I talked about an automated way to buy Leo through post rewards on threads and right now, it would seem that LSTR fixes that.

By buying and holding LSTR while setting a percentage of post earnings to @leostrategy as a beneficiary, one would be indirectly buying LEO, autonomously and potentially gaining x2 the sum(in LEO exposure) than they'd get buying manually!

Posted Using INLEO

Don't forget that SURGE is not capped to $1. It is downside-capped to $1

It can (and will) trade over $1. Why? There is a perpetual call option attached to SURGE where SURGE-holders can convert 50 SURGE into 1 LSTR token. This gives SURGE a $50 call option. When this call option is ITM (In The Money), it means that LSTR is trading for $50 or higher.

Then, SURGE holders can convert their shares or speculate on the ITM option.

So basically, SURGE is HBD but with a higher yield and higher future price (since it has theoretically unlimited upside with limited downside to $1).

Overall, great write-up here! Just wanted to make sure people understand the call option attached to SURGE.

Question: if SURGE reaches, let's say $1.30, and LSTR is at $50, will conversion remain 50:1? Is this fixed irrespective of price growth or depreciation?

@badbitch, I paid out 0.226 HIVE and 0.047 HBD to reward 1 comments in this discussion thread.